How Global Economic Resilience is Driving Markets

At the turn of the year, we knew tariffs were going to be a key factor in the global economic growth story. Just how much of a factor was unclear.

Fast forward to today, and I think it’s fair to say that the uncertainty surrounding trade policy went far higher than many expected, while the global economic fallout was far more muted than many anticipated (at least so far). A high-level takeaway is clear: the global economy has once again shown that it’s capable of absorbing shocks.1

The facts bear this out. Early estimates indicate that the global economy grew at a 2.4% annual rate in the first half of 2025, roughly matching its long-term trend. The IMF and World Bank have also both upgraded their full-year global growth forecasts in recent months, and we recently saw that world merchandise trade volumes rose 5.3% year-over-year in the first quarter, surprising to the upside. These are not data one would expect to accompany a global ‘trade war.’

The Fundamentals Most Investors Are Missing – Download Our Latest Report

While tariffs dominate the news cycle, the real drivers of market strength are happening underneath—solid fundamentals and surprising global resilience.

I encourage all readers to download our latest Stock Market Outlook Report2, where we break down how markets have absorbed recent shocks—and the key forces that could drive the second half of 2025. Inside, you’ll discover:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest, claim your free copy of the report and see how today’s shifts could shape tomorrow’s opportunities.

IT’S FREE. Download our Exclusive Stock Market Outlook Report2

Global economic resilience has also been reflected in business surveys. The S&P Global U.S. Composite PMI hit 54.6 in July, which is its fastest expansion rate this year. In the eurozone, PMIs have remained in expansion territory, with Germany’s new manufacturing orders recently rising at the fastest in three years. And PMI data for Japan, India, and Australia point to continued expansion. Remember, these are all countries that have been targeted with higher tariffs.

A major theme underpinning this resilience is how companies and supply chains have adapted. Businesses accelerated purchases to beat tariff deadlines (“front-loading”), rerouted exports through countries with lower tariffs, and shifted production closer to end markets—strategies honed during the pandemic. U.S. imports from Southeast Asia jumped 28% year-over-year in the first four months of 2025, and overall Chinese exports, despite falling to the U.S., rose 6% thanks to growth in Asia, Europe, and Africa.

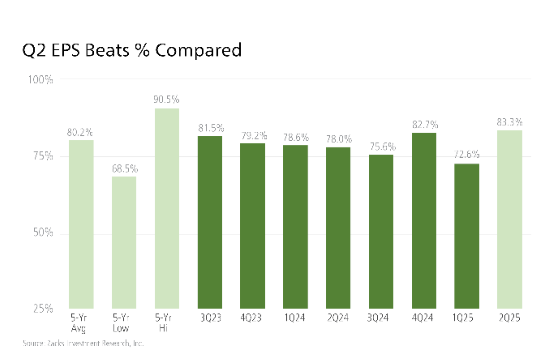

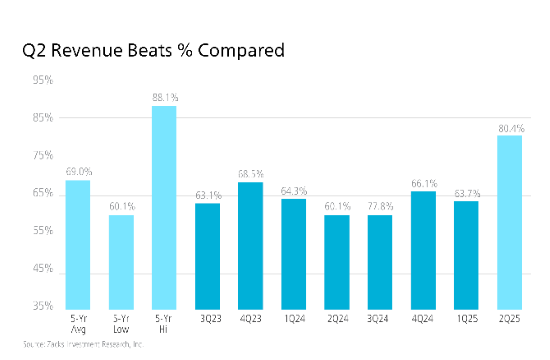

We’re also seeing fundamental strength in U.S. corporate earnings. As I write, S&P 500 companies have posted 8.3% earnings-per-share (EPS) growth on 4.9% higher revenues in Q2 2025. But the key metric is that 83.3% of reporting companies have beaten EPS estimates, and 80.4% have beaten revenue estimates. These ‘beats percentages’ are tracking notably above the historical averages for this group of reporting companies, as the comparison charts below show.

Zacks3

In my view, this resilience has fed into the sustained equity market rally. The ability of companies to navigate tariffs—whether it’s from passing on costs, shifting suppliers, or absorbing margin pressure—has made earnings season better-than-expected and provided a tailwind for stocks in the process.

As I’ve written many times before, markets do not need perfect conditions to move higher. They just need things to be less bad than feared, which is what I think we’re seeing today. Many investors braced for a negative shock months ago, which set the bar for a positive surprise very low. But as evidenced by global economic fundamentals we’re observing now, the tariff impact so far has been far less damaging than most expected, which has markets responding accordingly.

Bottom Line for Investors

The market has spent much of 2025 pricing in trade disruptions, geopolitical uncertainty, and the potential for slower global growth. But reality looks much different than the worst fears. Businesses are adapting, consumers are spending, and governments around the world have been engaging in fiscal and in some cases, monetary stimulus. In short, the global economy is navigating the tariff upheaval in stride.

This resilience has been welcomed, but to be fair its sustainability is not assured. Much recent strength reflects one-off factors—like inventory buildup and pre-tariff stockpiling—which could unwind in the months ahead. Survey data and central bank commentary (e.g., from the ECB and the Fed) suggest demand could cool, especially in the eurozone, if exports to the U.S. fall sharply. Watching data closely in the coming months will be crucial, in my view.

For now, I think it’s fair to say that the risks tied to the trade war have likely been overestimated. Economic resilience has been the bigger theme, and it also so happens to be one of the most important forces that drives markets over time.

That resilience isn’t just a theme—it’s a signal.

In our latest Stock Market Outlook Report4, you’ll get a clear view of what’s driving markets now and what most investors are overlooking. The report covers:

- Asset allocation guidelines for today’s market environment

- Expert forecasts for inflation, rates, and economic trends

- Industry tables and rankings to help you spot opportunities

- Buy-side and sell-side consensus insights at a glance

- And much more!

If you have $500,000 or more to invest and want to take charge of your financial journey, click the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

3 Zacks.com. July 25, 2025. https://www.zacks.com/commentary/2619170/mag-7-earnings-loom-what-can-investors-expect

4 Zacks Investment Management reserves the right to amend the terms or rescind the free-Stock Market Outlook Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.