Claudia G. from Charlotte, NC asks: Hello Mitch, I understand that by the reported numbers inflation has been coming down, but I just have a hard time believing the problem is solved. Every time I go to the grocery store, I’m reminded of why. Can you explain what I’m missing here?

Mitch’s Response:

Thanks for emailing your question. Your sentiment about expensive groceries is shared by households across the country, I’m sure.

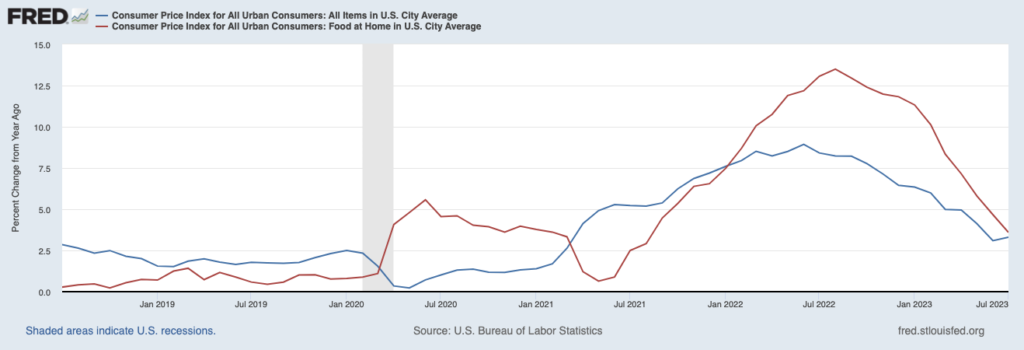

My first response to you is that you’re not missing anything at all – food prices have indeed risen briskly, and at a faster pace than overall prices. Take a look at the chart below. The red line shows the year-over-year percent change in the price of food at home, while the blue line is the consumer price index for all goods. It’s plain to see that food prices shot way higher than broad-based prices across the economy last year, and they’re still rising at a faster pace:

Consumer Price Index for all goods (blue) vs. Consumer Price Index for food at home

Worried About Lingering Inflation? Learn How to Protect Your Investments!

When you’re trying to stick to a fixed budget, higher prices combined with the reduced spending power of each saved dollar is challenging—and very stressful.

Fortunately, there are some steps you can take to reduce the sting of inflation – especially for those nearing retirement.

To help protect your portfolio, I’m offering our exclusive guide, 4 Ways to Protect Your Retirement from Rising Inflation2, where you’ll get insight on:

• How to build or modify your asset allocation to outperform inflation

• The importance of analyzing your spending by category

• Strategies to maximize Social Security retirement benefits

• Plus, more practical ideas to fight back against inflation

If you have $500,000 or more to invest, get our free guide today! Download 4 Ways to Protect Your Retirement from Rising Inflation2.

The reason we can say the inflation fight is on the right track – even though food prices remain sticky – is because food prices are not necessarily in the Fed’s purview when it comes to monetary policy. Food prices are notoriously volatile, and they’re controlled by supply and demand forces that are almost completely out of the Fed’s control.

In the current environment, I’d point to three factors that are driving food inflation, and only one of them is on the Fed’s ‘hit list.’ Let’s start with the two that are out of the Fed’s control and also not necessarily long-term drivers of underlying inflation.

The first is supply, namely the combined forces of the war, volatile weather, and drought. There is a region stretching across Ukraine, Russia, and Kazakhstan known as the “black soil” belt that is one of the world’s agricultural heartlands. Exports from the region have been severely compromised by the war. Russia is also a major exporter of fertilizer, the higher prices of which raise costs on farmers.

The second is pricing power, which grocery stores can exert in the face of rising input costs. Some types of businesses may respond to higher prices by seeing margins get crimped, as raising prices could risk losing customers. Grocery stores do not fit that profile, as consumers may shift brands and types of foods they buy, but trips to the grocery store will still inevitably happen.

The final driver is the piece that is on the Fed’s radar, and that’s rising labor costs. Retail food employees earn low wages, but tight labor markets particularly for low-wage work have provided some bargaining power for these workers. As a result, labor costs have gone up for grocery stores, which impacts the prices of goods on the shelf. The Fed would like to see some easing in the labor markets, via higher unemployment, to reduce these wage pressures over time.

As this all relates to investing in the equity markets, it’s important to remember that the Fed is focused on “core” inflation – which excludes food and energy. That’s where we’ve seen a good deal of improvement, though more is needed.

However, I recommend taking steps now that could help reduce the sting of inflation. I am offering our exclusive guide, 4 Ways to Protect Your Retirement from Rising Inflation3, where you’ll get insight on:

• How to build or modify your asset allocation to outperform inflation

• The importance of analyzing your spending by category

• Strategies to maximize Social Security retirement benefits

• Plus, more practical ideas to fight back against inflation

If you have $500,000 or more to invest, get our free guide today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Ways to Protect Your Retirement from Rising Inflation offer at any time and for any reason at its discretion.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free 4 Ways to Protect Your Retirement from Rising Inflation offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.