For several weeks now, readers have been inundated with news stories about the escalating trade war, the inverted yield curve signaling recession, ongoing geopolitical unrest (Iran, Hong Kong), and volatile stock markets. These stories all warrant watching and clearly point in the direction of a global economic slowdown.

But it’s not all doom-and-gloom in the global economy, and I’d argue that the onslaught of negative news stories today is more indicative of a growing “wall of worry” versus a flashing red signal of a bear market and recession. In my view, a global economic recession is headed our way – just not this year.

This week, I’m going to cut through the noise and highlight some positive economic data and trends happening in the global economy right now. In my opinion, with most news reports overlooking anything remotely positive in the economy – and in some cases with positive data being outright ignored – it could actually be viewed as a bullish sign. When everything is negative, a gap starts to form between perception (that the situation is dire and will only get worse) and reality (the situation isn’t actually as bad as many believe).

When stock prices pull back on perception versus reality, I think it’s only a matter of time before reality sets back in and new highs are reached.

__________________________________________________________________

See for Yourself with our Just-released August Stock Market Outlook Report!

Don’t take my word for it, let the data speak for itself with our just-released Stock Market Outlook Report. This 22-page report contains some of our key forecasts to consider such as:

- Our Global Outlook – China’s Economy, the Trade-war and More…

- Can a U.S. stock market bounce back this fall?

- Stock market returns expectations

- What of U.S. GDP Growth?

- Returns for Small, Mid, and Large Cap stocks

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released August 2019 Stock Market Outlook1

______________________________________________________________________________

The U.S. and Global Economy are Still Set to Grow in 2019

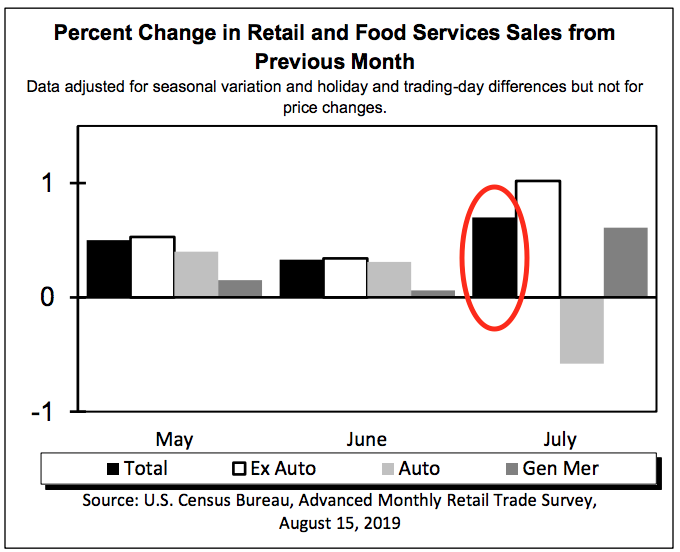

Let’s start with the most important component of the U.S. economy – the consumer. Consumer spending accounts for more than 65% of our country’s economic output.2 So, when the U.S. consumer is strong, the U.S. economy tends to be strong too. Just last month, retail sales – which measures purchases in restaurants, stores, and online – posted strong month-over-month growth at 0.7% (circled in red below), which marks the strongest reading since March. In my view, a combination of low unemployment, low interest rates, and rising wages are resulting in confident consumers who are opening their checkbooks to shop.

Source: U.S. Commerce Department3

Strong retail numbers are good news for the economy. The Atlanta Fed recently adjusted its GDPNow forecasts higher because of the retail-sales report, bumping it from 1.9% to 2.2%. Remember, too, that the U.S. economy grew a solid 2.1% in the second quarter even as business investment slowed and the trade war gained steam. 4 Growth in the 2% range is not the most inspiring and exciting kind of growth, but it also doesn’t look much like a recession to me.

Globally, the world actually saw a small increase in the rate of economic expansion in July. I realize for many readers that the idea of additional, accelerating growth is hard to fathom given all the bad news and the downside volatility. But readings from the Global Composite Output Index – which measures activity in services and manufacturing – showed that output growth accelerated to a three-month high (51.7) thanks to solid activity in services. Readings above 50 indicate expansionary conditions.

Manufacturing continues to weaken virtually across the board, which is concerning, but it’s being outweighed by strength in services, which tends to matter more in developed economies anyway.

Bottom Line for Investors

Much like the U.S. economy, on balance the global economy is expected to grow in the ~3% range in 2019. Most investors may not perceive this type of growth to be possible given all the negative headlines and market volatility, but I think the economic reality supported by hard data currently suggests more strength than many believe. As long as volatility and the negative perceptions of the global economy persist, I’d argue that there remains a gap between perception and reality that equity prices are likely to fill. It’s just a matter of time, in my view.

I recommend focusing on the hard data instead of the negative headlines. To help you do this, I am offering all readers a free copy of our just-released August Stock Market Outlook Report.

This Special Report is packed with newly revised predictions to consider for 2019 that can help you base your next investment move on data. For example, you’ll discover Zacks’ view on:

- Our Global Outlook – China’s Economy, the Trade-war and More…

- Can a U.S. stock market bounce back this fall?

- Stock market returns expectations

- What of U.S. GDP Growth?

- Returns for Small, Mid, and Large Cap stocks

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!5

Disclosure

2 The Wall Street Journal, Aug 15, 2019. https://www.wsj.com/articles/u-s-retail-sales-rose-0-7-in-july-11565872458

3 U.S. Census Bureau, August 15, 2019. https://www.census.gov/retail/marts/www/marts_current.pdf

4 J.P. Morgan, August 5, 2019. https://www.markiteconomics.com/Public/Home/PressRelease/b80f0526728e464588c914eb698267df

5 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.