In today’s Steady Investor, we dive into key factors and current events that we believe are influencing the current market, such as:

- More signs of another debt ceiling showdown

- Potential break in higher oil and gas prices

- Record-shattering housing market shows signs of cooling

- Workers’ upper hand may not last

Get Ready for Another Debt Ceiling Showdown – On Wednesday, Treasury Secretary Janet Yellen testified before a Senate panel and delivered a message we’ve heard time and again over the last decade: the U.S. government is running out of room to pay its bills, and Congress needs to act to raise the debt ceiling to meet the country’s obligations. The Treasury Secretary added that the pandemic and related spending has made it challenging to calculate when the Treasury would run out of funds, but that the current date of July 31, 2021 (when the pandemic-induced suspension of the debt ceiling expires) means Congress needs to act. This largely political song-and-dance has played out many times in recent history, and Congress has consistently raised or suspended the debt ceiling, often at the 11th hour. The risks of not taking action soon are the same as they’ve been in the past: the U.S. missing payments to bondholders, Social Security recipients, or even Medicare/Medicaid payments. A strong economic recovery could boost tax receipts and provide a cash cushion longer than the July 31 deadline, but Congress also leaves for recess from the end of July to September. Financial markets need a resolution on this issue soon, while the media is hoping for a showdown.

___________________________________________________________________________

8 Costly, Financial Mistakes That You Can Avoid!

Living the ultimate retirement is the goal for many investors, but some may be wondering how to better plan for it. There is no definite answer, especially while investing in a volatile market like the one we’re currently experiencing. It is possible, though, to better prepare for any given financial situation.

While there are many unknowns at present, we believe there are eight common mistakes that many investors make when planning for retirement. In our guide, 8 Retirement Mistakes to Avoid, we outline these mistakes and how you can potentially avoid them.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Learn About the 8 Retirement Mistakes to Avoid!2

___________________________________________________________________________

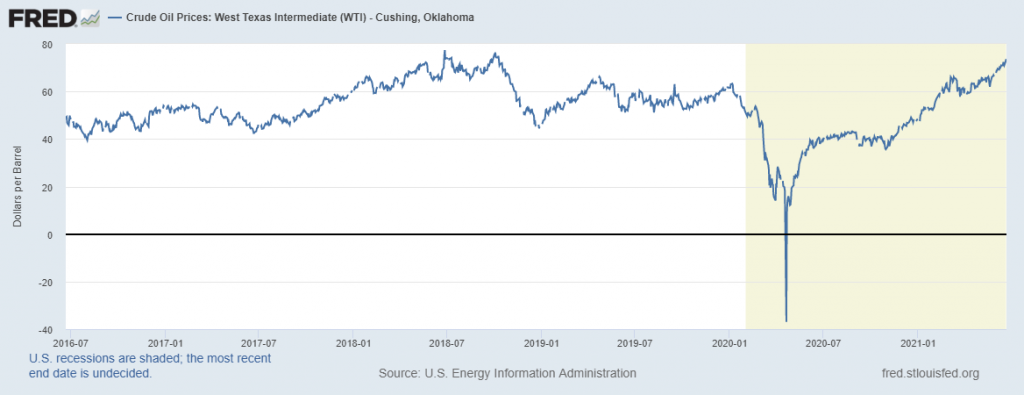

Higher Oil and Gas Prices Could Potentially Get a Respite – Crude oil prices (chart below) have rebounded swiftly from pandemic lows, as demand returns to the global economy and growth takes off in the U.S. and China. Oil prices have reached up past $70 a barrel, which marks a multi-year high and has put pressure on gas prices across the country. Demand has returned to the global economy and the U.S. faster than supply has kept up, hence the price pressures. Last year, OPEC+ cut output by 9.7 million barrels a day but have only retraced about 4 million barrels of that production since. OPEC+ and its allies are meeting this week to consider increasing the group’s output further, likely to take advantage of higher prices while also not flooding the market with supply.3

Housing Market Shatters Records, But Showing Signs of Cooling – The U.S. housing market is all over the news, and we have covered it several times in this space. There’s good reason for all the coverage – home prices continue charting new highs. In May, the median existing-home price crossed $350,000 for the first time ever, marking a 23.6% jump from the previous year. It was only 11 months ago that the median existing-home price topped $300,000 for the first time, underscoring the sharp price pressure as many urban workers migrated around the country and bought homes for remote work setups. Prices are also being pressured higher by persistently low mortgage rates, and a fairly drastic supply/demand imbalance (where demand far outweighs the supply of homes). There are signs that the wave of activity in the housing market is starting to cool off, however. In May, sales of existing homes fell 0.9%, which was the fourth consecutive month of declines. The market is approaching a point where new homebuyers are priced out.5

Workers Have the Upper Hand. Will It Last? The jobs market is roaring back to life, but there’s only one issue: there are not enough interested workers to fill job vacancies. This dynamic is giving workers the upper hand, at least for the moment. Average weekly wages in leisure and hospitality – where hiring is robust – were up 10.4% in May compared to February 2020, before the pandemic hit. Blue-collar and low-skill workers are seeing some of the biggest increases. High school diploma workers are seeing faster wage increases than those with a college degree. This shift marks a reversal of longer-term trends, which have seen wages and benefits fall as a share of national income over the last few decades. Wage pressures and the unique setup where there are more open jobs than workers willing to fill them may only prove temporary, however, and leverage could shift back to business once the initial surge of economic growth runs its course.6

Retirement Mistakes to Avoid During Times of Uncertainty – The future of the market is completely unpredictable, but keep your eye on the end goal – financial success! Even in times of uncertainty, it is possible to stay focused on actions that can help guide your future investments.

To start, there are common mistakes and habits that we believe can help some investors succeed while others fail. Don’t fall prey to common investing mistakes!

To help you understand some of these mistakes and how to avoid them, we have created the guide, 8 Retirement Mistakes to Avoid.7 In this guide, we provide our thoughts on what we believe are 8 of the biggest retirement mistakes investors should avoid. If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

3 Wall Street Journal. June 23, 2021. https://www.wsj.com/articles/opec-alliance-considers-boosting-production-amid-uneven-recovery-11624451530

4 Fred Economic Data. June 23, 2021. https://fred.stlouisfed.org/series/DCOILWTICO

5 Wall Street Journal. June 22, 2021. https://www.wsj.com/articles/u-s-existing-home-prices-hit-record-high-in-may-11624371222

6 Wall Street Journal. June 20, 2021. https://www.wsj.com/articles/tight-labor-market-returns-the-upper-hand-to-american-workers-11624210501

7 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.