With the recent news and headlines surrounding the current state of the market, we are taking a deeper dive into key factors that we believe investors should keep an eye on, such as:

• An update on the U.S. commercial real estate market

• Inflation continues to trend lower

• Small businesses may signal future economic cooling

Keeping an Eye on the U.S. Commercial Real Estate Market – Many stories have circulated recently about empty office buildings in major cities across the U.S., as the rapid rise of hybrid work has led companies to rethink their commercial real estate footprint. A Wall Street Journal analysis has found that these pressures are becoming a major factor in another area of commercial real estate finance: mezzanine loans. Readers can think of mezzanine loans as second mortgages on commercial real estate buildings. Much like a homeowner would, a commercial real estate owner may use a mezzanine loan to remodel the building, add more units, or make other changes related to its use. Not all of that money is spent well. According to the Journal analysis, foreclosure notices on mezzanine loans have more than doubled since last year, and have likely reached their highest level for a single year on record. Mezzanine loans generally carry very high-interest rates, which is why investors have flocked to them in recent years and also why owners are falling into distress now. With commercial real estate prices falling and interest rates rising, owners are increasingly left with no choice but to default and hand over the property to lenders.1

Planning Your Retirement? Avoid these 8 Financial Mistakes!

Retirement planning can be tedious, but with the right help, you can potentially enjoy the ‘golden period’ that you’ve always wanted!

However, there are some common mistakes that can foil your retirement plans. In our guide, 8 Retirement Mistakes to Avoid, we outline these mistakes and how you can potentially avoid them.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Learn About the 8 Retirement Mistakes to Avoid!2

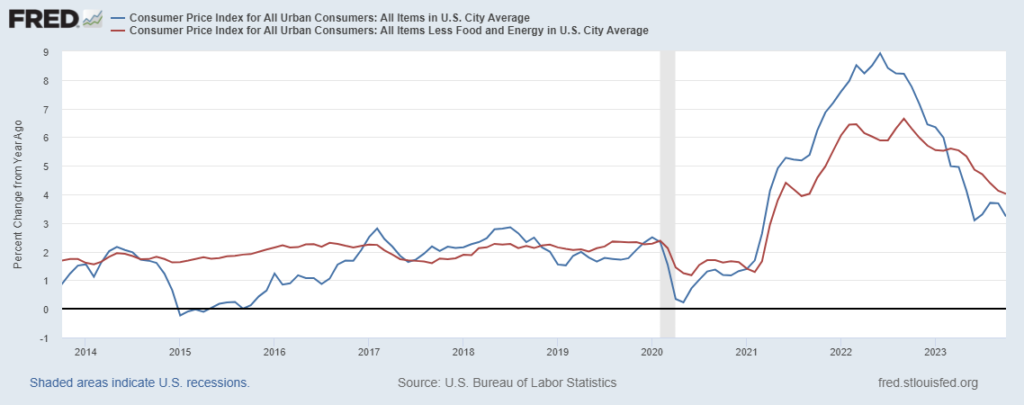

Inflation Continues to Trend Lower, Delivers Market Rally – Bond and equity markets got some good news on inflation this week, with the Labor Department reporting that core CPI was flat from September to October and rose 3.2% year-over-year. Importantly, core inflation (which excludes food and gas) from June to October rose at a 2.8% annual rate, which is a major improvement from the 5.1% pace in the first five months of 2023. The data makes it abundantly clear: inflation has improved greatly since last year and has continued to get a bit better with each print.3

Consumer Price Index (CPI, blue line) and Core CPI (red line)

There was plenty of good news in the Labor Department’s report. Prices for cars, airfares, and housing all softened, which followed a summer when furniture and other goods prices started to come down. In housing in particular, rents for new tenants fell -2.2% from a year ago, compared to the +13.7% jump experienced last year. Home prices remain elevated, and with mortgage rates higher, have become out of reach for many Americans. Couple this with 2022’s price surges on goods and services, and the pain of inflation is still being felt. The upshot is that many Americans are simultaneously benefiting from a strong jobs market, which has ushered in higher wages, and in turn helped offset rising prices and also kept consumer spending strong in the face of higher inflation. The other good news from this inflation report: it all but assures the Fed is done raising interest rates in 2023.

Small Businesses May Signal Future Economic Cooling – Small businesses are vital to the U.S. economy. According to the Small Business Administration, two-thirds of jobs in the economy are created by small businesses, and they account for nearly half of all economic activity. So, when reports show that small businesses are pulling back on investment due to high-interest rates, it’s usually worth keeping an eye on. According to the National Federation of Independent Business, the average interest rate paid by small businesses on short-term loans has risen 9% over the past three months, nearly double the 4.6% businesses were paying in the summer of 2021. This has caused many small business owners to delay hiring, put off new investments, or both. Since small businesses tend to operate with thinner profit margins and small cash reserves than larger companies, they have fewer financing options and generally cannot secure attractive rates on loans. By one analysis, small businesses spent roughly 6% of revenue on interest payments in 2021, versus 2% for larger companies.5

8 Retirement Mistakes to Avoid – Enjoying a stress-free retirement is everyone’s dream. However, we’ve witnessed investors make common but avoidable investing mistakes that have affected their portfolio.

We recommend taking a look at our guide, 8 Retirement Mistakes to Avoid6, to help familiarize yourself with these common investing mistakes. This guide digs deeper into the following:

• Is Your Portfolio Too Conservative?

• Trying to Time Markets

• Lack of Diversification

• Not Knowing How to Adjust Lifestyle After Retirement

• Switching Strategies Too Often

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

3 Wall Street Journal. November 14, 2023. https://www.wsj.com/economy/central-banking/what-to-watch-in-the-cpi-report-did-inflation-heat-up-or-cool-down-last-month-5c22f833

4 Fred Economic Data. November 14, 2023. https://fred.stlouisfed.org/series/CPIAUCSL#

5 Wall Street Journal. November 14, 2023. https://www.wsj.com/business/entrepreneurship/with-interest-rates-above-9-small-businesses-slam-the-brakes-4944a075?mod=djemRTE_h

6 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.