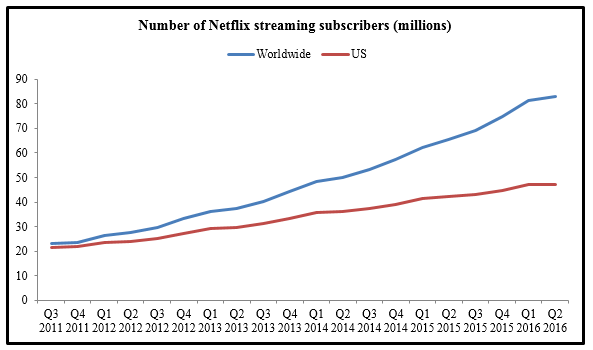

The way we watch television has changed dramatically in the last decade, and Netflix has been a prominent force behind the evolution. Its streaming and video-on-demand services have garnered more than 47 million subscribers in the U.S., as of Q2 2016, more than doubling since 2011.

Even more dramatic is Netflix’s international expansion into more than 190 nations. Starting with Canada in 2010, the company soon branched out to more than 60 countries. Earlier this year, it expanded into more than 130 countries, and as of Q2 2016, the count of worldwide subscribers of the network has exceeded 83 million, a +27% growth from the same quarter of the previous year (According to Netflix).

Source: Statista

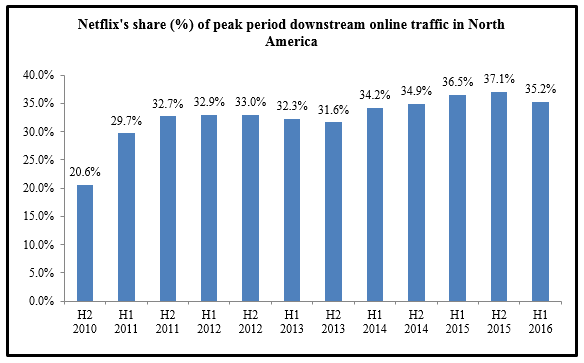

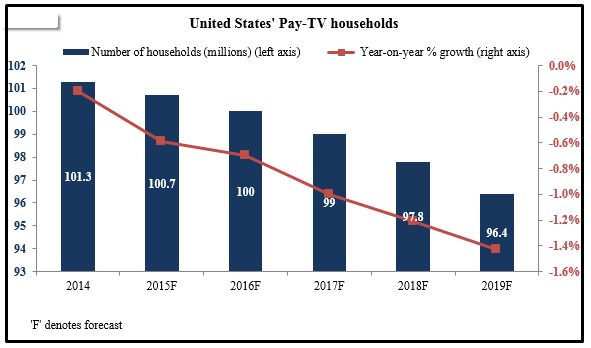

The ability to stream movies and shows produced from various networks (including foreign ones) on a single platform free from commercial breaks has broad-based appeal. Recent statistics show that more than 35% of peak internet traffic across North America consists of Netflix streaming, while the number of U.S. pay-TV subscribers is projected to rapidly decline over the next couple of years.

Source: Statista

Source: Statista

Netflix’s algorithms, which are designed to ascertain viewers’ preferences and accordingly provide personalized recommendations, has added more incentive for customers to stream more content. In 2015, users streamed Netflix videos for 42.5 billion hours, which is +47% more than the preceding year’s 29 billion hours.

A Brief History of Netflix

Founded in 1997 by Reed Hastings and Marc Randolph in California, Netflix started out as a DVD rental-by-mail firm, and its journey has been quite a roller-coaster ride. In 2000, it offered itself up for acquisition to Blockbuster, but the deal did not go through. Two years later, it raised $82.5 million in an IPO, and by 2003, it garnered more than 1 million subscribers for its DVD rental business and earned its first annual profit at the end of the year.

In 2007, Netflix expanded into video streaming. Among the first line of hour-long TV series to feature on its platform were ‘Mad Men’ in 2011 and ‘Breaking Bad’ in 2012, with the latter’s mass popularity reportedly soaring after it began streaming on Netflix.

