Darrin A. from Red Lodge, MT asks; Good Morning Mitch, I’d like to hear your thoughts on rising interest rates and technology stocks. All signs point to interest rates rising and tech stocks falling in the future, as far as I can see. Do you share this view? If not, what are your thoughts? Thank you.

Mitch’s Response:

Thank you for emailing your question, Darrin. It’s a great question, and one that I think has a few different answers.

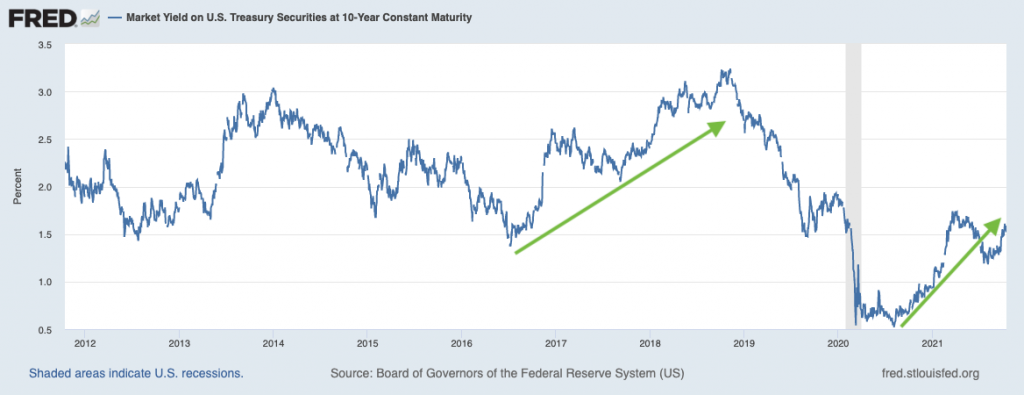

Let’s start with the basic premise of rising rates, for which we’ll use the 10-year U.S. Treasury bond as a proxy. The pandemic response pushed the 10-year to a record low (chart below), and rates have started to move higher of late, albeit at a relatively slow pace. By historical standards, long-duration Treasury bond yields are still very low.

The Federal Reserve has increasingly indicated their intent to gradually reduce QE purchases, which I think is fair to say will put a little upward pressure on long-duration bond yields. Inflation has run longer and hotter than many Fed officials expected, though in their view – and in mine, I should add – these inflationary pressures are likely to abate in the near future. Even still, reducing QE purchases, while the economy is simultaneously expanding, could see the 10- and 30-year US Treasury bond yields move higher – but not in the sustained and rapid manner as many people fear.

_____________________________________________________________________________

Understanding a Bull vs. Bear Market and How to Protect Your Assets During Both!

There is no better time than now to understand the ins and outs of a bear market versus a bull market. For investors, the uncertainty of the bear market can be scary. How long will it last? How far will stocks fall? How much will it damage my nest egg?

I believe that good information is the best way to combat investor fears during a bear market. That’s why I’d like to help you understand these market downturns and the steps you can take to protect your assets from potential damage. You’re invited to get our free guide, Everything You Need to Know About Bear Markets.1

If you have $500,000 or more to invest, get this helpful guide today. It walks through the history and types of bear markets, how investors typically react to extreme volatility, and what we can learn from the history of bear markets and pandemics.

Download – Everything You Need to Know About Bear Markets1

_____________________________________________________________________________

Your question is whether higher yields are bad for tech stocks. Conditions today are different than they were 10 or 20 years ago, but the first thing I’d like to point out is that historically, rising rates have not necessarily been bad for tech stocks. In the two periods I highlight below with green arrows, yields were rising while technology stocks were performing very well. In the 2016 to 2018 period, technology stocks significantly outperformed the broad S&P 500 index, while the 10-year U.S. Treasury yield was also moving up.

10-Year U.S. Treasury Bond Yield

Now, a counter-argument to my point would be that today, many tech valuations are far more stretched than they were five or ten years ago. Fair point. When yields are low, investors are more willing to buy growth stocks and pay premiums for doing so, meaning that many tech stocks were bid up to relatively high multiples. Since rising rates generally benefit value-oriented companies, a higher rate environment could result in a rotation away from growth toward value, which could mean selling pressure in those high valuation tech names.

I believe that is the premise of your question, Darrin, and I think you have a good point. I would counter, however, by saying that a portfolio response should not be to sell out of tech – a better response would be to apply critical fundamental analysis to your portfolio holdings, and think about what valuations are fair relative to expected future earnings and which valuations are maybe too steep.

In other words, it’s a good time to be very careful in-stock selection within the technology sector, but not bearish on the sector overall, in my view. Many technology companies are not facing the same price pressures and supply chain issues as other companies in the economy, and they still post accelerating earnings and rising gross margins. Slightly higher rates should not materially alter the profit outlook for these companies, which is the main reason investors should consider owning them in the first place.

Carefully selecting and diversifying your portfolio can help you better protect your assets, especially when a bear market hits. There are also other steps you can take during a volatile market, like this one, to keep your investments on track for the future.

If you have $500,000 or more to invest, get our guide, Everything You Need to Know About Bear Markets.3 It walks through the history and types of bear markets, how investors typically react to extreme volatility, and what you can learn from the history of bear markets and pandemics. Click on the link below to get your free copy today!

Disclosure

2 Fred Economic Data. October 15, 2021. https://fred.stlouisfed.org/series/DGS10

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Everything You Need to Know About Bear Markets offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.