The U.S. Consumer Won’t Go Away – In the first quarter of this year, it appeared that the U.S. consumer was pulling back spending. Some economists pointed to dwindling savings and rising concerns about the health of the banking system as reasons for the slight retrenchment. Others cited worries over the jobs market. Data from April shows the pullback didn’t last very long – retail sales for the month rose a seasonally adjusted +0.4% from March. Retail sales measure spending at stores, online, and in restaurants. The Commerce Department reported that spending on dining out, shopping online, and autos all went up. Consumers pared back spending on big-ticket items like furniture and appliances, however. The uptick in consumer spending is a positive development, but there is an important caveat to retail sales data – it does not adjust for inflation. Year-over-year, retail sales rose by 1.6%, but inflation went up by 4.9% over the same period. In other words, consumers are not necessarily out spending more, they’re just paying more for the same items.1

Is Your Retirement Prepared for What’s Next?

If you are like most investors, you are concerned about your retirement. One reason for this worry—that is shared by most people—is that there are so many unknowns.

No one can predict the future, but you can build a retirement strategy that takes these “what ifs” into account. Instead of worrying about them, you can use our free guide to help you prepare.

If you have $500,000 or more to invest, get our free guide, How Solid Is Your Retirement Strategy? You’ll get valuable and practical ideas to help build a “weatherproof” retirement strategy that can potentially protect your retirement nest egg from any storm that could threaten your financial security.

Get our FREE guide: How Solid Is Your Retirement Strategy?2

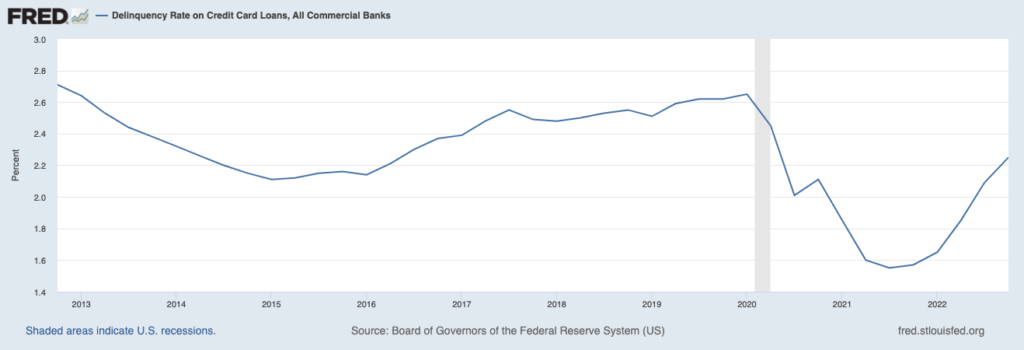

Consumers are Spending, But Are They Using Too Much Credit? Delinquency rates on credit cards, auto loans, and mortgages are rising. According to the Federal Reserve Bank of New York, about 4.57% of credit card debt crossed 90+ days delinquent in the first quarter, compared to 3.04% in Q1 2022. For auto loans, the delinquent rate rose from 1.61% to 2.33% over the same period, and mortgages moved from 0.34% to 0.54%. Many readers may rightly point out that these figures are quite low, which should be encouraging when thinking in terms of macroeconomics. They are also pretty much in line with pre-pandemic levels when the economy was in fine shape. But there are two features of this delinquency data that are worth noting. The first is that the age group with the highest delinquency rate was 18- to 29-year-olds. The second is that this age group is generally the cohort with the highest level of student debt, the payments of which have been paused because of a Covid-era policy. The question is, what happens to this group when the freeze on federal payments is lifted? The expectation is that delinquencies could rise further, not just in credit cards but also in student loans. All the more reason to start financial education at a young age.3

Source: Federal Reserve Bank of St. Louis4

U.S. Workers are Staying Put – One of the economic legacies of the pandemic was the rise of remote and hybrid work, which spurred many workers to leave cities in search of homes that could facilitate home office setups. In many cases, workers could keep their jobs and work remotely. The return to offices has halted this trend, along with higher mortgage rates that have cooled the housing market. But a recent study also finds that workers are relocating for jobs at the lowest rate on record, with records going back to 1986. Back in the 1980s and 1990s, about one-third of workers would move for new jobs, but higher housing costs coupled with the ability to work remotely have seen these figures plummet. In a survey conducted in Q1 2023, only 1.6% of workers relocated for a new job.5

Looking for a Solid Retirement Strategy? There is no way of predicting how the current events above will pan out. But you can build a retirement strategy that takes these “what ifs” into account. Instead of worrying about them, you can use our free guide to help you prepare.

If you have $500,000 or more to invest, get our free guide, How Solid Is Your Retirement Strategy?6 You’ll get valuable and practical ideas to help build a “weatherproof” retirement strategy that can potentially protect your retirement nest egg from any storm that could threaten your financial security.

Click on the link below to get your free copy today!

Disclosure

2 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

3 Wall Street Journal. May 16, 2023. https://www.wsj.com/articles/credit-card-car-debt-payments-behind-decc1a22?mod=djemRTE_h

4 Fred Economic Data. February 21, 2023. https://fred.stlouisfed.org/series/DRCCLACBS#

5 Challenger Gray. May 16, 2023. https://www.challengergray.com/blog/q1-2023-job-seeker-relocation-falls-to-lowest-on-record-as-remote-hybrid-work-persists/?mod=djemRTE_h

6 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.

The Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.