The 2020 U.S. presidential election has been a slog for just about everyone, no matter what your political orientation. Unfortunately, the tension is likely far from over – the outcome may not be determined for days, weeks or even months. Legal challenges are likely.

My advice to readers this week is to push back against the uncertainties of politics and to check your emotions at the door. Too often, I see investors conflate their political beliefs with their beliefs about economic outcomes – a very flawed approach, in my view. Feeling bad about the election outcome may lead to feeling bearish about the country’s economic future, which may lead to selling stocks for the wrong reasons. I think that’s a big mistake.

_________________________________________________________________________

Counter the Uncertainties of the Election by Focusing on Hard Data & Economic Indicators

Even though the outcome of the current election brings uncertainty and tension, the stock market responds far more to long-term earnings and economic growth trends over politics. Therefore, I suggest focusing more on the hard data and economic indicators that could positively impact your investments instead of getting caught up in the unknowns of the election.

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- The economic effects of the COVID-19 pandemic

- U.S. returns expectations for 2020

- Potential impact of the election

- Why you should be careful in determining what S&P 500 data to use

- Zacks Rank S&P 500 Sector Picks

- Status of global energy markets

- What produces 2021 optimism?

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released November 2020 Stock Market Outlook1

_________________________________________________________________________

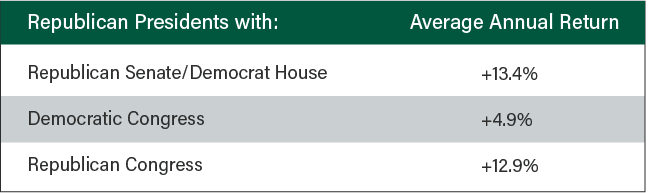

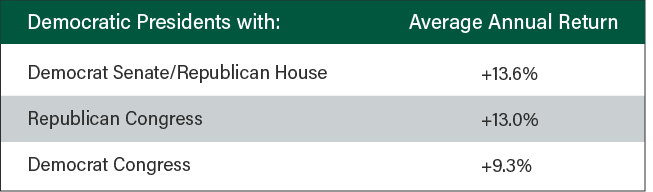

I included the data below in a previous column, but I’m sharing it with readers again as an important reminder that economics and markets have pushed higher no matter what the political balance of power. The reason, in my view, is simple: politicians aren’t the engine driving the U.S. economy forward – corporations and small businesses are.

The balance of power in government is constantly in flux, and we should reasonably expect it to remain that way indefinitely. But history tells us the stock market goes up regardless of how power is divided:

S&P 500 Average Annual Performance, 1933 – 2019

I could write pages and pages on how certain election outcomes might result in different possibilities for stimulus, tax policies, new regulations or deregulation, deficit spending, and on down the line. But sketching out hypotheticals would be feckless, in my view. Even if we did know the balance of power today, no policy directive is assured and a policy proposed often looks a lot different than policy enacted. Politicians have a long history of over-promising and under-delivering.

What’s more, the kinds of changes that matter most, like big adjustments to the tax code, often take years to complete. Back in 2017 when President Trump was inaugurated, the administration had “The Ryan Blueprint” for lowering corporate tax rates ready to go. It still took a year to push through the changes.

Ronald Reagan is another example. He focused much of his 1980 campaign against Jimmy Carter on tax reform, but his signature Tax Reform Act was not signed into law until 1986. Investors have time to plan for changes.

Bottom Line for Investors

In my view, the uncertainty of the moment should inspire investors to focus on decisions and strategies that have historically led to consistent outcomes. Long time readers probably know what I’m specifically referring to: the value of owning a diversified portfolio of stocks over long stretches (20+ years) of time. In a moment rife with uncertainty, I think you can hang your hat on the value of owning a diversified portfolio.

At the end of the day, in my view, the stock market responds far more to long-term earnings and economic growth trends – not to changes in political leadership. Investors all too often conflate political beliefs with economic outcomes, which I think is a mistake. I strongly believe investors can achieve better outcomes – and also feel better in general – by countering the uncertainties of politics with consistent investment strategies.

So, while all eyes are on the election outcome, I recommend

not losing focus on the long-term outlook. To help you to this, I am offering all readers our Just-Released

November 2020 Stock Market Outlook Report.

This report looks at several factors that are

producing optimism right now and contains some of our key forecasts to consider

such as:

- The economic effects of the COVID-19 pandemic

- U.S. returns expectations for 2020

- Potential impact of the election

- Why you should be careful in determining what S&P 500 data to use

- Zacks Rank S&P 500 Sector Picks

- Status of global energy markets

- What produces 2021 optimism?

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2Strategas, Quarterly Review in Charts, July 1, 2020.

3Strategas, Quarterly Review in Charts, July 1, 2020.

4Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.