Zacks Investment Management provides insight into the biggest news stories and key factors that we believe are currently impacting the market. This week we dive into 3 Reasons to Expect Downside Volatility in the Second Half of 2021.

Reason #1: Downside Volatility is Normal, and It’s Been a While

The S&P 500 has not pulled back -5% since October 2020, over which time it has continued to rally strongly. Even though downside volatility is very normal in equity investing, it’s been a while since the S&P 500 has exhibited much of it.

The last time the S&P 500 went this long without a -5% pullback was during June 2016 to February 2018 stretch. Even when we look at an even longer stretch of history, we find that the S&P 500 has gone a full year without a -5% pullback only three times in the last 50 years – twice in the 1990s and again in 2017.1 Will 2021 be the third year with such a long stretch?

Every investor wants to see the stock market trend nicely higher with no downside volatility. But it’s just not a realistic outcome. Data shows that since 1980, the S&P 500 has experienced an average intra-year correction of -14.3%2, underscoring how common and oftentimes steep market pullbacks typically are. The longer the S&P 500 goes without exhibiting more downside volatility, in our view, the more likely it becomes.

Long stretches of rallies often cause investors to forget that pullbacks are normal and natural, which increases the risk of making knee-jerk decisions when the stock market does eventually turn volatile. Complacent investors may see downside volatility as more worrisome than it is, which could lead to decision-making that runs counter to an investor’s long-term goals and adversely impacts returns. We would encourage investors to remain patient and stick to your long-term plan.

______________________________________________________________________

How to Navigate Through the Market Despite Volatility

Inflation, a tight labor market, and supply chain issues are only a few examples of challenges facing the current economic recovery. Through these challenges, stocks still soared in 2021 and the market experienced strong earnings, but will that be the case for the rest of the year?

To better navigate through market volatility, it’s important to be prepared for both the good and bad. In this report, we look at the earnings picture so far and EPS estimates for the quarters ahead. We also take a look at:

- Fundamentally Strong Earnings Picture Driving Stocks

- Analyzing 3 Big Tech Players: Apple, Alphabet (Google), and Microsoft

- Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more, download your guide today!

Download Our Just Released, “September Market Strategy Guide”3

______________________________________________________________________

Reason #2: Companies May Be Facing Peak Growth and Peak Profit

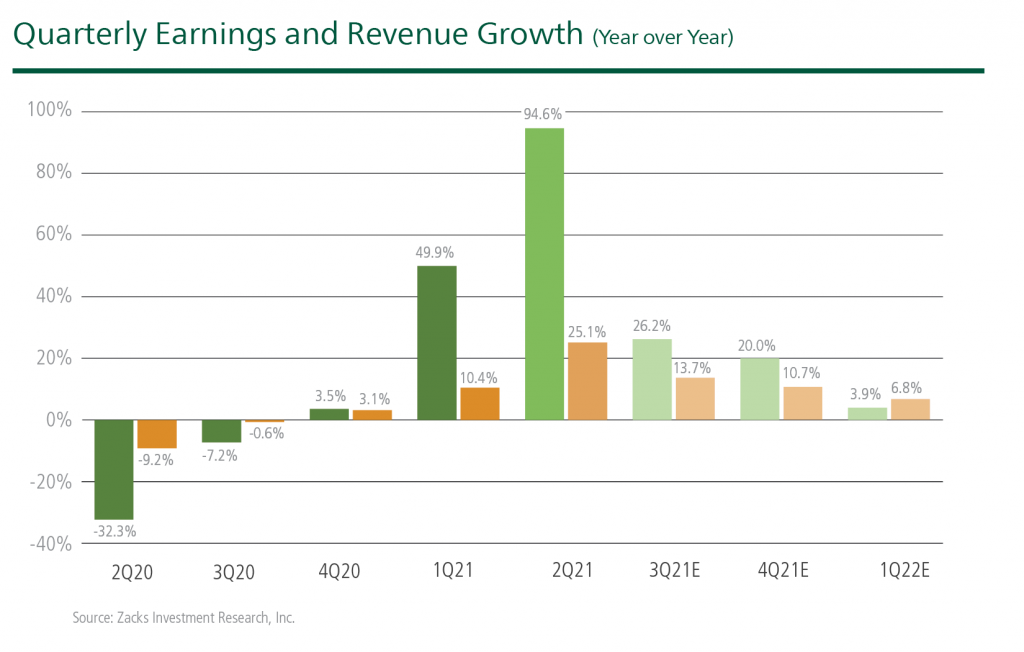

Total Q3 2021 earnings for the S&P 500 index are expected to be up +26.2% from the same period last year on +13.7% higher revenues. These are assuredly strong numbers – except when you look at them in comparison to Q2, which posted +94.6% earnings growth on +25.1% higher revenues in Q2.4 The narrative that economic growth and corporate earnings are decelerating from peaks could cause some choppiness in the markets.

The ‘law of large numbers and the end of pandemic comparisons means earnings and revenue growth were bound to decelerate. The question is by how much, and whether investors get skittish if estimates end up being revised downward.

As you can see from the chart below, Q2 2021 stands out, particularly since it is being compared to Q2 2020 – when many economies were shut down. Earnings growth is set to decelerate in coming quarters, but investors will want to see consistent growth alongside optimistic revisions.

Reason #3: The Federal Reserve Moves Closer to ‘Tapering’

Investors have long parsed every statement made by the Federal Reserve for clues about monetary policy. In the second half of the year, participants will be watching very closely for signs the Fed could start trimming its monthly bond purchases, a process known as ‘tapering.’

In 2013 and 2014, Fed tapering became synonymous with downside stock market volatility, and the coined phrase “taper tantrum” is still thrown around quite a bit in financial media. The chart below shows the S&P 500 index performance during the time Ben Bernanke announced tapering (summer 2013) to the actual end of the QE program (fall 2014).

As you can see, there’s plenty of volatility, but it’s also true the stock market continued trending nicely higher throughout the tapering period. It’s a reminder to investors that volatility is not necessarily synonymous with significant losses. In other words, the market can be volatile and still trend higher alongside economic and earnings growth.

How to Prepare for Volatility in the Remainder of 2021 – Are you prepared to navigate through both upside and downside volatility when it occurs?

In our just-released September Market Strategy Report, we take a look at the key factors that are influencing the economy and markets as the rest of the year unfolds. We also take a look at the earnings picture so far, and:

- Fundamentally Strong Earnings Picture Driving Stocks

- Analyzing 3 Big Tech Players: Apple, Alphabet (Google), and Microsoft

- Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free report today!

Disclosure

2 J.P. Morgan. Guide to the Markets, Slide 17. https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/?c3apidt=p40886527407&gclid=Cj0KCQjw7MGJBhD-ARIsAMZ0eetAtDTTTXf-7nxGmiDzRfjFi0846AdeQqnqYl_70pIFeGHSE2Hv4TsaAhkvEALw_wcB&gclsrc=aw.ds

3 Zacks Investment Management reserves the right to amend the terms or rescind the free-Market Strategy Report offer at any time and for any reason at its discretion.

4 Zacks.com. September 1, 2021. https://www.zacks.com/commentary/1790010/can-earnings-continue-to-improve

5 Zacks.com. September 1, 2021. https://www.zacks.com/commentary/1790010/can-earnings-continue-to-improve

6 Fred Economic Data. September 4, 2021. https://fred.stlouisfed.org/series/SP500#0

7 Zacks Investment Management reserves the right to amend the terms or rescind the free-Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.