Is the U.S. Economy Showing Real Signs of Weakness?

I’ve noticed recently that many economists and ‘experts’ appear to be resetting their expectations for when the U.S. economy might enter a recession. Many now seem to believe it could happen as soon as this year, and some are citing a host of economic data that appears to show a U.S. economy weakening on many fronts.

One of the major causes of concern came from weak data in the biggest contributor to overall U.S. GDP: consumer spending. Since the current U.S. economic expansion began in 2009, retail sales have risen an average of 0.4%. That’s why it came as a shock to Wall Street when government data showed that retail sales fell -1.2% month-over-month in December, which is typically a sturdy month for consumer spending.1

It was the largest retail sales drop since September 2009, and it was widely unexpected. Consensus estimates were forecasting a modest, but still positive +0.1% increase in retail sales for the month. To make matters more troubling, the weakness in retail sales appeared to be broad-based: sporting goods stores sales dropped -4.9%, department stores fell -3.3%, and non-store retailers (which includes e-commerce) declined -3.9%. miscellaneous store retailers fell

-4.1%, non-store retailers — which includes online retailers — dropped 3.9%.2

___________________________________________________________________

Prepare for a Potential Recession with our Stock Market Outlook Report

Do not let fears of a potential recession force you to make hasty investment decisions; instead, keep your eye on critical economic indicators with our Stock Market Outlook Report.

This report will provide you with our forecasts along with additional factors to consider:

- Will 2019 stay bullish?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released Stock Market Outlook3

____________________________________________________________________

Attention also shifted to declining U.S. home sales, which registered a -6.4% drop in December to fall to their lowest level in three years.4 The Conference Board’s Leading Economic Indicator (LEI) index, which has historically been a reliable barometer of U.S. economic activity, also reported a decrease of -0.1%.5

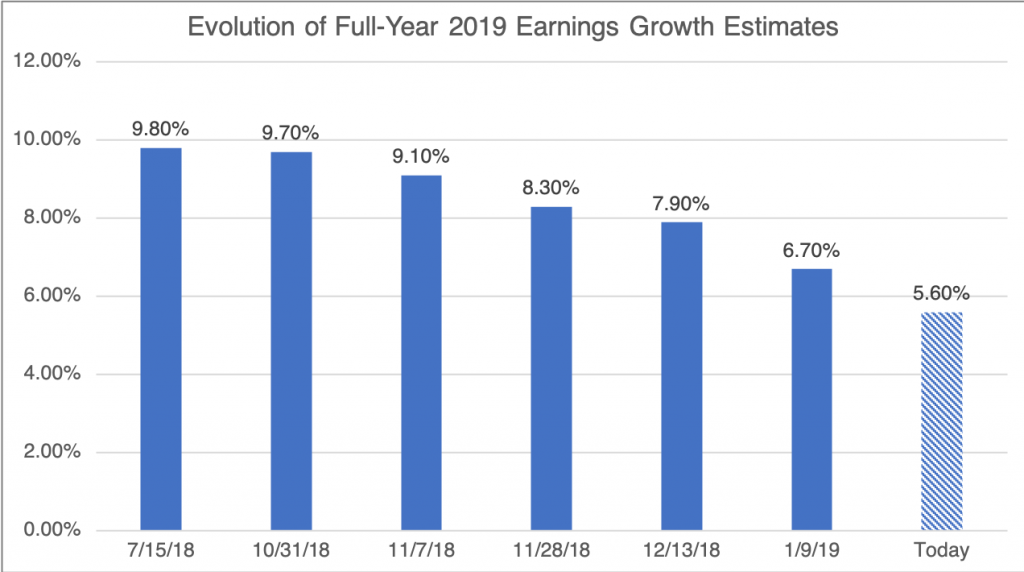

But perhaps the most notable and real cause of concern came in the arena of U.S. corporate earnings. Corporations steadily issued negative revisions to earnings estimates for the current and coming quarters, which have left growth expectations for the first half of 2019 barely in positive territory. This negative revision trend is a function of uncertainty about global economic growth, with a host of leading companies in different industries citing weakness in China, Europe and elsewhere as the driver of weak guidance. In my view, the numbers tell a clear story:6

Taken together, all signs appeared to point in a similar direction, with the implication being that the U.S. economy was weakening perhaps more quickly than many anticipated.

