In today’s Steady Investor, we look at what is going on in the markets and our key takeaways and questions for investors to consider, such as:

- U.S trade deficit reaches new record

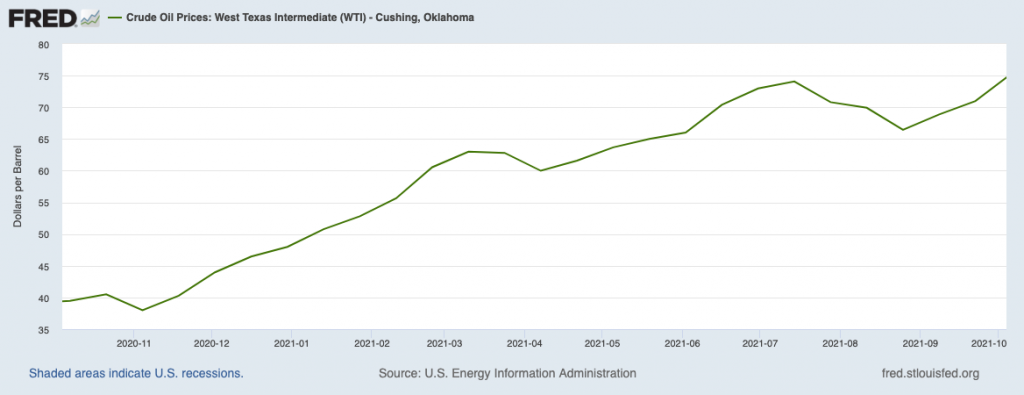

- Oil prices rise as OPEC raises production

- Higher unemployment rate

U.S. Trade Deficit Reaches New Record – American businesses and consumers imported goods at a record pace in August, buying $287 billion worth of foreign items from toys, to clothes, to pharmaceutical products. The Commerce Department also reported that the difference between imports and exports expanded to $73.3 billion, also setting a new record. Trade deficits are often framed as negative for the economy since at a basic level the U.S. is buying more goods and services than it’s selling. But the real metric that matters is total trade, as it is a better indicator for the overall level of economic activity. The good news here is that even as imports climbed to record levels, exports also rose – a good sign for the global economy. Trade relations with China – which took center stage this week as the Biden administration negotiates a path forward – showed weaker data. The U.S. trade deficit with the world’s second-largest economy expanded to $31.7 billion in August, a by-product of rising imports but falling exports.1

__________________________________________________________________________

Is There an Economic Rebound Around the Corner…or is This Time Different?

Investors are questioning another economic rebound. And even though history shows that markets have recovered from volatility, it’s natural to think, “maybe this time it’s different.”

Feeling uncertain about what’s to come is normal, but don’t give in to fear and panic! As difficult as it is to remain calm in uncertain times, focus your actions right now to better plan your financial future.

That’s why we have put together a free investing playbook with insights and guidance to help you seek success when investing through these unprecedented times. If you have $500,000 or more to invest, get our free investing playbook today.

Download – The Black Swan Investing Playbook2

__________________________________________________________________________

OPEC Slowly Raises Production, Oil Prices Rise – Surging demand has featured prominently in 2021, as U.S. households picked up travel and vacation trips. This return of demand has not been met with the surging supply of oil – in the U.S., oil drilling and output have moved higher, but they are far from pre-pandemic levels. According to oil-field-services firm Baker Hughes, the last time crude oil prices were at these levels, there were over 1,000 additional rigs drilling for oil. OPEC stirred markets additionally this week by announcing they would increase production, but not nearly at levels needed to meet current demand. OPEC plans to produce more barrels incrementally, rather than in large quantities immediately – they plan to raise collective output by 400,000 barrels a day in monthly installments. As you can see in the chart below, crude oil prices continue responding to rising demand and too-low supply, climbing to $75 a barrel and showing few signs of retreat.3

Would a Higher Unemployment Rate Actually Be a Good Thing? The unemployment rate is notoriously calculated in a wonky format – it only accounts for Americans actively seeking work but unable to find it. If some Americans are unemployed but also not looking for work, they are not counted towards the unemployment rate. That’s why seeing a slight increase in the unemployment rate would not necessarily be a bad thing, assuming that the uptick was due to more people coming off the sidelines in search of a job. According to the Labor Department, there are millions of Americans who stopped working and have not actively looked for work since early 2020, when the pandemic stifled economic activity. This dynamic is measured by the labor-force participation rate, which measures the number of adults seeking work. In January 2020, the labor-force participation rate was 63.4%, but it has not crossed above 62% in some time. Economists will be watching this metric especially closely this fall, as federally expanded unemployment benefits have ended and most schools have reopened.5

Managing Your Retirement Assets – It’s important for investors, especially those nearing retirement, to take actions right now that have the greatest potential to define their financial future. When the market is experiencing high volatility, remember not to exit out of fear!

To help you stay grounded and understand how the market has recovered historically, we have put together a free investing playbook6 with insights and guidance to help you seek success when investing through these unprecedented times.

If you have $500,000 or more to invest, get our free investing playbook today. You’ll learn about seven time-tested guidelines to help you seek investing success.

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Black Swan Investing Playbook offer at any time and for any reason at its discretion.

3 Wall Street Journal. October 4, 2021. https://www.wsj.com/articles/opec-russias-gradual-oil-hike-pushes-prices-to-seven-year-high-11633356803?mod=djemRTE_h

4 Fred Economic Data. October 4, 2021. https://fred.stlouisfed.org/series/DCOILWTICO#0

5 Wall Street Journal. October 3, 2021. https://www.wsj.com/articles/falling-unemployment-could-add-to-worries-about-the-u-s-labor-market-11633269601

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Black Swan Investing Playbook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.