Today’s market offers plenty of noise and opportunity. In this issue of Steady Investor, we look at what’s shaping investor sentiment now and how you can keep your strategy focused on long-term growth.

- Bank earnings are looking strong

- “Non-official” data on retail spending shows solid activity

- The data center boom is outpacing the U.S. power grid

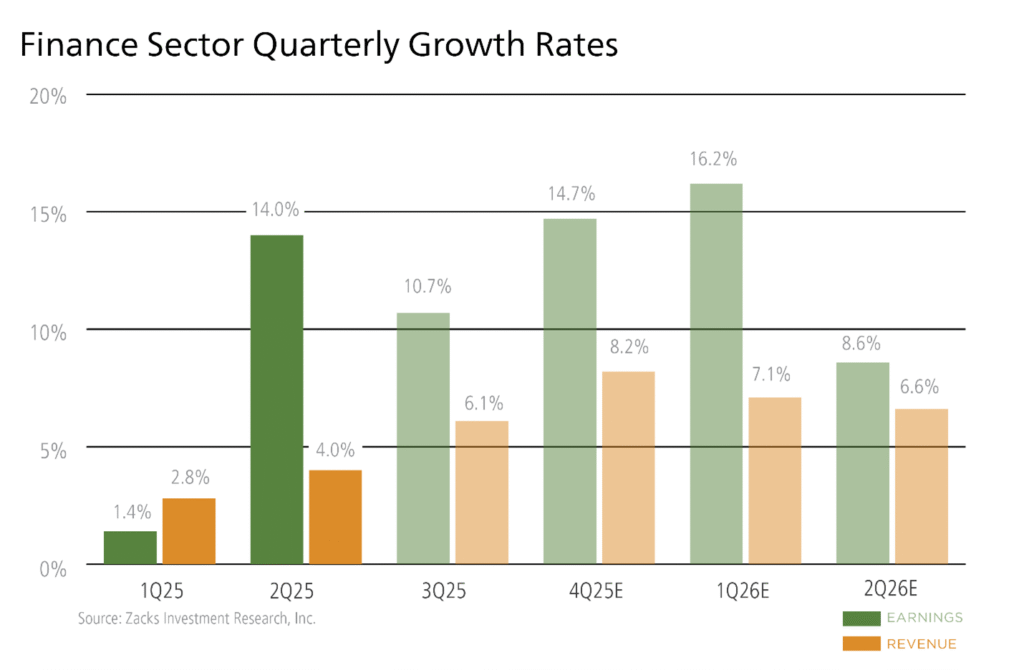

Bank Earnings Are Hitting the Tape, and They’re Looking Strong – America’s biggest banks kicked off third-quarter earnings season with a clear message: the economy is holding up. Profits and revenues for major money center banks came in above expectations, helped by rising deal activity, corporate spending, and resilient consumer behavior. Taken together, the six largest U.S. banks earned nearly $41 billion last quarter, a 19% increase from a year ago.In earnings calls, we’ve been hearing a consistent set of themes: U.S. consumers remain strong with stable deposits and steady card spending. But as ever, the optimism coming from banks also cited risks on the horizon, namely a cooling job market, potential fallout from the government shutdown, and recent high-profile bankruptcies in the credit space. We tend to see these fears as largely priced-in (government shutdown, job weakness) and not necessarily indicative of the broader U.S. economy’s health (high-profile bankruptcies in the auto sector). Overall, delinquencies remain low and lending activity is steady. A steepening yield curve with falling short-term rates could bolster that outlook. For the Zacks Finance sector as a whole, Q3 earnings are expected to increase by +10.7% from the same period last year on +6.1% higher revenues, as the chart below shows.1

Finance Sector Quarterly Growth Rates Comparison

How to Avoid Financial Pitfalls in this Market

Numerous financial myths, like social security running out, circulate widely, often leading to detrimental consequences.

I recommend familiarizing yourself with common financial myths and pitfalls that can derail your financial journey.

To keep you on track, I’m offering our guide, Debunking Common Financial Myths3, which addresses myths, like:

- When you retire, you should get out of stocks completely

- It’s essential to watch the daily movements in the stock market

- Financial advisors always have your best interests in mind

- And more!

