Government Shutdown Fears

Rachel T. from Seattle, WA asks: Hi Mitch, I think it’s pretty much a foregone conclusion that the government will shut down this week, and based on how things are going, it’s not looking good for some deal to be made. I’m worried about what that would mean for the economy and the stock market. Should investors be bracing for a big impact?

Mitch’s Response:

By the time readers see our exchange here, it may very well be the case that Congress hits the October 1 funding deadline without a continuing resolution. That would mean parts of the federal government would shut down.

The implications can be far-reaching. As many as 900,000 federal workers could be furloughed, there would be delays in agency services, closed national parks, and postponed release of key economic data. For everyday life, I want to be clear that these delays and closures would not be trivial matters. But from an investor’s standpoint, history suggests shutdowns are more noise than fundamental risk.

Case-in-point: since 1976, there have been more than 20 shutdowns of varying lengths. None has ever caused a recession, and none has been the spark for a bear market.

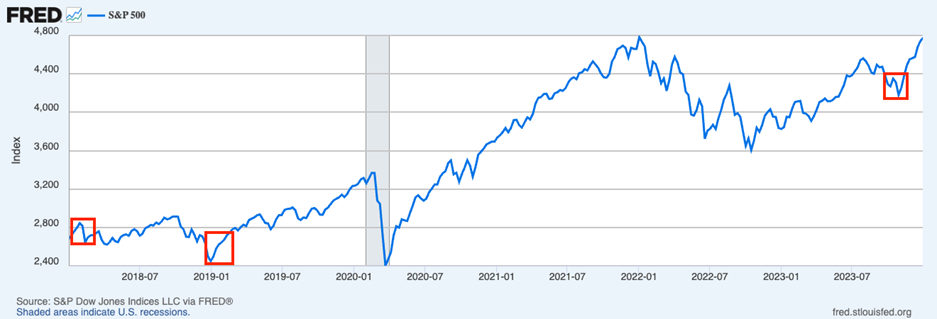

In fact, stocks have risen more often than not during shutdowns, and in the majority of cases, they were higher in the months immediately after. I offer readers a visual breakdown of the three most recent shutdowns, which took place in early 2018, late 2018/2019, and October 2023. The longest shutdown on record, the 35-day episode in late 2018 into 2019, coincided with a strong equity rally as seen below.

Markets May Swing — Here’s How to Stay on Track

Government shutdowns and other Washington standoffs grab headlines but rarely trigger recessions or bear markets. The bigger danger is reacting to the noise and trying to time the market, a move that often hurts long-term returns.

Our free guide, “The Perils of Market Timing” 1 shows why staying invested through uncertainty works better than jumping in and out. You’ll learn:

- The real cost of trying to time the market

- Two simple steps that may help you stay invested and on track

- The bottom line for investors

If you have $500,000 or more to invest and want to learn how you may be able to avoid these mistakes today, click on the link below to get your free copy:

Download Zacks Guide, “The Perils of Market Timing”1

The S&P 500 and Government Shutdowns, 2018 – 2023

This isn’t to dismiss the hardship for workers and contractors who lose work as a result, but it shows markets are usually focused on longer-term fundamentals rather than temporary political standoffs.

That said, short-term sentiment can wobble. Headlines about furloughs and delayed paychecks can weigh on consumer confidence, and markets don’t like uncertainty. If a shutdown drags beyond a few weeks, the cumulative effects—lost consumption from unpaid workers, delayed contracts for businesses, disruptions in data—could start to add up. Today’s environment adds a few wrinkles as well. Stock valuations are elevated, the U.S. dollar has been under pressure, and the Fed is highly data dependent. A prolonged lapse in government reports could complicate monetary policy and add to volatility.

Still, perspective is key. Mandatory programs like Social Security and Medicare would continue operating, and three-quarters of government spending stays funded. Housing, consumer spending, business investment, and global growth, the forces that drive earnings and markets, do not necessarily hinge on whether the Smithsonian is open or a monthly jobs report comes out on time. Shutdowns are more political drama than they are economic drivers.

When news like government shutdowns or record margin debt hits, it’s tempting to act fast. But history shows that emotional trading and market timing often hurt more than they help.

Our free guide, The Perils of Market Timing³, explains the traps many investors fall into and how to stay disciplined when uncertainty strikes. Inside, you’ll learn:

- The real cost of trying to time the market

- Two simple steps that may help you stay invested and on track

- The bottom line for investors

- If you have $500,000 or more to invest, download your copy today and learn how to keep short-term noise from derailing your long-term goals.

Get Your Free Guide: The Perils of Market Timing 3

Disclosure

2 Fred Economic Data. September 29, 2025. https://fred.stlouisfed.org/series/SP500#

3 ZIM may amend or rescind the “The Perils of Market Timing” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

“The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.”

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.

The Russell 1000 Value Index is a well-known, unmanaged index of the prices of 1000 large-company value common stocks selected by Russell. The Russell 1000 Value Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.