In today’s Steady Investor, we examine the forces driving recent market volatility and what they could mean for investors in the months ahead, including:

- AI challenges the software business

- Services steady, manufacturing uneven

- Trade deal signals tariff shift

‘AI Displacement’ Worries Spill into Software Companies – An existential question surfaced this week both for investors and major software companies: what happens if AI doesn’t just enhance software, but begins to compete with it?That concern moved quickly through parts of the market last week, following Anthropic’s rollout of legal/contract focused AI tools that could handle tasks traditionally done by specialized software platforms and data providers.Up to this point, software companies have been viewed as beneficiaries of AI adoption, given their role as the systems of record that businesses rely on for workflows, data, and compliance. Investors loved the recurring revenue software giants posted month after month with subscription models. But as AI tools have become more capable of drafting documents, analyzing data, and even writing code, investors are reassessing how durable those advantages may be, especially for application-layer software.The stock market selloff this week reflected this growing concern. Many companies with ties to financial software, payments, data services, and enterprise platforms sold off sharply, as did private-equity firms that have built significant exposure to software through buyouts and private-credit investments. The episode underscores how attention is expanding to second-order effects of AI development, i.e., identifying which existing business models could face pressure if AI lowers barriers to entry or compresses pricing power.

We saw this in the stock market this week, but investors should also be eyeing private markets and in particular, private credit, where software now represents a meaningful share of portfolios. As AI capabilities accelerate, investors are beginning to differentiate more carefully between companies that can harness AI as a competitive advantage and those that may see it erode their moat.1

A Smarter Way to Invest Through Uncertainty

Today’s markets move fast, and emotional reactions can easily replace disciplined decision-making. Fear of loss, headline chasing, and short-term thinking often lead investors away from their long-term goals.

Our complimentary guide, Three Steps to Combat Investment Behavioral Bias2, offers practical strategies to help you stay grounded and make clearer decisions. Inside, you’ll find insights, such as:

- The two main types of biases that affect investors: Cognitive and Emotional

- Specific examples of biased decision-making that can negatively impact your portfolio

- Three essential actions you can take to counteract the natural investor tendencies toward bias

If you have $500,000 or more to invest, simply click on the link below to get your copy today!

Download Zacks Guide, Three Steps to Overcoming Investment Behavioral Bias2

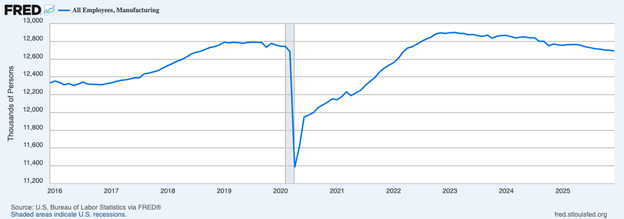

U.S. Services Hold Steady While Manufacturing Wobbles – Recent survey data continue to point to a U.S. economy moving at two different speeds. Activity in the services sector, which makes up the bulk of economic output, remains firmly in expansion, while manufacturing shows tentative signs of stabilization after a prolonged slump.The Institute for Supply Management’s Services PMI held at 53.8 in January, marking the second straight month in which all major subcomponents remained in growth territory. Business activity strengthened, new orders stayed positive, and employment expanded for a second month.Manufacturing presents a more mixed picture. After more than two years of contraction, the ISM manufacturing PMI moved back into expansion territory in January, driven by a rebound in new orders and production. Several large manufacturing industries reported growth, and backlog measures improved meaningfully, which is typically a constructive signal for future output.However, the labor side of manufacturing remains a clear weak spot. Employment in the sector is still contracting, even as other components improve. Many firms report managing headcounts rather than hiring, reflecting both efficiency gains and lingering uncertainty around demand, costs, and supply chains.3

Manufacturing Employment Peaked in 2023 and Has Been in Decline Since

A key metric to watch in the manufacturing sector is construction spending, which peaked in 2024 and has been in a steady decline over the past year. For companies to invest in new plants and domestic growth projects, there needs to be multi-year certainty of the viability of the plans, which has been difficult for many companies in the face of inconsistent tariff policy.

U.S. Manufacturing Construction Spending

U.S. – India Trade Deal Indicates Potential Thawing in Tariff Policy – The U.S. and India have reached a new trade agreement that lowers tariffs on Indian goods while securing commitments on energy purchases, underscoring a more pragmatic turn in recent trade negotiations.Under the deal, the U.S. will reduce its reciprocal tariff on India to 18%, down from 25%. In return, India has agreed to stop buying Russian oil and instead increase purchases of U.S. energy and agricultural products. The agreement also includes pledges from India to reduce tariff and non-tariff barriers on U.S. goods over time and to commit to as much as $500 billion in U.S. imports.Details of the agreement remain limited, and India has a long history of announcing tariff reductions that take time to materialize in practice. The headline commitments are meaningful, but follow-through will determine their ultimate economic impact.

Still, the agreement fits a broader pattern emerging in global trade. Even amid elevated tariffs, countries are continuing to strike bilateral and regional deals aimed at preserving market access and reducing uncertainty. In that sense, recent trade negotiations appear less about reversing globalization and more about reshaping it.6

Three Steps to Overcoming Investor Bias – Headlines can change by the hour, but a sound investment process shouldn’t. The key to better decisions is recognizing how emotion can quietly shape your choices and having a plan to counter it.

To help guide your current investing decisions, I’m offering our guide, Three Steps to Overcoming Investment Behavioral Bias7, designed to help you spot emotional traps, recognize market patterns, and respond with confidence instead of reaction. In this guide, you’ll learn:

- The two main types of biases that affect investors: Cognitive and Emotional

- Specific examples of biased decision-making that can negatively impact your portfolio

- Three essential actions you can take to counteract the natural investor tendencies toward bias

If you have $500,000 or more to invest and are ready to learn more, click on the link below to get your copy today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Three Steps to Overcoming Investment Behavioral Bias offer at any time and for any reason at its discretion.

3 Wall Street Journal. February 4, 2026/. https://www.wsj.com/economy/u-s-services-sector-activity-continues-to-rise-in-january-cbf6a20c?mod=economy_feat3_central-banking_pos1

4 Fred Economic Data. January 9, 2026. https://fred.stlouisfed.org/series/MANEMP

5 Fred Economic Data. January 21, 2026. https://fred.stlouisfed.org/series/TLMFGCONS

6 Wall Street Journal. February 2, 2026. https://www.wsj.com/politics/policy/u-s-will-cut-tariffs-on-india-to-18-in-trade-deal-trump-says-6045d0f3?mod=economy_feat2_trade_pos3

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Three Steps to Overcoming Investment Behavioral Bias offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The ICE U.S. Dollar Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973: the Euro zone, Japan, the United Kingdom, Canada, Sweden, and Switzerland. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.