Logic holds that as an item becomes more expensive, buyers become more reluctant. In a retail setting, you don’t hear people say, “No, I’m going to wait until it becomes more expensive before I buy.” That would be ridiculous, right?

Not for the stock market! In fact, this thinking is related to one of the most common investor mistakes we see here at Zacks Investment Management. In my 20+ year career, I can’t possibly count the number of times I’ve seen investors sell stocks ‘low,’ following a correction or downward market volatility, then hear, “I’m going to wait until the market rises before I buy again.” It happens all the time.

Of course, there are emotional challenges that come with investing as no one likes to see their nest egg dwindle. According to behavioral psychology, people loathe losses about two and a half times more than they enjoy gains. It’s understandable. But, it’s also illogical from an investing perspective. That is, unless you’re a perfect market timer (and, no one is).

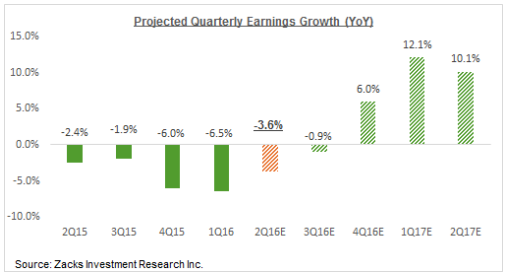

Here’s what I’m getting at: as Brexit and China growth worries fade, and stock prices defy uncertainty by continuing to rise, I think we’re going to start seeing investors worry more about missing the upswing than a potential bear market. What’s more, if earnings rebound nicely in the next 6–12 months (our expectation), this will likely further support investor confidence. Here is what we believe we’ll see in terms of quarterly earnings over the next year.

And, don’t forget about two other tailwinds blowing into the U.S. stock market right now:

- ‘Lower for longer’ global interest rates

- Capital inflows away from uncertainty in Europe, Japan and China and toward the United States which continues to offer relative stability.

The confluence of these factors should, in my view, push valuations higher and, at the same time, make stocks even more attractive. Alas, we’ve arrived at a paradox of stock investing—as stocks become more expensive, investors want more.

As it stands right now, the forward P/E on the S&P 500 is a little over 17x, compared to the 25-year historical average of 15.9x. If you’re a fan of the CAPE ratio (I am not a fan), then you’re looking at a P/E of about 25x compared to the 25-year average of 25.8x. The read here is that stocks are a bit expensive, but not out-of-control expensive. Stocks held a P/E above 20x for over a year heading into the Technology bubble in 2000, which didn’t pop until the P/E was up around 24x. Stocks should still have some room to run.

Two More Bricks in the ‘Wall of Worry’

As mentioned, I think Brexit worries and China growth concerns are fading. But, two new bricks in the ‘wall of worry’ for stocks have emerged 1) the upcoming U.S. election and 2) the recent spate of random terrorist acts. While terrorist attacks are despicable, they have not historically had much impact on the stock market. Additionally, election years in the past have been good for stocks. The reason I raise these items is that I see them as two “false fears,” or ones that investors will likely shift focus to in coming months. I think the market will climb these ‘walls of worry,’ and they won’t prevent valuations from moving higher.

Bottom Line for Investors

At present levels, valuations in the U.S. stock market are rich, but not exorbitant. An investor that looks at valuations and thinks the market is overvalued should remember two things: 1) valuations can (as we’ve seen before) move notably higher, and 2) there are plenty of investors willing to pay a premium for U.S. risk assets in the current environment. In the next six months, I believe that case is likely to grow stronger as investors become less worried about a potential bear market and more nervous about missing a market upswing.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.