Concerns are growing about the strength of the U.S. economy and the longevity of the bull market. Many readers may notice that “recession” seems to be the hottest trending topic in the news these days, with any bit of negative data being seized upon as a potential canary in the coal mine. I’ve even written about the possibility of recession quite a bit in this space in recent weeks, though my commentary tends to illuminate the hard data underscoring modest – but still positive – economic growth.

As fear and concern grow about the fate of the U.S. economy and stocks, my message to readers is to look the other way – literally. If you see a scenario where economic data and leading economic indicators point to more growth (check), where governments and central banks are posturing for more stimulus (check), but where fear and negativity are getting worse in the news and amongst investors (check), then in my opinion that’s a clear and classic sign that a “wall of worry” is building. And, based on decades of experience in equity investing, I can tell you that markets love to climb a wall of worry.

_________________________________________________________________________

Let Other Investors Worry, You Can Stick to the Hard Data!

Instead of getting caught up in the headlines that tell you to be fearful about the fate of the market, I suggest sticking to hard data and key economic indicators. To help you do this, I am offering all readers a look into our just-released October 2019 Stock Market Outlook report.

This 22-page report contains some of our key forecasts to consider such as:

- Can a U.S. stock market bounce back this fall?

- Why are Zacks strategists (including me) staying bullish?

- Stock market returns expectations for 2019

- Stock market returns expectations

- What of U.S. GDP Growth?

- Returns for Small, Mid, and Large Cap stocks

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released October 2019 Stock Market Outlook1

_________________________________________________________________________

I’ll pull an example from earlier this year to help demonstrate the point. Back in early August, many readers will remember the sudden and dramatic August 5th decline when the S&P shed 3.3% and the tech-heavy Nasdaq fell -3.8% in a single trading session.2 In a “Mitch on the Markets” column just a few days after the decline, I asserted my belief that the downside volatility was a correction (and not a bear market), and reminded readers that “equity market recoveries often happen in ‘v-shaped’ patterns, which means in many cases, the recovery can happen just as quickly as the decline.” I urged patience in the face of fear.

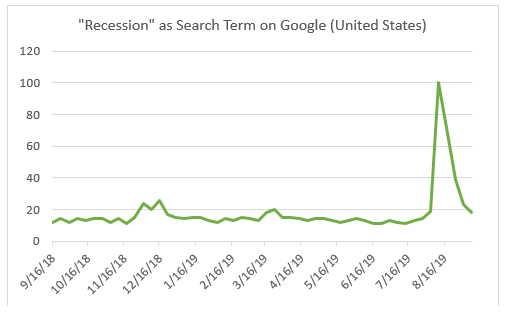

As you can see in the chart below, concern about the U.S. economy bubbled up as a result of the selling pressure. Data from Google Trends shows that searches for recession in the U.S. spiked at precisely the time the S&P 500 entered a volatile patch:

Source: Google Trends3

In my experience, it is during these times – when the market goes haywire and investor sentiment shifts decisively to the negative – that bottoming patterns tend to form.

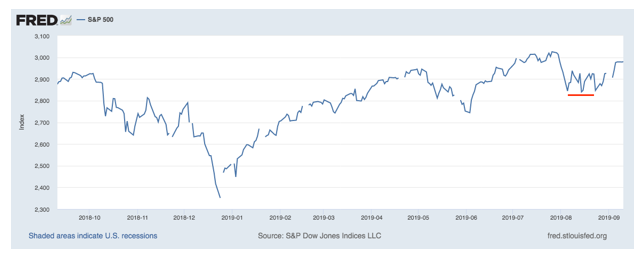

The S&P 500 Over the Last Year (red line indicates ‘bottoming’ following August 5)

Source: Federal Reserve Bank of St. Louis4

For long-term investors who ignore the noise and focus on where the markets will likely be in 10, 20, even 30 years, these events often end up being attractive entry points, in my view. In the example above, the proof is in the pudding: it’s only been a little over a month since the big August 5th decline, but the equity markets as measured by the S&P 500 appear to remain in recovery mode. The S&P 500 ended August 5th at 2,844 and as of Thursday was trading close to 3,015.5

Bottom Line for Investors

To be 100% clear, I do not advocate for investors to seek out volatility and negative sentiment as a signal to trade in-and-out of the markets. At Zacks Investment Management, we do not believe in short-term market timing, and as I’ve written many times before, we think investors give themselves the best chance at realizing long-term financial goals by maintaining exposure to risk assets (like stocks) over long stretches of time, in the realm of 20+ years.

The point of making “fear your friend” is so that as a savvy and experienced investor, you can see when fear bubbles form in the news – even as the U.S. economy continues to grow and economic data remains solid. When you recognize those disconnects, between expectations about future growth and realities about future growth, it is easier to resist the urge to make kneejerk reactions to big down days or endless media coverage of recessions and bear markets. It can help you keep a steady hand, which in my view is the key to long-term investment success.

To help you stick to the realities of the market, I recommend staying focused on the fundamentals and key economic indicators. To help you do this, I invite you to download our Just-Released October 2019 Stock Market Outlook Report.

This Special Report is packed with our newly revised predictions for 2019. For example, you’ll discover Zacks’ view on:

- For how long will 2019 stay bullish?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest, learn how you may be able to prepare your portfolio for changes in the economy by reading this new report today.6

Disclosure

2 Financial Times, September 2019. https://www.ft.com/content/ab8d654c-b71d-11e9-96bd-8e884d3ea203

3 Google Trend, September 11, 2019. https://trends.google.com/trends/explore?q=recession&geo=US

4 S&P Dow Jones Indices LLC, S&P 500 [SP500], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/SP500, September 11, 2019.

5 Yahoo Finance, September 11, 2019. https://finance.yahoo.com/quote/%5EGSPC?p=^GSPC

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.