The start of the year is the perfect time to focus on strategies that matter most. This week’s Steady Investor highlights three key themes that are shaping the current market:

- The Fed signals a pause in rate cuts

- The hidden force driving mortgage rates lower

- Unemployed office workers face challenges finding new jobs

The Fed Signals a Coming ‘Pause’ in Rate Cuts – Many economic forecasters and large banks anticipate 50 basis-points or more of rate cuts in 2025. The Fed wants everyone to know those cuts are not a given. In parsing the minutes from the December 17-18 policy meeting, it was clear that a majority of Fed officials saw the December 25 basis-point cut as appropriate given year-over-year progress on inflation, a notable softening in the labor market (via fewer hires, not increased layoffs), and the overarching desire to bring the benchmark fed funds back toward the so-called “neutral rate.” According to the minutes, however, the rate cut was still a close call, and “participants indicated that the committee was at or near the point at which it would be appropriate to slow the pace of policy easing.” On one hand, the Fed is showing signs of concern that inflationary pressures may be more “sticky” than anticipated, especially given the slight reacceleration seen in Q4 2024. On top of that, some Fed officials appear to be adopting a ‘wait-and-see’ posture regarding the potential impact of higher tariffs and mass deportations, both of which could arguably reignite inflationary pressures. On the other hand, however, recent data in the labor market suggests that the pace of hiring slowed in the second half of last year, and the Bureau of Labor Statistics reports that more than 1.6 million jobless workers had been job hunting for at least six months, a 50% increase since the end of 2022. The Fed has also made clear that if the labor market softened further, they would arguably lean towards further rate cuts to support employment and not worry as much about inflation being 50 basis points or so above target. All told, the Fed’s official projections now pencil two 25 basis-point rate cuts in 2025, but the timing of those cuts—and whether they come at all—is far less clear.1

How to Turn Volatility into a Strategic Advantage

Market volatility can feel unsettling, but it’s a natural part of investing—and often, it presents opportunities. While the ups and downs can be tough to navigate, volatility offers a unique chance to refine your strategy and potentially capitalize on market shifts.

Our free guide, “Using Market Volatility to Your Advantage2,” reveals proven strategies to help you not only weather the storm, but thrive during it.

In this guide, you’ll discover:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

Download Our Guide, “Using Market Volatility to Your Advantage”2

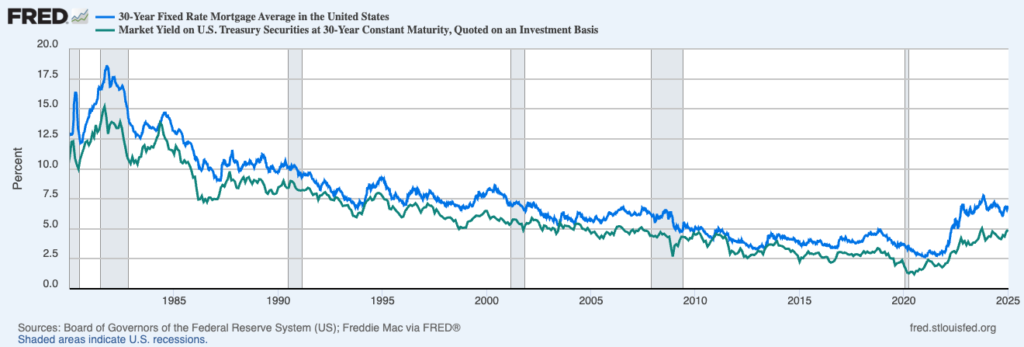

Could Mortgage Rates See Some Relief in 2025? Would-be homebuyers were feeling hopeful last year when the Fed was telegraphing rate cuts and the 30-year fixed mortgage rate started marching from 7% to 6%. Then rates reversed course. Towards the end of 2024, long-term Treasury yields shot higher, ostensibly driven by market expectations for higher growth in the new year but also the potential for higher inflation and deficits tied to trade and fiscal policy. Mortgage rates tend to track long-duration Treasury bond yields (see chart below), which meant upward pressure was applied across the board.3

30-year Fixed Mortgage Rates (blue line) and 30-year U.S. Treasury Bond Yields (green line)

There are a few factors that could potentially bring down long-duration Treasury yields (and mortgage yields down with them). The first is better-than-expected inflation data in the coming months and quarters. The second is a clear end to the Fed’s rate cutting cycle, which could increase demand for longer-duration Treasuries since institutional buyers (banks, mutual funds, ETFs) would feel more confident about yield volatility subsiding. These two factors combined could also help close the gap between 30-year fixed mortgage rates and 30-year Treasury bond yields, which stood at approximately 1.4% as of the end of last year. This gap is unusually high relative to history (see chart above).

Layoffs are Low, But So is the Probability of Finding a New Job – As mentioned above in comments regarding the jobs market, many Americans are having a hard time finding work. According to the Bureau of Labor Statistics, of the 7 million unemployed Americans today, 1.6 million have been looking for a job for at least six months. While many types of jobs in services and healthcare remain relatively abundant, it is jobs in high-paying, white-collar roles like technology and law that are increasingly hard to come by. This trend may point to something of a plateau in labor market tightness, which may also signal an abating of wage pressures.5

Make Market Volatility Work for You This Year – Volatility isn’t something to fear—it’s something to leverage. When approached with the right strategy, market fluctuations can present unique opportunities to refine your investment approach and unlock new potential.

Today, we’re offering our guide, “Using Market Volatility to Your Advantage6,” packed with insights from decades of experience. Learn how to harness market volatility to enhance your strategy and potentially generate stronger returns.

You’ll get our ideas on:

- How market volatility can “shake up” complacent investors

- Potential bargains that may be uncovered through turbulence

- Why volatility may help prevent overheating and market “bubbles”

- What history shows us about opportunities for steady investors in turbulent markets

- Plus, more ways you may be able to benefit from a volatile market

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

2 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion

3 Wall Street Journal. January 8, 2025. https://www.wsj.com/finance/investing/the-hidden-force-that-can-bring-mortgage-rates-down-9639dd46?mod=djemMoneyBeat_us

4 Fred Economic Data. January 2, 2025. https://fred.stlouisfed.org/seriesBeta/MORTGAGE30US#

5 Wall Street Journal. January 5, 2025. https://www.wsj.com/economy/jobs/job-search-workers-unemployment-months-5a4cfcee?mod=economy_trendingnow_article_pos2

6 ZIM may amend or rescind the free guide offer, Using Market Volatility to Your Advantage, for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.