Sean F. from Savannah, GA asks: Hi Mitch, I’m writing to ask for your thoughts on the latest Federal Reserve comments, regarding interest rate increases sooner than later. The markets seemed to sell off on the news and have been a bit volatile since. Will this be problematic in 2022?

Mitch’s Response:

Thank you for emailing your question. The Fed minutes from their December 14-15 meeting certainly made a splash in the headlines last week, and for good reason – Fed monetary policy impacts the economy.1

For readers who may have missed the announcement last week, we know based on the Fed’s December meeting that the central bank is no longer comfortable waiting for inflationary pressures to ease. Here are some key quotes from the meeting:

- “[Fed] participants generally noted that…it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated.”

- “[Some Fed participants deem it] appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate.”

Looking for a Guide to Planning an Easy Retirement?

For investors who are planning for retirement soon, we can help you! Truth is – the sooner you plan, the better advantage you will have for your financial future.

If you want help creating a long-term financial plan and investment discipline, I recommend reading our Retirement Guide. This guide will give you a step-by-step outline of how you can plan for your financial future. You will get answers to critical questions like:

- How much should you be saving?

- What is the best long-term approach?

- How do you hire the right money manager?

- And more…

If you have $500,000 or more to invest and want to learn more about retirement planning, click on the link below to get your free guide today!

Download Your Copy of “Retirement Made Easy” Today!2

Trading in interest rate futures indicates an approximately 70% probability the Fed would increase the fed funds rate at or before their March meeting, a greatly accelerated timeline from expectations just two months ago. It is also worth noting that the decision to potentially begin shrinking the size of the Fed’s balance sheet soon after rate increases are new – during the previous rate hike cycle in the 2010s, the Fed waited about two years before reducing its balance sheet.

Sean asks if this ‘Fed pivot’ to the more hawkish policy will be problematic in 2022. I think the market and economy can absorb tighter policy for two reasons.

First, it is also important to acknowledge current Fed policy is extraordinarily accommodative. In other words, even if the Fed follows through with ending QE, raising rates three or four times in 2022, and they start shrinking their $8.76 trillion balance sheet over the year, they would still end the year with a very accommodative monetary policy stance, by historical standards. The Fed’s actions in 2022 may be better described as ‘becoming less accommodative’ versus engaging in monetary tightening, in my view.

Second, during the last cycle, many readers may remember that the Fed started raising interest rates in December 2015, pushing the fed funds rate from 0.5% in December 2015 up to 2.5% in December 2018.3 I am not saying there was no market volatility in the wake of the monetary tightening – there was. But for long-term investors, short-term market volatility should not be much of a factor. Market returns matter over years and decades, not weeks and months.

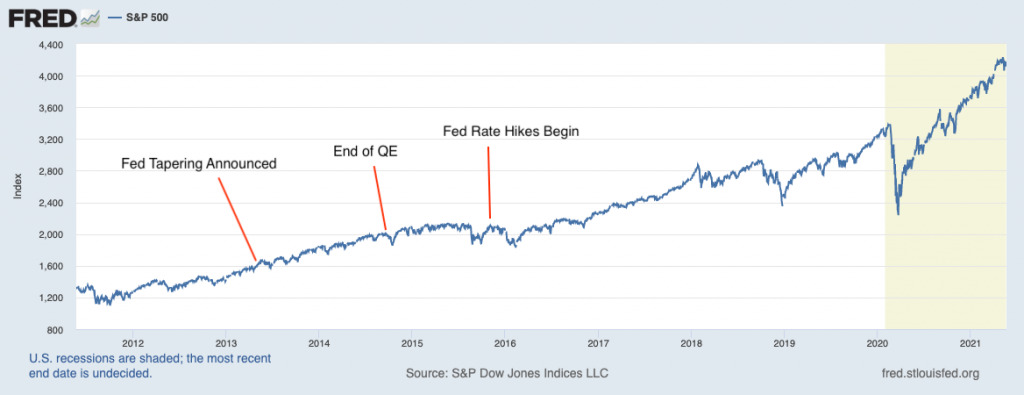

As you can see from the chart below, Fed tightening caused a few blips and pullbacks during the last bull market, but QE tapers and rate hikes were not powerful enough to prevent the market from pushing higher over time. The bull market cycle continued for years after rate hikes commenced.

The S&P 500 During the Previous Monetary Tightening Cycle

So, while I do think a shift in Fed policy and interest rate increases could result in heightened volatility in 2022, I do not necessarily view their approach as ‘problematic.’ I still expect economic and earnings growth to continue apace in the new year, albeit at more modest paces than last year.

With that being said, investors, especially those looking to retire soon, are probably wondering what does this mean for their investments and retirement plans? Here’s the truth – if you start preparing for your retirement now, you will have a better advantage when making future financial decisions (even when the market is volatile!)

To help you do this, I recommend reading our Retirement Guide.5 This guide will give you a step-by-step outline of how you can plan for a successful financial future, and it provides our answers to critical questions like:

- What is the best long-term approach?

- How do you manage your retirement income for taxes?

- How much should you be saving?

- And more…

If you have $500,000 or more to invest and want to learn more about retirement planning, click on the link below to get your free guide today!

Disclosure

2 ZIM may amend or rescind the “Retirement Made Easy” guide for any reason and at ZIM’s discretion.

3 The Balance. January 6, 2022. https://www.thebalance.com/fed-funds-rate-history-highs-lows-3306135

4 Fred Economic Data. January 7, 2022. https://fred.stlouisfed.org/series/SP500

5 ZIM may amend or rescind the “Retirement Made Easy” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.