Small-cap stocks have been on a solid run in 2021. In particular, small-cap value stocks have delivered strong performance relative to small-cap growth stocks, perhaps as investors have shifted preferences in favor of companies with steady earnings and relatively modest valuation multiples.

Investing in small-cap stocks can be challenging – the universe of available companies’ numbers in the thousands, and most of them are companies retail investors have never heard of. The top three holdings in the Zacks Small Cap Equity Strategy as of Q2 2021, for example, are Moelis & Co, Boot Barn, and Generac Holdings. Depending on where you live, none of these companies may ring a bell. It’s for that reason many investors turn to exchange-traded funds (ETFs) in order to gain exposure to the small-cap category.1

I generally do not have an issue with ETFs as an investment option. They can offer investors low-cost access to a diversified portfolio of assets, which is especially useful for someone just starting out. ETFs make less sense with higher net worth investors, in my view, because owning the index means taking the good with the bad, instead of using empirical research and a disciplined investment process to choose individual stocks that address your growth, risk, and tax objectives.

__________________________________________________________________________

Base Your Investing Decisions on Fundamentals and Hard Data!

While exploring different investing options, I want to remind you about the importance of keeping an eye on economic indicators as opposed to timing the market. This may be difficult to do especially in times like these, but that’s where we can help!

In our just-released Stock Market Outlook report, we provide insight on how to focus on the facts and hard data. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Zacks ranks industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released October 2021 Stock Market Outlook2

__________________________________________________________________________

In the small-cap world, however, I see a problem with ETFs in 2021 no matter what type of investor you are. The problem: “meme stocks.”

As it relates to small-cap value as a category, AMC and GameStop have been the two biggest contributors to performance for the year, which has also vaulted them into outsized holdings in ETFs. In the iShares Russell 2000 Value ETF and the Vanguard Russell 2000 Value ETF, for example, AMC is the biggest holding. The company’s outrageous $22 billion market cap – which has been driven in large part by online fame and social media postings – makes it 14 times larger than the ETF’s average holding. That’s troublesome.

AMC’s fundamentals are murky at best, and the stock is trading at a very high multiple. Many investors may think twice about buying it, and that’s where owning a small-cap value ETF could be problematic – it means having AMC as a top holding. GameStop was dropped from the Russell 2000 value index in June, but it is also a stock many investors may not want as a primary holding in an ETF. These types of scenarios expose issues with the passive index ETF approach. Sometimes you end up owning stocks you don’t want.

I’m not making the case for or against GameStop and AMC. They just do not currently meet the research-driven, fundamental criteria we use to inform our decision-making at Zacks Investment Management. We start with the entire universe of small-cap names (which includes growth and value stocks), run each company through a proprietary quantitative screen, weigh the risk-adjusted return potential, and then monitor the top 100 or so stocks regularly to ensure they keep meeting our criteria. We do not choose stocks based on online trends or viral videos, and stocks with declining fundamentals are promptly sold.

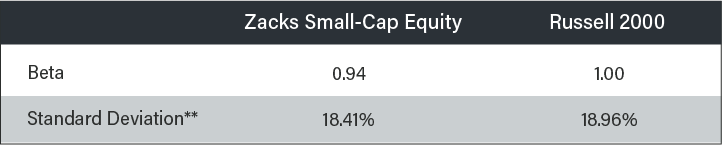

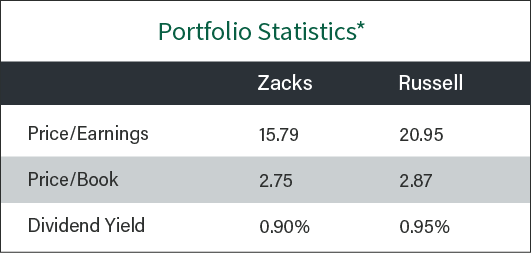

As of the end of Q2 2021, the Zacks Small-Cap Equity strategy has yielded a portfolio with lower risk than the Russell 2000 Index (as measured by beta and standard deviation, the table below), and lower price to earnings and price to book ratios. In our view, we’ve constructed a portfolio with lower risk and better value than the index, which we believe can deliver better risk-adjusted returns to investors.

Bottom Line for Investors

As I mentioned in this column, I do not take issue with ETFs in general. They can be useful for many types of investors to gain diversified exposure to an investment category – like small-cap stocks – at a low cost.

But it’s important to understand the rules and guidelines informing how an ETF is constructed, which could ultimately mean you end up owning stocks with poor fundamentals. Investors who are truly value-oriented and focused on fundamentals would not be satisfied with that outcome. An actively managed approach, like we have with the Zacks Small-Cap Equity Strategy, means taking greater care to know exactly what is in your portfolio, and what isn’t.

We also provide insight into other ways on how to stay focused on long-term financial success. That includes keeping an eye on economic indicators and hard data that can positively impact your investments. Our Just-Released October 2021 Stock Market Outlook Report4, will help you do this!

This report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Zacks rank S&P 500 sector picks

- Zacks view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Zacks ranks industry tables

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

**The standard deviation shown here is calculated since inception

1 Wall Street Journal. September 13, 2021. https://www.wsj.com/articles/meme-stocks-amc-and-gamestop-push-small-cap-benchmark-higher-11631525580

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Zacks Investment Management. Q2 2021. Small Cap Equity Strategy.

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The MSCI ACWI captures large and mid-cap representation across 23 Developed Markets (DM) and 27 Emerging Markets (EM) countries. With 2,986 constituents, the index covers approximately 85% of the global investable equity opportunity set. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The MSCI UK All Cap Index captures large, mid, small and micro-cap representation of the UK market. With 819 constituents, the index is comprehensive, covering approximately 99% of the UK equity universe. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 1000 Value Index is a well-known, unmanaged index of the prices of 1000 large-company value common stocks selected by Russell. The Russell 1000 Value Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The Russell 2000 Index is a well-known, unmanaged index of the prices of 2000 small-cap company common stocks, selected by Russell. The Russell 2000 Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.