In today’s Steady Investor, we are taking a deeper dive into key market factors that we believe investors should keep an eye on, such as:

• The April inflation report

• Pressure is on for corporations to beat earnings expectations

• Share buybacks rose sharply in Q1

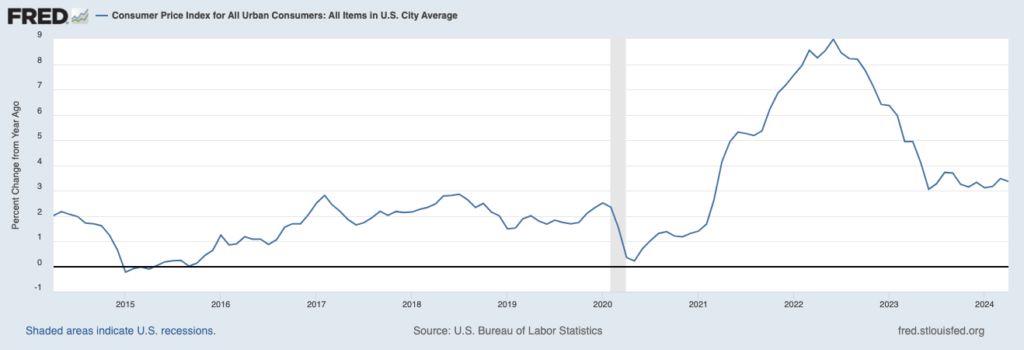

The April Inflation Report Welcomed by Investors and the Fed – Inflation came in hotter-than-expected in the first quarter, which had many market watchers on edge for April’s consumer price index (CPI) report. Fortunately, it did not disappoint. The Labor Department reported that CPI rose 3.4% from a year ago, with core prices (excluding food and energy) up 3.6%. Many investors reading these figures may see them as problematic and think “isn’t inflation still well above the Fed’s 2% target?” The short answer is yes, but the important takeaway is that inflation is not re-accelerating—an important distinction for the Fed. At 3.4%, CPI’s year-over-year increase was the lowest it has been since April 2021. In addition, consider that last April, the CPI print was 4.9% year-over-year, which underscores inflation’s gradual but steady trend downward. Gas prices and housing contributed to inflation’s stickiness in April, though year-over-year rent increases slowed from March levels.1

7 Secrets to Building the Ultimate Retirement Portfolio in 2024!

Feeling overwhelmed by retirement planning is normal, but you don’t have to navigate it alone. Achieving your financial goals involves some work: Defining your investing objectives, determining your asset allocation, and managing investments over time.

At Zacks, we manage retirement portfolios every day and understand the time and effort it takes. So, to help you, we are offering readers our free guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio3, which offers a step-by-step blueprint of our customized investing process.

If you have $500,000 or more to invest, download your free guide today!

Get our FREE guide: 7 Secrets to Building the Ultimate DIY Retirement Portfolio2

The CPI Measure of Inflation Eased in April, Providing Relief to Investors and the Fed

Equity markets seemed to welcome the inflation news, with the S&P 500 rising to a record high along with the Nasdaq and the Dow Jones Industrial Average. With retail sales also coming in lighter-than-expected, and April jobs growth marking a steep decline from March payrolls, the U.S. economy is seen as slowing as inflation modestly ticked lower. Bond prices seemed to suggest that the Fed could be closer to cutting interest rates as well—yields on 2-year U.S. Treasury bonds fell on the news.

Pressure is On for Corporations to Beat Earnings Expectations – S&P 500 companies are poised to deliver year-over-year earnings growth of 5.4%, the largest increase in almost two years. But with the S&P 500 trading at around 20x forward earnings, there’s a good argument that Wall Street has already priced in better-than-expected earnings, leaving corporations very little wiggle room for disappointment. Indeed, companies that have missed on earnings have seen their shares fall an average of -2.8%, which is higher than the five-year average of -2.3%. And on the flip side of the equation, corporations that have exceeded expectations have only seen shares rise an average of 1%, largely in line with the five-year average of 0.9%. The Federal Reserve may also be influencing the higher bar for U.S. corporate earnings. With falling expectations for rate cuts in 2024, investors have had to factor in a higher discount rate for future cash flows, which is making stocks look more expensive relative to bonds.4

Share Buybacks Rose Sharply in Q1 2024 – The message corporations are sending to markets, however, is that businesses and balance sheets are in good shape. In addition to better-than-expected earnings, companies have been buying back shares at a strong pace so far in 2024. S&P 500 companies announced nearly $200 billion in share buybacks in Q1, a 16% increase from the same period in 2023. Around 443 companies have announced plans to buy back shares, which is up from 378 a year ago. Companies typically buy back shares to boost shareholder equity by reducing the number of shares outstanding, and they can be a signal to markets that the business is confident about the growth outlook. By some estimates, S&P 500 share buybacks could reach $925 billion in 2024, an annual growth rate of 13%.5

As we wait to see how the market will be impacted by these events, there are things you can do now to protect your investments and create a retirement portfolio that meets your financial goals. To help you do this, we recommend reading our guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio.6 It provides a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio of your own and pursue long-term investing success.

If you have $500,000 or more to invest, get this guide to help you reach your goals and enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

3 Fred Economic Data. May 15, 2024. https://fred.stlouisfed.org/series/CPIAUCSL#

4 Wall Street Journal. May 12, 2024. https://www.wsj.com/finance/stocks/wall-street-turns-up-the-heat-on-companies-to-perform-12010d2b?mod=djemMoneyBeat_us

5 Wall Street Journal. May 9, 2024. https://www.wsj.com/finance/stocks/stock-buyback-big-tech-314f79c5?mod=djemMoneyBeat_us

6 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees or other expenses. An investor cannot invest directly in this Index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.