It’s been a “nowhere to hide” situation for investors over the last several weeks.

If we look at the performance of 70 different types of asset classes from gold to bonds to oil to stocks, about 90% of them are down for the year through mid-November (negative total return in dollar terms). The last time that many asset classes were down at the same time, none of us were alive – we’d have to go back to 1920, when 84% of 37 asset classes were negative.1

Normally, we expect uncorrelated asset classes to zig while others zag, which is why diversification is generally a useful tool in smoothing out returns over time. But these days, there seems to be only one possible direction for asset classes to go: down.

Regular readers know there’s probably an upshot to this gloomy data, since I’ve been consistently bullish on the equity markets all year on the basis of low recession risk and a conviction that the U.S. and global economy will continue to grow throughout 2019. Well, there is an upshot: I see these synchronized declines as a “pause and refresh” for markets, before what could possibly be the final up leg in this bull market over the next year or so.

____________________________________________________________________________________________________________

Make the Most of the Remainder of this Bull!

It can be easy to get caught up in declines and volatility, but this bull isn’t dead yet. So how can you make the most of it?

As a service to Mitch on the Markets readers, Zacks’ Stock Market Outlook for December 2018 is available today and can help you keep an eye on economic data releases, earnings reports, and other economic factors!

This 22-page report is packed with our forecasts along with additional factors to consider as you finish 2018 and look towards the New Year:

- Should you stay bullish?

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- What produces U.S. optimism on the coming year?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns in 2018

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the December 2018 Stock Market Outlook Now2 >>

____________________________________________________________________________________________________________

In other words, I view the current corrective activity as a positive for the markets, not a negative. In 2017, just 1% of asset classes delivered negative returns3 – a reminder that with all the ‘give’ we’ve gotten out of this bull market, we should reasonably expect a little ‘take’ as well. This is how markets work.

To be sure, we’ve seen a bit of weakness in the housing and auto markets in the last quarter or two, which is important consumer-oriented data worth watching closely. But by and large, in my view, the economy remains on strong footing – even to the point where I believe an interest rate increase in December is still warranted, in spite of its perceived risk and unpopularity. S&P 500 corporations are still turning-in double digit earnings growth, unemployment hovers around record lows, inflation remains in check, and we expect the economy to grow close to 3% in 2019. With all of these factors in mind, investors might be encouraged to view the current selling pressure as I view it: as a strategic opportunity, not as a sign that it’s time to go defensive.

The Bigger Picture

Sell-offs often provide strategic opportunities to rebalance portfolios. As asset prices change or perhaps decline in value very quickly, oftentimes investors can use those opportunities to build a position in a security, a sector, or an asset class – ultimately re-allocating an investment portfolio.

But that’s not what I want to focus on here. Instead, I want to use the current ‘corrective’ action in the markets to provide readers with long-term perspective, particularly if the declines are nudging you towards wholesale changes in your portfolio. We consistently need healthy doses of long-term perspective when it comes to investing, in my view, and there’s arguably not a better time to do that than during a selloff.

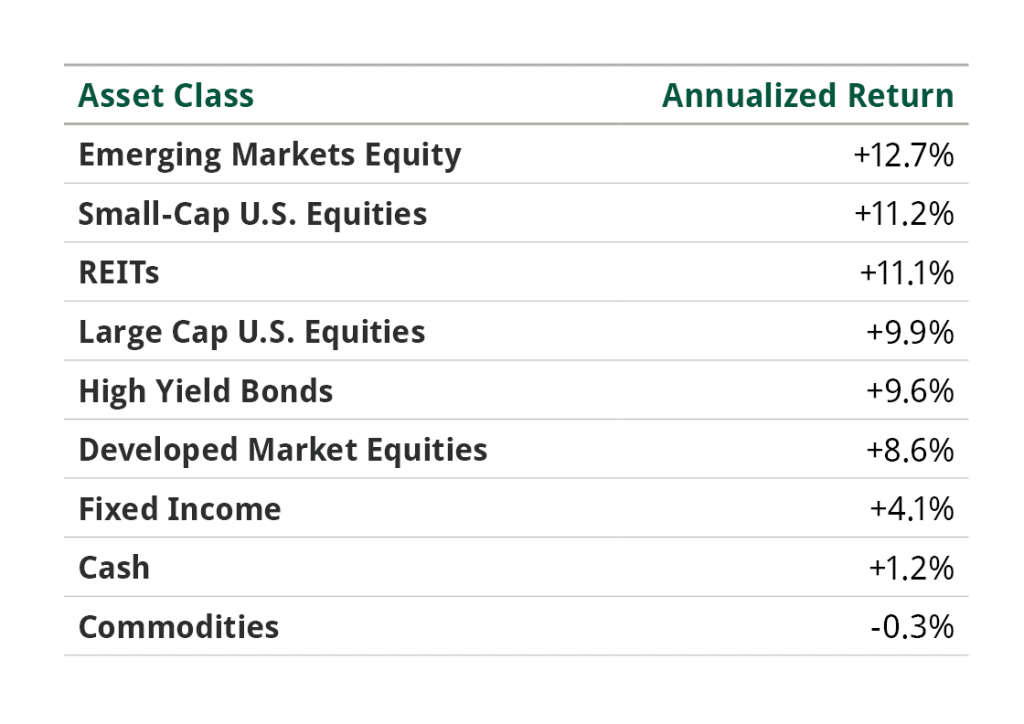

Since the theme of this week’s column is focused on asset classes across the board falling, I think it’s a good idea to take a look at a variety of asset class returns over the longer-term. The idea here is to contrast the short-term selling pressure against the strength of long-term gains. Investors with a long-term mindset, it follows, are generally less spooked by market volatility like we’re seeing today.

Below, I map out the total annualized returns for a handful of asset classes over a 15-year period, from 2003–2017. It is very important that readers bear in mind that these returns include the Great Recession declines, when the stock market at one point lost nearly half its value.

Total Annualized Return from 2003–2017:4

Source: JP Morgan

Bottom Line for Investors

I have four takeaways from the data above to share with readers for this week’s bottom line:

- Over long stretches of time throughout history, stocks and bonds have delivered favorable positive returns.

- A diversified portfolio of stocks, bonds, and REITs may have yielded solidly positive returns over the last 15 years.

- Even with having to endure the worst bear market in nearly a century, stocks, bonds, and REITs managed to do just fine over the last 15 years.

- Focusing on the long-term versus the short-term is perhaps the greatest key to success in investing, in my view.

In addition to these 4 takeaways, I recommend keeping an eye on economic data releases, earnings reports, and other key economic factors. Our Just-Released December 2018 Stock Market Outlook Report, will give you insight into just that!

This Report is packed with our newly revised predictions as 2018 ends and 2019 gets rolling. For example, you’ll discover Zacks’ view on:

- Should you stay bullish?

- What sectors does Zacks Industry Ranks show the best opportunity?

- What industries within those sectors most merit your attention?

- Year-end forecast for the S&P

- Small-cap vs. large-cap returns

- Our view on the odds for a recession in 2019

- And much more…

If you have $500,000 or more to invest, get your portfolio better prepared for 2019 by reading this new report today.

FREE Download – Zacks’ December 2018 Stock Market Outlook5 >>

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 The Wall Street Journal. November 25, 2018, https://www.wsj.com/articles/no-refuge-for-investors-as-2018-rout-sends-stocks-bonds-oil-lower-1543155033?mod=djem10point

4 J.P. Morgan. October 31, 2018, https://am.jpmorgan.com/us/en/asset-management/gim/adv/insights/guide-to-the-markets/viewer

5 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.