Key Distinction: Weakening is not the Same as Contracting

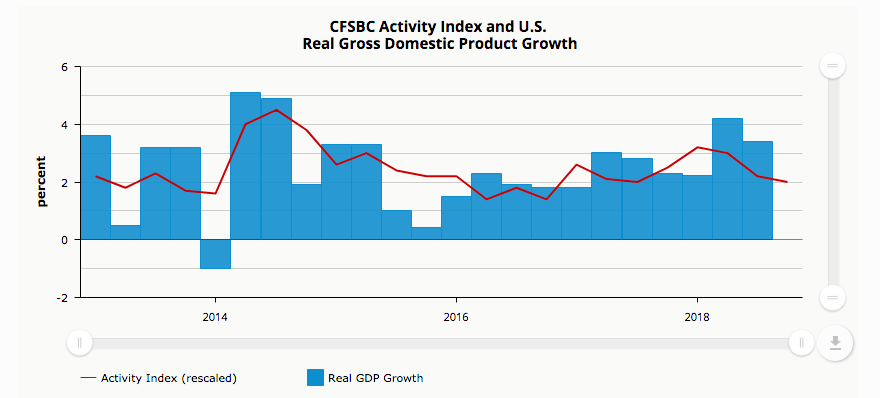

All told, the economic data may very well be telling us that the U.S. economy is weakening. But for investors, weakening is not the same thing as contracting. And positive economic growth in the U.S. in 2019 appears all but assured, in my view. The Chicago Fed’s Economic Activity Index shows steady activity and modest – but very normal – expectations for future GDP growth:

Source: Federal Reserve Bank of Chicago7

Investors should also keep in mind that economic data like retail and existing home sales, while important, is also quite volatile from month to month and even quarter to quarter. Looking back at this economic expansion alone, we can find several instances when economic activity turned negative – particularly in 2015 and 2016. If we continue seeing weak readings for the next few months or even quarters, we should perk up and think about the broader trend. For now, however, a couple of weak readings don’t necessarily portend an end to the expansion.

Bottom Line for Investors

At the end of the day, some of the concern over weak retail sales may be misplaced: the bureau in charge of compiling retail sales data was closed in the later days of December and a majority of January, when much of this data would have been processed and analyzed.8 What’s more, investors should remember that government data on the economy tends to be fairly volatile and is often revised several times before final numbers are released. We might reasonably expect a similar outcome this time around.

Regardless, investors should be cautious not to conflate weakening economic data with negative economic data. You can have one without the other, with the economy still growing albeit at a more modest pace. That’s what I believe we’ll see throughout 2019.

Going forward, I think patience will be rewarded. So, instead of letting fears of a recession push you to make hasty investment decisions, I recommend staying focused on the long-term view, meaning focus on fundamentals instead of the daily price movements. To help you do this, I am offering all readers our Just-Released Stock Market Outlook Report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Will 2019 stay bullish?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

FREE Download – Zacks’ Stock Market Outlook9 >>

Disclosure

2 Yahoo Finance, February 14, 2019. https://finance.yahoo.com/news/retail-sales-declined-in-december-153022812.html

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion

4 CNBC, January 22, 2019 https://www.cnbc.com/2019/01/22/december-existing-home-sales-down-6point4percent-vs-1point3percent-expected.html

5 February 21, 2019. https://www.conference-board.org/pdf_free/press/US%20LEI%20-%20Tech%20Notes%20Feb%202019.pdf

6 February 8, 2019, Zacks.com. https://www.zacks.com/commentary/212038/earnings-growth-deceleration-details

7 Federal Reserve Bank of Chicago, January 16, 2019. https://www.chicagofed.org/publications/cfsbc/index

8 Yahoo Finance, February 14, 2019. https://finance.yahoo.com/news/retail-sales-declined-in-december-153022812.html

9 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.