If you have $500,000 or more to invest, download our free guide below!

Get our FREE guide: Debunking Common Financial Myths3

“Non-Official” Data on Retail Spending Shows Solid Activity in September – With the official government retail sales report delayed due to the ongoing shutdown, investors are leaning more heavily on alternate indicators, produced by regional Fed branches and private companies.The Chicago Fed’s Advance Retail Trade Summary (CARTS), a model-based proxy for Census Bureau retail sales data, estimated that retail sales excluding motor vehicles and parts rose 0.5% in September, following a 0.7% increase in August. That growth moderated slightly when adjusting for inflation, with real sales up an estimated 0.2% last month, down from 0.3% the month before.Private data sources echoed the trend. Fiserv’s ‘SpendTrend’ report showed retail sales were up 2.5% year-over-year in September, with electronics and general merchandise stores leading the way. Online, furniture, and health-related categories saw declines, underscoring a shift toward more necessity-driven spending.Importantly, retail activity continues to be supported by higher-income households, who are still benefiting from solid wage growth and rising real estate and investment wealth. A Bank of America Institute survey showed that September spending among high earners rose 2.6%, compared to 1.6% among middle-income and 0.6% among low-income groups.4

The Data Center Boom is Outpacing the U.S. Power Grid – As tech companies race to dominate artificial intelligence, they’re hitting a critical, structural roadblock. There’s not enough electricity. In an effort to adapt and stay ahead in the ‘AI arms race,’ tech companies are building their own energy solutions: natural gas turbines, fuel cells, diesel generators, and battery storage systems. Building or connecting to large-scale transmission lines (i.e., connecting to the grid) can take years, and permitting delays, equipment shortages, and tariffs have only made things harder. A single data center now consumes as much electricity as thousands of homes, and AI workloads multiply demand further. A single AI search, for instance, can require 10x the energy of a standard Google search.All this is happening while U.S. generation capacity is falling behind. The U.S. is adding fewer than 65 gigawatts per year, far short of the 80 gigawatts needed annually to support growing demand from AI, crypto, manufacturing, and electrification trends. Globally, the U.S. is falling behind China in building power infrastructure. China added over 400 gigawatts of new generation last year, about 8x the U.S. pace, and is on track to double U.S. investment in power plants, storage, and grid upgrades in 2025, according to the IEA.

Even if the U.S. ramps up soon, some data centers won’t be able to plug into the grid until the 2030s.Until then, the ‘DIY power’ model is booming. Projects are snapping up small turbines, backup engines, and natural gas infrastructure to power AI campuses in Oklahoma, Utah, California, and beyond.5

Headlines Change Fast. Don’t Let Them Shake Your Plan – Market headlines will keep, but lasting success comes from tuning out the noise and staying focused on what drives long-term growth.

Our free guide, Debunking Common Financial Myths6, helps familiarize long-term investors with common myths and pitfalls that can derail your journey to success.

This guide covers a few myths, such as:

- Retirees should get out of stocks completely

- It’s essential to watch the daily movements in the stock market

- Financial advisors always have your best interests in mind

- And more!

If you have $500,000 or more to invest, I recommend downloading your free guide today!

Disclosure

2 Zacks Investment Research, Inc. October 8, 2025. https://www.zacks.com/commentary/2764974/the-q3-earnings-season-gets-underway-a-closer-look

3 ZIM may amend or rescind the Debunking Common Financial Myths guide for any reason and at ZIM’s discretion.

4 Zacks Investment Research, Inc. October 15, 2025. https://money.usnews.com/investing/news/articles/2025-10-15/us-retail-sales-excluding-autos-likely-increased-again-in-september-chicago-fed-says

5 Wall Street Journal. October 15, 2025. https://www.wsj.com/business/energy-oil/ai-data-centers-desperate-for-electricity-are-building-their-own-power-plants-291f5c81?mod=djemMoneyBeat_us

6 ZIM may amend or rescind the Debunking Common Financial Myths guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward-looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein, and accordingly no such persons make any representations with respect to the accuracy, completeness, or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

“The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.”

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.