In today’s Steady Investor, we look at key factors that we believe are currently impacting the market and what could be next for the markets such as:

- Inside the housing market’s v-shaped recovery

- The S&P 500 reclaims all-time highs

- The long-term trend points to a full economic recovery

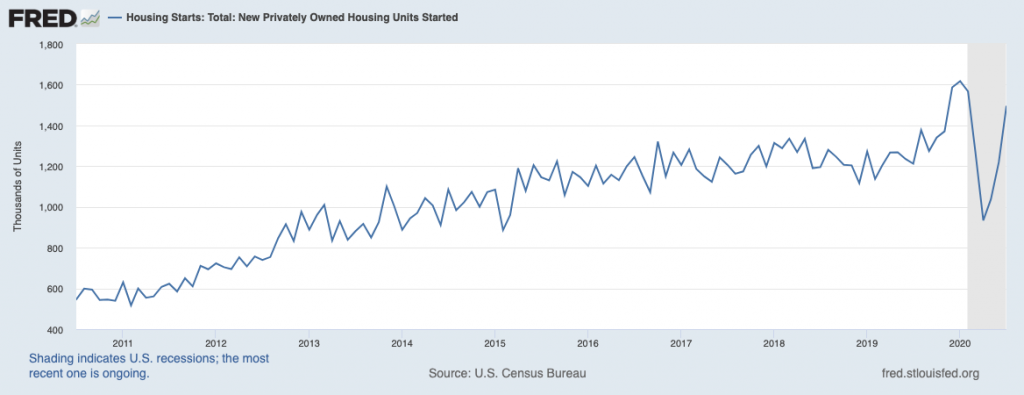

The U.S. Economy Has a ‘Hot Spot’ – Housing – Economists and analysts on the news continue debating the shape of the economic recovery, whether it’s “v-shaped,” a Nike swoosh shape, or even W or L. But one sector has emerged as looking distinctly like a v-shaped recovery: housing. In the month of July, housing soared 23% from June, hitting an annual pace of close to 1.5 million. The housing sector declined in-line with the broader U.S. economy in the spring, but has since climbed back to pre-pandemic levels in terms of housing starts and construction. Consumer spending on furniture, appliances, and home improvement has outperformed spending across most other sectors, and construction employment has recovered briskly. One familiar name in the space, Home Depot, underscores the sector’s strength: the company posted its best quarterly sales growth in nearly 20 years. The National Association of Home Builders said this week that its housing index touched its highest level since 1985, with current sales, expected sales, and foot traffic all growing firmly. The housing sector is no doubt benefiting from historically low interest rates, which appear poised to remain low for years to come. Additionally, the ‘work-from-home’ movement may be spurring new and existing homeowners to upgrade for more and better office space.1

New Housing Starts Show a “V-Shaped” Recovery

______________________________________________________________________________

7 Reasons to Stay Bullish!

While the first half of the year was volatile to say the least, now we are seeing new highs in the market. This begs the question – what is in store for the remainder of 2020? We look at this answer in our just-released market strategy report.

In this report, we’ll take a look at who the leaders of the rally were (and are), take a walk down memory lane to look for lessons from old investing legends, and give readers seven reasons to stay bullish in the uncertain year ahead.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free report today!

Download Our Just-Released August Market Strategy Report3

______________________________________________________________________________

The S&P 500 Index Reclaims All-Time Highs – Many investors remained baffled by the stock market’s surge, even as the economy struggles to regain pre-pandemic footing and even as Covid-19 continues to spread. Technology shares continue to be a driving force behind the market’s strength, but recently we have seen some rotation showing other cyclical categories rallying as well. Small-caps and industrials have surged in August, and economically-sensitive sectors like Energy have also seen strong relative gains in recent weeks. For investors thinking that “what goes up must come down,” and/or that the stock market is wildly overvalued, we would advise against the temptation to time the markets. In our view, the equity markets tend to price-in economic outcomes six or even twelve months from now, meaning that rising prices likely reflect a post-pandemic economic and earnings rebound.4 What’s more, money supply growth via Federal Reserve policy and fiscal spending currently exceeds nominal GDP growth, which tends to result in extra liquidity flowing through the capital markets. This “wall of liquidity” has the potential to push asset prices even higher, in our view.5

The U.S. Economic Recovery is Underway, But Not Quite Robust Yet – Recent economic data paints a picture of a U.S. economy that is trickling back to life, but not quite in full force. July marked the third consecutive month that retail sales ticked higher, and importantly July sales were 1.7% higher than levels seen in February (the month before the pandemic-induced shutdown). Consumers were spending across virtually all categories, from home appliances to furniture, to electronics, health products, and food. Early data shows that August retail sales may taper off slightly, particularly as the extra $600 unemployment benefit runs out and as Congress debates the next round of stimulus. Other economic data points to a ‘mixed’ picture regarding the economic recovery.6 The New York Fed’s Empire State survey, which tends to be a bellwether indicator for other Fed surveys across the country, showed manufacturing activity slowing from July to August. To say the economic recovery is losing momentum in the short-term may be accurate, but we believe long-term the trend still points to a full economic recovery – and then some.

What is in store for the remainder of 2020? We look at this answer in our just-released market

strategy report.7 In this report, we’ll take a look at who the

leaders of the rally were (and are), take a walk down memory lane to look for

lessons from old investing legends, and give readers seven reasons to stay

bullish in the uncertain year ahead.

If you have

$500,000 or more to invest and want to learn more, click on the link below to

get your free report today!

Disclosure

2 U.S. Census Bureau and U.S. Department of Housing and Urban Development, Housing Starts: Total: New Privately Owned Housing Units Started [HOUST], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST, August 20, 2020.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

4 The Wall Street Journal, August 16, 2020. https://www.wsj.com/articles/cyclical-stocks-are-leading-the-latest-leg-of-the-markets-recovery-11597593600?mod=djem10point

5 Charles Schwab, June 19, 2020. https://www.schwab.com/resource-center/insights/content/quarterly-market-outlook

6 The Wall Street Journal, August 14, 2020. https://www.wsj.com/articles/us-economy-july-retail-sales-coronavirus-recovery-11597360020

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Market Strategy Report offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.