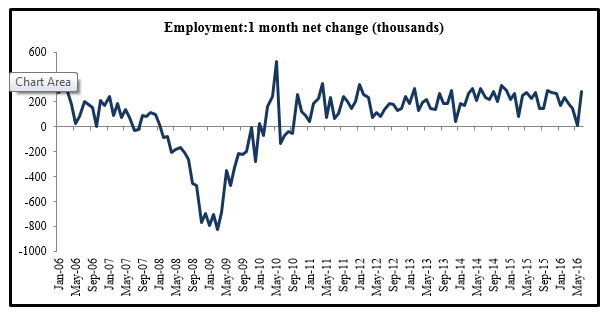

The U.S economy added 287,000 jobs during the month of June, an impressive total that outpaced early estimates by 175,000 jobs. June’s gains represent the largest addition since October 2015, and also marks the largest monthly increase this year. It was a welcome change from May’s dismal report, and eased fears that the job market was sputtering.

Data Source: BLS

Data Source: BLS

The leading contributors to the June job gains were: leisure and hospitality (+59,000), education and health services (+59,000), and financial activities (+16,000). Factories also increased payrolls by +14,000 following the preceding month’s 16,000 decline. To note, manufacturing jobs are historically volatile, so rather than seeing this as a trend reversal it is better to see it as a confirmation that the sector is not in a downward spiral.

The retail trade sector is a bit different, however, as seasonal changes affect activity. Summer is historically a strong time for the sector, and it was encouraging to see 30,000 new workers in June, a possible indication of strengthening consumer demand.

Mining and logging, not surprisingly, continued dragging the economy, with 6,000 fewer jobs in June.

Data Source: BLS

Data Source: BLS

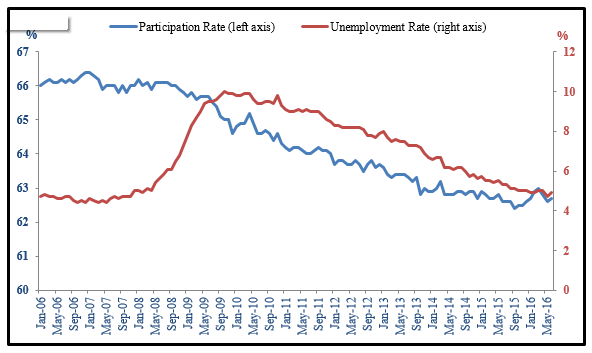

Another bright spot of the report was a one-tenth of a percentage point increase in the labor force participation rate (up to 62.7% in June), after a two-month decline. There were also approximately 5.8 million part-time workers who wanted to be employed full-time:

Data Source: BLS

Data Source: BLS

The June underemployment rate was 9.6%, which is at the lowest level since April 2008, while overall unemployment remained at 4.9%—still in the full employment range. The jobless rate has not exceeded 5% in any of the last nine months.

Wages also Showing Signs of Strength

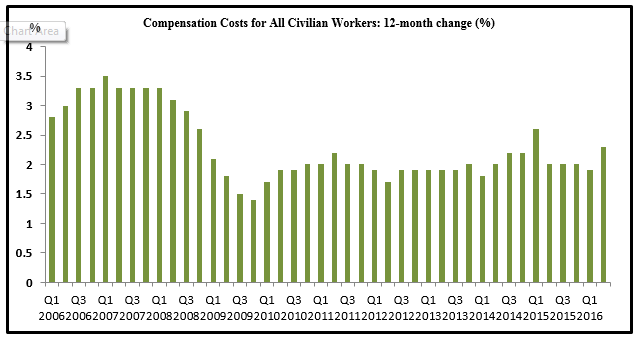

For the quarter ending in June, compensation costs increased 2.3% from a year ago. This is a significant improvement from Q1’s year-on-year +1.9%. Q2 also had the highest 12-month growth in compensation since Q1 2015.

Data source: BLS

Data source: BLS

The average hourly earnings for private non-farm payroll employees increased by 2 cents in June to $25.61. Furthermore, if the minimum wage floor shifts up, the effects could extend beyond the direct recipients. A Brookings Institute study estimates that a minimum wage hike could push up the wages for up to 35 million workers (comprising 29.4% of the workforce).

Bottom Line for Investors

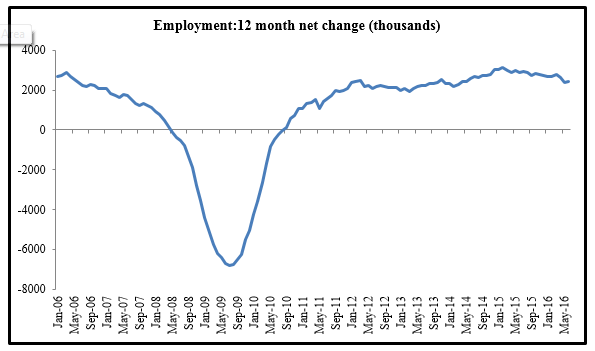

There have been around 2.45 million jobs created in the 12 months ending in June, exceeding the gains of several pre-recession periods. The June jobs report should ease concerns about the U.S. economy’s prospects following the May’s disappointing figures, and the numbers underscore how demand conditions have not deteriorated amid global uncertainty, including Brexit. The near full employment levels increase the likelihood of monetary tightening in the near future, particularly if momentum continues. The likelihood of a December Fed funds rate hike increased from 12 percent to 24 percent, according to Jefferies, following the June report.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.