In today’s Steady Investor, we answer some of the top questions on investor’s minds such as:

- U.S. saving has increased, but what does this mean for GDP growth figures?

- Are the repo markets in crisis?

- Time is running out for the Brexit – will Parliament try to agree on terms for leaving the EU, request an extension, or leave the EU with no deal?

Read on to get the details!

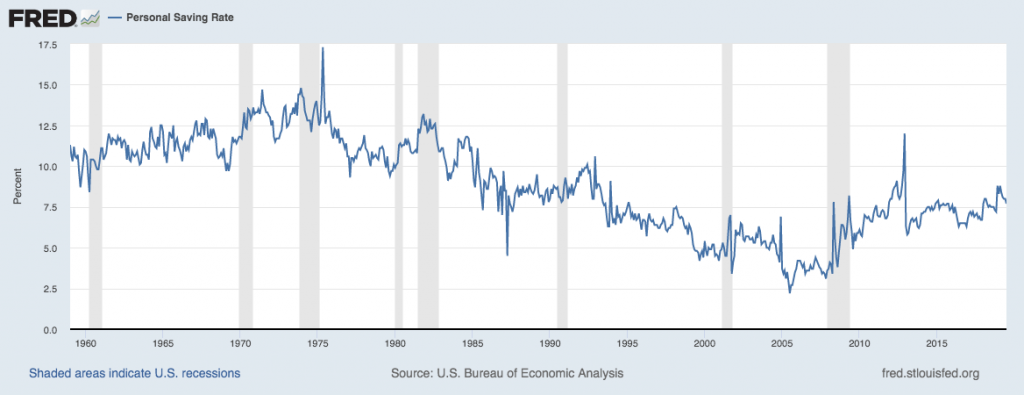

Good Trend: Americans are Saving More – Though normally known for our robust spending, American households have also been locked into another trend: saving more. In the first seven months of 2019, the personal saving rate for U.S. households climbed to 8.2% – the highest it’s been since 2012. If you consider that the personal saving rate remained below 7% for most of the 1990’s and had even dipped below 5% in the lead up to the Financial Crisis, then it seems like a solid development and accomplishment for U.S. households to be saving more. We would argue that consistent saving throughout a lifetime is good for building and maintaining wealth, so we welcome the development. But there is also another angle to this story that we believe is important to take into consideration – as wages have barely ticked higher over the last few years, and savings rates increase, it could mean the possibility of softer spending on a going forward basis. Since approximately two-thirds of the U.S. economy is comprised of consumer spending, 1 too much saving could eventually make its way into GDP growth figures.

Personal Saving Rate for U.S. Households

Source: Federal Reserve Bank of St. Louis2

____________________________________________________________________

Is Corporate America in an Earnings Recession?

While we need to keep an eye on GPD growth figures, it appears Corporate America could have an earnings problem with earnings posting the second consecutive quarter of declines. If corporate earnings are generally thought of as the backbone of stock market returns, is this trend something investors should be concerned about?

Take a deeper look with our just-released September Market Strategy report. In this report, we’ll take a closer look at what is happening in Corporate America with earnings, and we also give readers insights for possible ways to hedge portfolios against potential deleterious effects of the trade war.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free report today!

Download Our Just-Released September Market Strategy Report3

____________________________________________________________________

Brexit Clock is Ticking Fast, and Options are Running Out – In a landmark decision this week, the United Kingdom’s top court ruled that Prime Minister Boris Johnson essentially broke the law when he closed Parliament for five weeks (September 9 – October 14) in the lead-up to the hard Brexit deadline of October 31. As such, Parliament officially reconvened this week and now faces the daunting task of trying to agree on terms for leaving the EU, requesting an extension from the EU, or leaving the EU with no deal. In essence, Parliament is in the exact same place it was before the suspension, but now with less time. A hard Brexit, in our view, appears to be the least desirable option as it relates to the U.K. economy, but we would also opine that the markets have already priced in the worst-case scenario. Prime Minister Boris Johnson, in his first speech before a reconvened Parliament, doubled down on leaving the EU without a deal.4

Are the Repo Markets in Crisis? Last week we explained how the repo markets worked and what we believed caused the cash shortage (corporate taxes coming due, massive bond sale). This week, however, despite tens of billions of cash infusions every day, the cash shortage continues to be an issue for the repo markets. The New York Federal Reserve has stepped in with overnight cash loans of $100 billion a day, with 2-week offerings of $60 billion. Even still, days like Wednesday continue to happen, when the Fed supplied $75 billion of cash but received $92 billion of security offers. In short, a near $20 billion cash shortfall is a fairly significant deal. Mutterings around the Fed this week have centered around the unveiling of a potential $300 billion to $500 billion standing credit line, in an effort to provide consistent liquidity versus ‘reactive’ liquidity each time there’s a cash shortage.5 Such a sizable credit line would bring calm to the markets, in our view, but the overarching question for financial markets remains: Is there a systemic problem that needs solving?

Corporate America Could Have an Earnings Problem – In the second quarter of 2019, earnings posted declines. This marks the second consecutive quarter where U.S. corporate earnings have posted declines. If corporate earnings are generally thought of as the backbone of stock market returns, is this trend something investors should be concerned about as the third quarter comes to an end?

Take a deeper look with our just-released September Market Strategy report.6 In this report, we’ll take a closer look at what is happening in Corporate America with earnings, and we also give readers insights for possible ways to hedge portfolios against potential deleterious effects of the trade war.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free report today!

Disclosure

2 U.S. Bureau of Economic Analysis, Personal Saving Rate [PSAVERT], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PSAVERT, September 26, 2019.

3 ZIM may amend or rescind the Market Strategy Report for any reason and at ZIM’s discretion

4 The Wall Street Journal, September 25, 2019. https://www.wsj.com/articles/british-leader-goads-rivals-to-end-his-rule-call-new-vote-11569443576?mod=hp_listb_pos3

5 Bloomberg, September 25, 2019. https://www.bloomberg.com/opinion/articles/2019-09-25/why-i-m-worried-about-the-repo-market?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosmarkets&stream=business

6 ZIM may amend or rescind the Market Strategy Report for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.