In the latest edition of Steady Investor, we explore market updates and essential points for investors to keep in mind, such as:

- The Federal Reserve pauses rate hikes

- The cost of rent is falling fast

- Saudi Arabia announces oil production cuts

The Federal Reserve Pauses Rate Hikes, But Signals More Tightening Ahead – Starting in March 2022, the Federal Reserve raised interest rates at every meeting, pushing the benchmark Fed funds rate up by 5% in 10 meetings. The pace of monetary tightening was the fastest the U.S. has seen since the 1980s, when inflation was running at double-digits. At the latest June meeting, the Fed decided that it was appropriate to take a pause, leaving the fed funds rate at 5% to 5.25% and agreeing to monitor economic data over the coming weeks to see if inflation and economic activity continue cooling. Earlier in the week, the Labor Department reported that inflation, as measured by the consumer-price index, had risen by 4% year-over-year in May. This was a significant decline from April’s 4.9% increase, and well below the peak of 9.1% reached last June (see chart below). But it also still doubles the Fed’s target of 2%, which is partly why Fed Chairman Jerome Powell signaled that more hikes could come in 2023 following this June pause. Indeed, the Fed released projections for the Fed funds rate for the remainder of 2023, and 12 of 18 officials indicated that rates would need to rise to 5.5% to 5.75% or even higher, if the economy continues growing at its current clip. These projections imply two or three more rate hikes in 2023, which is higher than just about anyone – including this publication – had expected for the year. Just a few months ago, in March, a majority of officials had projected that no additional increases would be needed in 2023, but a stubbornly strong labor market and economy have shifted their thinking.1

Overcome Investor Bias in Today’s Market!

In a volatile market, investors tend to have different biases, such as fear of loss, that affect their decision-making process.

The first step is to be aware of your potential biases, and we can help with our free guide, Three Steps to Overcoming Investment Behavioral Bias. You’ll learn how to re-examine your portfolio and take key steps to avoid bias and potentially reach your ultimate financial portfolio goals. If you have $500,000 or more to invest, download our guide Three Steps to Overcoming Investment Behavioral Bias.2 Simply click on the link below to get your copy today!

Download Zacks Guide, Three Steps to Overcoming Investment Behavioral Bias2

Year-over-Year Change in Consumer Price Index (Inflation)

Source: Federal Reserve Bank of St. Louis3

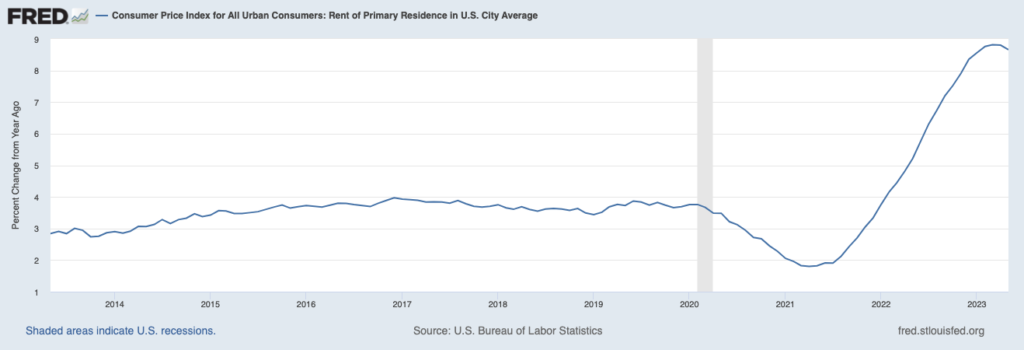

Rents are Falling Fast, Good News for Households and Inflation – As we’ve written in this space before, housing is a major component of the consumer price index, and its contributions to date have been negative – i.e., high housing costs are putting upward pressure on the inflation print. We’ve also written that actual changes to rents work on a lag, since both new and existing leases are factored into the inflation reading. The chart below shows how rent CPI has lagged trends in overall CPI:

Source: Federal Reserve Bank of St. Louis4

A look under the hood reveals that apartment rent growth has been declining at a much faster pace, however. The average of six national rent-price measures from property data companies indicates that rents for new leases rose less than 2% for the year ending in May, which marks a plummet from the double-digit increases last year. In the coming months, this rapid decline in rent growth will factor into the CPI reading, which should pull inflation down even further towards the Fed’s goal – assuming other goods and services prices continue trending in the same direction.

Saudi Arabia Announces Oil Production Cuts, But Prices Move the Other Way – Another key factor for U.S. inflation is energy prices – namely the prices Americans pay at the pump. It follows that oil markets are the major determinant of energy inflation, which can make news of production cuts from the world’s second-largest oil producer seem counter-productive. But in this case, it hasn’t been – Saudi Arabia last week announced it would cut oil production by 1 million barrels a day in July, on top of previously announced cuts earlier in the year. Crude oil prices fell on the news, and are now hovering around 2023 lows5:

Global Price of Brent Crude Oil

Source: Federal Reserve Bank of St. Louis

The Saudis pushed for production cuts because they want to see upward pressure on prices, but they got the opposite. Why? For one, oil production is global, with the U.S. as the world’s top producer. More Russian and African oil has also made its way into the market than expected in 2023, which has kept downward pressure on prices. There are also demand forces, i.e., the fact that global economic growth has been very modest so far in 2023, with the eurozone sliding into a recession and China’s post-zero-Covid recovery faltering. Demand from the U.S. has remained firm, but rising interest rates and the possibility of additional credit tightening later in the year are expected to produce a slowdown.

Three Steps to Overcoming Investor Bias – News and headlines like the ones above may cause you to worry about what’s next for the market, but I recommend making decisions based on data, instead of emotional attachment.

The best way to overcome investor bias is to understand its impact on your decision-making process. That’s why we have prepared this educational guide, Three Steps to Overcoming Investment Behavioral Bias6, that can help you become aware of your own biases, and overcome them. You’ll learn:

- The two main types of biases that affect investors: Cognitive and Emotional

- Specific examples of biased decision-making that can negatively impact your portfolio

- Three essential actions you can take to counteract the natural investor tendencies toward bias

If you have $500,000 or more to invest and are ready to learn more, click on the link below to get your copy today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Three Steps to Overcoming Investment Behavioral Bias offer at any time and for any reason at its discretion.

3 Fred Economic Data. June 13, 2023. https://fred.stlouisfed.org/series/CPIAUCSL#

4 Fred Economic Data. June 13, 2023. https://fred.stlouisfed.org/series/CUSR0000SEHA#

5 Fred Economic Data. June 15, 2023. https://www.wsj.com/articles/saudi-arabia-sought-to-push-oil-prices-higher-markets-had-other-ideas-30583af6?mod=djemRTE_h

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Three Steps to Overcoming Investment Behavioral Bias offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The ICE U.S. Dollar Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973: the Euro zone, Japan, the United Kingdom, Canada, Sweden, and Switzerland. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.