Will and Judith M. from Appleton, WI ask: Hi Mitch, we’ve been seeing some stories about rising debt levels for U.S. households. Credit cards, mortgages, student loans, etc. are all going way up, and we’re a bit worried about the impacts of mass defaults. Eerily reminds us of 2008. What’s your take? Thank you.

Mitch’s Response:

Thank you for sending in your question. There is much debate in macroeconomic circles about the health of the U.S. consumer and households. On one hand, retail spending has remained steady despite higher prices, and wages have gone up. On the other, we’re starting to see signs of strain on consumer finances in the form of rising delinquencies (i.e., being 30+ days late on a debt payment).1

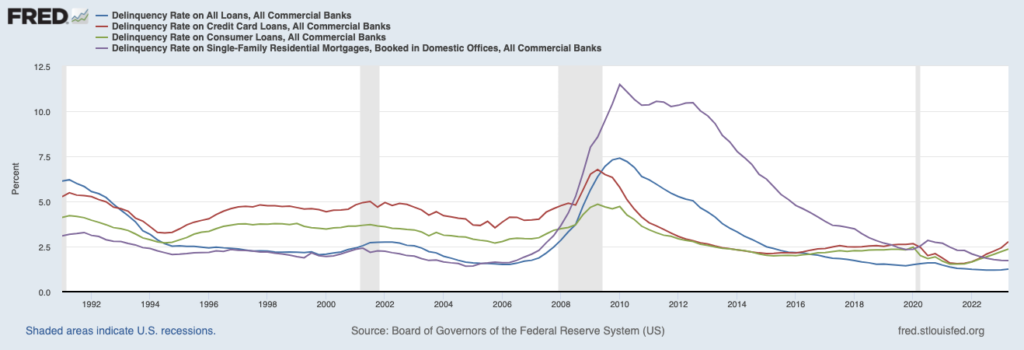

The chart below shows the delinquency rate of single-family mortgages (purple), consumer loans (green), credit card loans (red), and all loans (blue). All loans include business loans, commercial real estate loans, and others, and can be viewed as an aggregate economic view of how loans are performing.

Retirement means living the life you want, in the place you want, with activities you enjoy. Of course, making all that happen means spending some of the money you’ve worked so hard to accumulate.

If you want to ensure your money will last, it’s essential to understand some strategies and best practices. Our free guide, 4 Strategies for Spending Money in Retirement2 offers some guidelines to help ensure your retirement nest egg lasts as long as possible. You’ll also get insight on:

• Spending 101: Understanding Tax Buckets

• The 4% Rule

• Dynamic Spending with the 5% Rule

• And more…

If you have $500,000 or more to invest, download our guide 4 Strategies for Spending Money in Retirement.2 Simply click on the link below to get your copy today!

Download Zacks Guide, 4 Strategies for Spending Money in Retirement2

In my view, there’s a clear takeaway from the chart above: households are starting to feel some pressure in consumer loans and credit card loans, but mortgages (benefiting from low rates) and the broad economy are holding up well. The uptick in credit card, auto loan, and other consumer loan delinquencies is certainly worth keeping an eye on here. According to the Federal Reserve Bank of New York, the percentage of credit-card and auto-loan balances transitioning into delinquency is happening at a faster pace than we saw in 2019, which while noteworthy is also arguably not grounds for sounding the alarm. The economy was in good shape in 2019.

There are a few reasons I don’t think it’s time to worry just yet. The first is that the economy remains flush with jobs and wages are higher, both of which support household finances. The second is that bank account balances across various income groups in the U.S. are about 30% higher than they averaged in 2019, according to the Bank of America Institute. Even though inflation is eating into savings to a certain degree, households are also bringing home more income. A final factor to note is that a wide majority of U.S. homeowners are benefiting from the 10+ year period of ultralow interest rates, which followed the 2008 Global Financial Crisis and the 2020 pandemic. A majority of homeowners purchased or were able to refinance at low rates, which translates to relatively low mortgage payments. According to mortgage data firm Black Knight, the average monthly principal and interest payment for households was $1,355 in June, which is just 21% of median household income – near a record low.

One factor we’ll be watching this fall is the resumption of student loan payments, which are scheduled to resume in October. The impact of these monthly payments returning could mean less spending capacity for some households and also the possibility of falling behind on other payments, which could see the delinquency rate tick even higher. Time will tell, but I don’t think you need to be worried about a return to 2008.

As investors await the outcome of the market – I also recommend taking a look at your retirement plan.

Today, I am offering our exclusive guide, 4 Strategies for Spending Money in Retirement4, to all Mitch’s Mailbox readers. In this guide, we explore some effective strategies and best practices that investors should consider when developing a retirement spending plan. You’ll get insight on:

• Spending 101: Understanding Tax Buckets

• The 4% Rule

• Dynamic Spending with the 5% Rule

• And more…

If you have $500,000 or more to invest and are ready to learn more, click on the link below to get your copy today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

3 Fred Economic Data. August 21, 2023. https://fred.stlouisfed.org/series/DRALACBS#

4 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Strategies for Spending Money in Retirement offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The ICE U.S. Dollar Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973: the Euro zone, Japan, the United Kingdom, Canada, Sweden, and Switzerland. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.