The European sovereign debt crisis that characterized the region in 2011 has faded, but now Europe faces another conundrum – problems in the banking sector. Burdened by bad loans, high capital requirements, negative interest rates and regulatory penalties, Europe’s banks are scrambling for ways to grow earnings.

Below we take a look at a few headwinds they face today.

Non-Performing Loans Pile Up

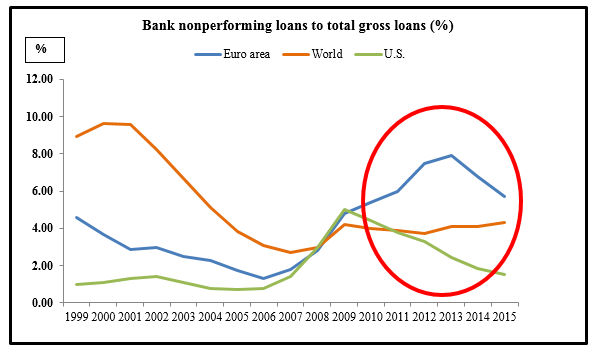

Non-performing loans (NPLs) are around 5.7% of gross loans and almost 9% of GDP in the European Union (EU). According to the European Banking Authority (EBA), NPLs in this region are upto three times higher than other global jurisdictions, as of March 2016.

Non-Performing Loans as a % of Total Loans has Grown Rapidly in the EU

Source: World Bank

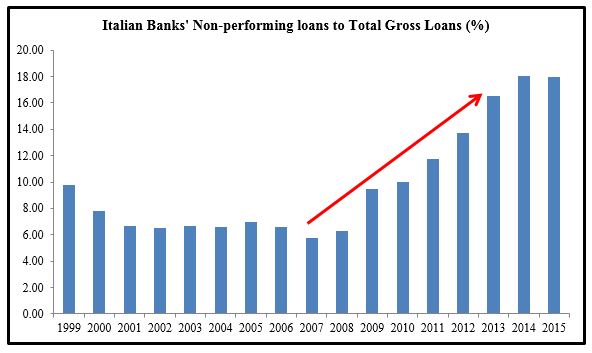

This rise in loans as a percent of GDP may to some extent explain several banks’ reluctance to lend over the last couple of years. At the forefront of euro area’s NPL problem is Italy, where banks’ combined bad loans are €360 billion (€87 billion after write-downs). From around 6.3% in 2008, the country’s banks are burdened with close to 18% NPLas of 2015.

Source: World Bank

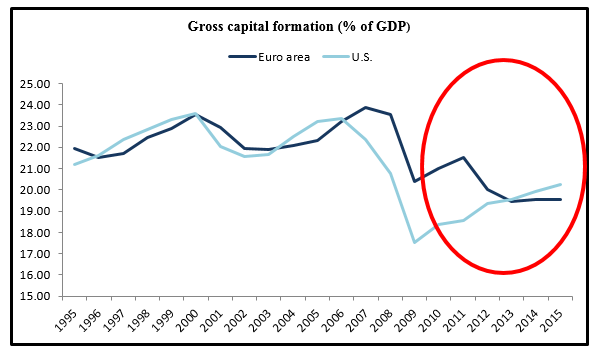

The EU’s struggle with non-performing assets could potentially be eroding real investment opportunities. As it is after the financial crisis, the gross capital formation’s share in GDP did not show much traction in the EU, even as the U.S. economy – where the crisis had its origins – improved on that front.

Source: World Bank

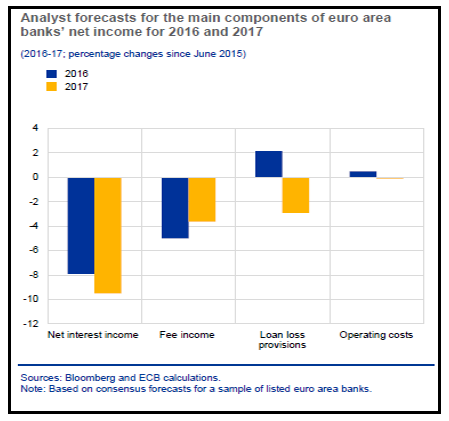

Margins Under Pressure

Adding to banks’ woes are higher regulatory costs and negative interest rates on deposit facility. Following the 2014 interest rate cut to sub-zero levels, the European Central Bank (ECB) slashed rates further down to -0.4% this March. But, cutting interest rates to levels that low creates a catch-22: low rates are designed to stoke inflation and real economic activity, but negative rates have the effect of squeezing banks’ net interest margins. Earnings forecasts for 2017 look bleaker mainly due to lower interest income expectations, as revealed by the ECB’s Financial Stability Review.

Source: European Central Bank’s Financial Stability Review, May 2016

The return-on-equity (ROE) of the region’s largest banks has remained below the cost of equity (COE) since the 2008 financial crisis. According to Bloomberg data, the average ROE has plunged from above 15% before the crisis to barely 5% at present, even as the average COE has increased.

Afflicted with attenuating profit margins, European banks are planning to cut about 20,000 . Germany’s Commerz bank is planning to retrench 9,600 jobs (about one-fifth of its workforce), halt dividend payments, shrinkits securities trading businessand merge certain divisions.

The Next Shoe to Drop: Fines

Like getting hit while you’re already down, the U.S. Department of Justice (DOJ) is seeking penalties on six European banks. The charges stem from the selling of mortgage-backed securities – close to $80 billion in aggregate – in the lead-up to the 2008-09 financial crisis, based on U.S. Federal Housing Finance Agency’s (FHFA’s) complaints.

Concerns are mounting, particularly about Deutsche Bank’s ability to cough up $14 billion. Even as the German bank is apparently hoping to have the penalty reduced, it has already reached an agreement to sell-off its life insurance unit, Abbey Life Insurance, to Phoenix group for €1.09bn. However, the deal is a 20% discount on embedded value, a bigger undervaluation compared to the average on similar deals over the last decade (as suggested by the Financial Times). That’s not all – Deutsche has had to shell out £175m to Phoenix to cover charges/fines that could be needed against the UK’s Financial Conduct Authority’s investigations that were announced in March. Though Deutsche appears able to withstand whatever penalty is levied (they have 5.5 billion euros set aside for litigation costs and they can raise another 5 billion in an equity sale), the impact to sentiment in the banking industry is significant. Risk averse banks worries about penalties are not likely to lend, which means a reacceleration in economic activity is unlikely.

Bottom Line for Investors

As the EU’s banking sector faces tough times, speculations about government interventions have risen. But, bailouts could be dicey: on one side, there are bleeding banks struggling with bad loans; on the other, taxpayers’ money is at stake in an already sluggish economy. It is still too early to determine whether bailouts would be necessary. In the meantime, volatility in Europe’s banking stocks should not surprise us, given the existence of negative interest rate policy along with the drag to risk-taking and sentiment caused by regulations and fines.

Investors should be cautious about having too much exposure to European financials in portfolios. A diversified approach can ensure that whatever the outcome in Europe, your portfolio is exposed to other assets that may do well when European banks suffer. If you are unsure if your portfolio is effectively diversified for your investing objectives, a money manager can help guide your investments to success. But, don’t take our word for it. If you’re thinking about working with a manager, read “What to Look for in a Money Manager” – it includes ten tough questions you can ask any prospective investment manager…download it now

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.