Feeling threatened by the possibility of online streaming eating away at their markets, some cable TV networks began charging more for licensing content to Netflix, while some others like Starz stopped renewing deals.

But that’s when Netflix planned to up its game by foraying into original production/distribution of content (the second venture in this space, after it had closed down its independent films’ distribution venture, ‘Red Envelope Entertainment’ in 2006). Netflix bought David Fincher’s ‘House of Cards’ after outbidding TV industry giant HBO, and promising Fincher full commitment to two seasons with no pilot and zero interference. The series debuted on Netflix in February 2013, and the rest is history. Five months later, yet another critically acclaimed and award-winning show, ‘Orange is the New Black,’ was added to the Netflix ‘original’ family.

Is Competition Driving Up Costs?

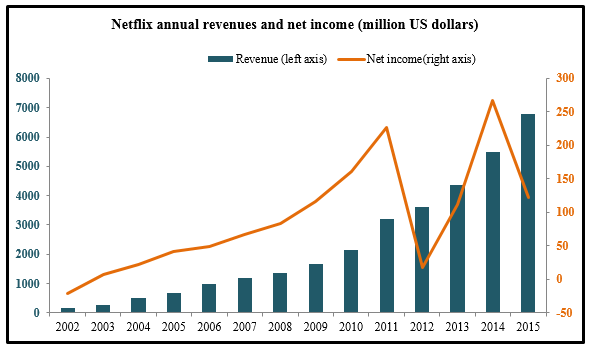

While Netflix’s revenues have increased steadily (touching around $6.78 billion in 2015), its profits’ trajectory has not been as smooth—probably a reflection of rising programming expenses owing to license fees hikes amid rising competition from players like Hulu and Amazon. Amazon beat Netflix in the battle to stream USA Network’s hit “Mr. Robot” and also sealed an enviable $250 million deal with the famed “Top Gear” team last year for a new show.

Source: Statista

Source: Statista

It appears that Netflix is in no mood to let go of its leading position, something that’s probably making it splurge on producing and licensing content, whose budget ($6 billion) this year is triple that of HBO. Netflix is expected to incur negative cash flow of around $1 billion in 2016 and to raise borrowings towards the end of this year or early 2017. All that spending could help, but only if Netflix manages to identify and pick shows that attract maximum viewership.

Bottom Line for Investors

Being at the forefront of the revolution in TV viewing experience, Netflix’s real test now lies in its ability to sustain growth against increasing competition from other players, and probable authoritarian restrictions in regions like China.

What adds to Netflix’s challenges is the likelihood of a conflict between its popularity’s impact on the business of pay-TV operators/movie production houses and its bargaining power to acquire licenses from them. Nonetheless, licensing fees from Netflix (or other streaming companies) could be a much-needed revenue source for cable TV networks as traditional TV viewership is shrinking: recent GfK findings reveal that about 25% of U.S. households don’t subscribe to pay-TV.

Whether or not Netflix will be able to overcome speed bumps remains to be seen. But what’s already apparent is that licensing/distributing content is getting more expensive for streaming companies, something that could eventually rake in big bucks for players who manage to stake money on the ‘right’ content, while threatening others’ margins.

From the beginning, Netflix has been on a roller coaster of highs and lows. Similarly, as the market this year has not provided investors with the smoothest ride, many have found themselves on a similar roller coaster of ups and downs as they debate whether to hold or sell or stay steady for the long-term. If you have struggled to find an investment strategy that fits your needs, we can help. At Zacks Investment Management, our focus is on risk-adjusted returns to optimize for your risk/reward equation as defined by you. Know too that Morningstar currently ranks five of our investment strategies in the top 10% of their respective classes (as of 6/30/16)—we call this our “Dean’s List.” To learn more about these strategies and how they might steady your nerves by clicking below…

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.