In today’s Steady Investor, we look at key factors that we believe are currently impacting market volatility and what could be next such as:

• Inflation gauge rose to 2.5% in February

• The U.S. services sector expands

• An update on the U.S. housing market

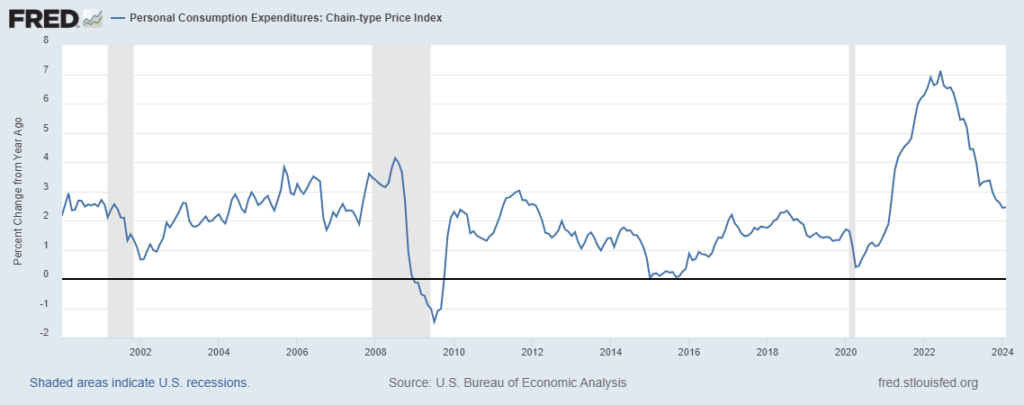

Getting Closer to 2% Inflation – The consumer price index (CPI) measure is the most widely-known and cited inflation metric in the U.S. But it’s arguably not the metric that matters the most. The Federal Reserve pays more attention to the personal-consumption expenditures (PCE) price index, which is released by the Commerce Department and tends to get buried in the news cycle. If the PCE price index is the Fed’s preferred inflation gauge, it should be the one investors watch most closely, in our view. Last Friday, the Commerce Department reported that the headline PCE price index rose 2.5% year-over-year in February, which is well within reach of the Fed’s long-run 2% target. Month-over-month, the PCE price index rose 0.3%, which was slightly better-than-expected.

The PCE Price Index is Running Closer to the Fed’s 2% Target Than CPI

Retiring in 2024? Get Our Retiree Checklist!

Investing in today’s market can challenging, especially for those who are trying to build their retirement portfolio. One way to ease your worries is to make thorough plans. So today, we’re offering our free retiree checklist2!

This checklist covers four essential investment topics for new retirees, with detailed helpful information on:

• The current and expected future costs of healthcare in retirement

• Strategies for retirement investment income in today’s current low-rate environment

• The key tax rules that every retiree must know

• The most important way to protect your retirement assets from market volatility

• Be prepared with this guide to the most important retirement financial and investment issues

If you have $500,000 or more to invest, get our free checklist today!

Download Zacks Guide, Looking to Retire Soon2

Federal Reserve Chairman Jerome Powell seemed pleased overall with the data, saying that “it’s good to see something coming in in-line with expectations.” Powell reiterated that the Fed at this stage is not necessarily looking for further improvements in the inflation data, but rather more evidence that it is anchored.

The U.S. Services Sector Continued Expanding in March – The Institute for Supply Management (ISM) reported the 15th straight month of expansion for the U.S. services sector, with the Services PMI registering at 51.4%. This print was slightly lower than February’s, but a key detractor from expansion was a 3.5% decline in supplier delivery times, to 45.4%. This piece of the data should arguably be viewed as a positive, as it underscores rising efficiency in supply chains. On the flip side, the Business Activity and New Orders components of Services PMI—which can be viewed as leading indicators for the economy—remain firmly in expansion territory, and the production gauge rose to a very solid 57.4%. The Employment Index component registered at 48.5%, marking the third contraction in four months. This data point, though slightly weak, provides evidence of labor market softening—which factors as a positive for the outlook on interest rates. Manufacturing, which contributes a substantially smaller share to overall U.S. GDP, also expanded in March for the first time in 16 months, with New Orders shifting back into expansion territory at 51.4%.4

Is a U.S. Housing Rebound Underway? 2023 was tough sledding for the U.S. housing market, with sales falling to their lowest levels in almost three decades. Low inventory, high prices, and soaring mortgage rates all contributed to the pressure. 2024 looks different out of the gates. For the first time in over two years, home sales have increased month-over-month for two consecutive months (January and February), with sales of existing homes jumping 9.5% in February to a seasonally adjusted annual rate of 4.38 million. Economists had expected a 1.3% decline. Mortgage rates have eased off highs and inventories are on the rise particularly from newly built homes, moving in the direction of rebalancing supply and demand. The imbalance remains in place for now, however, as the national median existing-home price rose 5.7% year-over-year in February to $384,000.5

Plan to Retire Soon? – If you’ve been planning to retire for a while, now is the perfect time to review your investment plan.

Retirement marks the end of one life stage, but also the beginning of another—full of new adventures and opportunities. To guide you through this new phase, we’re offering our retiree checklist6, which provides helpful information about:

• The current and expected future costs of healthcare in retirement

• Strategies for retirement investment income in today’s current low-rate environment

• The key tax rules that every retiree must know

• The most important way to protect your retirement assets from market volatility

• Be prepared with this guide to the most important retirement financial and investment issues

If you have $500,000 or more to invest and want to understand your retirement options, click the link below to get your copy today!

Disclosure

2 Fred Economic Data. March 29, 2024. https://fred.stlouisfed.org/series/PCEPI#

3 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

4 ISM. 2024. https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/services/march/

5 Wall Street Journal. March 21, 2024. https://www.wsj.com/economy/housing/u-s-home-sales-jumped-nearly-10-in-february-7f77a35a?mod=economy_feat6_housing_pos2

6 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.