Low interest rates coupled with a flat yield curve usually mean bank profits will come under pressure. Generally speaking, the flatter the yield curve, the lower a bank’s net interest margins – which is the difference between what a bank earns on loans versus what it pays out in interest on deposits. J.P. Morgan saw its net interest margin fall to 2.49% in the second quarter (from 2.57% in Q1), while Wells Fargo’s fell from 2.91% to 2.82%.1 For banks, these represent paltry margins.

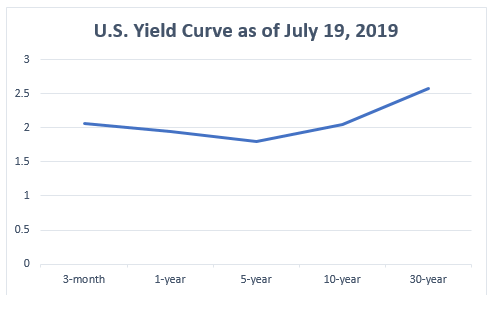

The Yield Curve is More “U-Shaped” than Inverted

Source: U.S. Department of the Treasury2

Yet in the second quarter, Financials were the best performing sector. Financial stocks delivered nearly double the return of the S&P 500 in Q2, climbing +8.0% versus the S&P 500’s +4.3%. How and why did bank stocks do so well?3

______________________________________________________________________________________________

See What’s Next for the Market with our Midyear Market Strategy Report4

In our just-released market strategy report, we take inventory of the market’s performance so far in 2019 – what’s driving it, what’s challenging it, and what needs to happen in order for stocks to break through to new highs. We also take a look at the fixed income markets, where we note that global bond yields are on the decline, and the U.S. yield curve is interestingly “u-shaped.”

Get deeper insight on the following:

- The Global Economic Expansion Continues, But for How Long?

- The Fixed Income View

- Keeping an Eye on the Geopolitical Climate

- The Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Download Our Just-released 2019 Midyear Market Strategy Report!

______________________________________________________________________________________________

The answer can be found by taking a closer look at the divergence between consumer confidence and business confidence in the current U.S. economic climate. While consumers are growing increasingly confident and enjoying the tailwinds of a modestly strong economy, businesses are growing increasingly concerned about how much longer the business cycle may last.

Let’s start with the consumer. The United States currently has near record low unemployment, low interest rates, wages modestly on the rise, and a stock market near all-time highs. In the mind of the consumer, times are good. High confidence and low interest rates often lead to more spending and borrowing, which is helping prop up bank profits.

Indeed, banks that cater to the Main Street consumer have been enjoying a surge in profits in consumer lending divisions. Banks like J.P. Morgan, Wells Fargo, and Citigroup – which all have large lending and credit businesses – saw profits climb in the second quarter. At J.P. Morgan, credit card spending climbed 11% to $192.5 billion in the second quarter, while outstanding credit balances jumped 8% to $157.6 billion. J.P. Morgan enjoys status as the largest U.S. lender by assets, but Citigroup and Wells Fargo also felt the boost. Purchase volume at Citi rose 8% in Q2 while balances rose 6% at Wells. Mortgage origination and refinancing was also higher at all three banks in Q2, as the rate on a 30-year fixed mortgage fell below 4%.

Note: whether or not rising credit balances and new/refinanced mortgages is a good trend for consumers is another story for another day, but in the meantime, banks have been feeling the profitable effects.

Meanwhile, banks with smaller consumer credit and lending divisions, like Goldman Sachs, saw profits fall in the second quarter. Goldman was the only U.S. bank to report lower profit in Q2 versus what it reported in Q1, with a 6% decline fueled by slower activity in trading, investment banking, and corporate debt issuance.

Herein lies the tale of two confidence measures. On the one hand, consumer confidence is high and rising on the heels of low unemployment and low interest rates. On the other, business confidence is mixed as global economic growth is seen slowing and as the U.S. and China continue apace with a trade dispute that has no tangible end in sight.

Where businesses are reluctant to borrow and invest in expansion and growth, consumers feel confident enough to keep spending and running-up credit balances. The key question is whether banks’ reduction in business lending is due to lower confidence or to a lack of investment opportunity. But it may also be a byproduct of sinking demand – publicly traded corporations have been borrowing heavily in debt markets largely to buy-back stock, which would seem to indicate the issue is a lack of investment opportunities.

Goldman Sachs has responded to this new dynamic by pivoting to cater to Main Street consumers, rolling out a personal loan and consumer banking division known as Marcus. But the investment bank has a lot of ground to make up to compete with the likes of Bank of America, J.P. Morgan, Citigroup, and Wells Fargo.5

Bottom Line for Investors

Banks are adapting to an environment where “smaller fish” are a better source of profits than the larger deals that hinge on activities like debt trading, corporate lending, and investment banking. At the end of the day, from a macro perspective, this dynamic is being driven by lower global investment opportunities available to corporations. Effectively, I see a global oversupply of money available for lending, which drives down interest rates.

For investors, this means Financials should not be dramatically underweighted relative to benchmarks. Ultimately, consumer-focused lending likely has some room to run. However, how bank stocks perform is likely to be driven by whether the yield curve continues to invert. My best estimate, based on leading economic indicators, is that the yield curve will normalize but at a lower slope than we’ve seen historically.

Want more insight on what’s next for the market? Don’t miss our just-released Midyear Market Strategy Report.

This report takes inventory of the market’s performance so far in 2019 – what’s driving it, what’s challenging it, and what needs to happen in order for stocks to break through to new highs.

Get deeper insight on the following:

- The Global Economic Expansion Continues, But for How Long?

- The Fixed Income View

- Keeping an Eye on the Geopolitical Climate

- The Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!6

Disclosure

2 U.S. Department of the Treasury, July 22, 2019. https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield

3 S&P 500 Total Return. Strategas Quarterly Review in Charts, July 1, 2019.

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report at any time and for any reason at its discretion.

5 The Wall Street Journal, July 16, 2019. https://www.wsj.com/articles/consumer-lending-powers-big-bank-earnings-upstaging-wall-street-11563301446?mod=djem10point

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.