In today’s Steady Investor, we dive into key market factors that we believe investors should keep an eye on for the future, such as:

- Wages and inflation on the rise

- U.S. GDP growth boom in Q4 2021

- Consumer spending

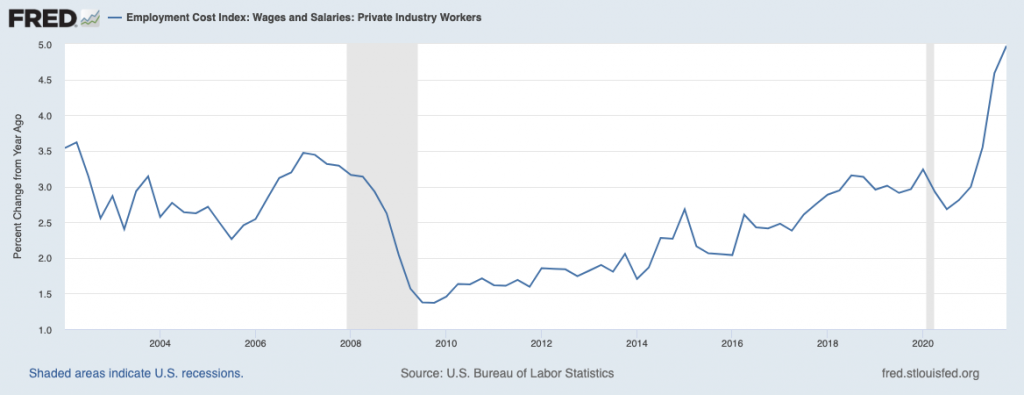

Wages Up, Inflation Up – It is common knowledge by now that inflation in the U.S. – and also around the developed world – has been rising at a faster-than-expected pace. According to the Bureau of Labor Statistics, the Consumer Price Index for all urban consumers rose 0.5% in December (seasonally adjusted), putting its full-year increase at 7% and marking its fastest increase in over 20 years. It’s not all bad news though – wages are also on the rise, and higher incomes can serve to neutralize the effect of higher prices for goods and services. According to the Labor Department, the U.S. employment-cost index, which measures wages and benefits paid by employees, jumped 4% in Q4 2021 from a year earlier – which also marked the fastest rate of growth in 20+ years. The offset is not perfect, and not everyone received wage or salary increases last year. But as you can see in the chart below, wage increases have been stubbornly low in the previous decade, so the sharp increase over the last year was a welcomed development for workers.1

Protect Your Retirement Against Life’s Unknowns!

Are you worried about volatility and inflation and it’s impact on your retirement assets? How can you protect them against these market unknowns?

In times like these, it is important to have a strategy in place to account for the market’s ups and downs. Our free guide, How Solid Is Your Retirement Strategy? can help you build a retirement strategy that takes the “what ifs” into account.

This guide offers our views on some key retirement investment strategies that may help you preserve your financial security in retirement, including:

- The importance of flexible portfolio allocation

- Why keeping some liquid assets can potentially help you preserve more wealth

- Understanding your risk tolerance in case of a market downturn

- Plus, more strategies to help you protect your retirement assets

If you have $500,000 or more to invest, get our free guide by clicking on the link below.

Get our FREE guide: How Solid Is Your Retirement Strategy?3

U.S. GDP Growth Booms in Q4 2021 – The Omicron surge had many market watchers worried. Would the economic effect be similar to what we saw with Delta, which dealt a brisk headwind to spending and growth and ultimately anchored GDP for the quarter? The answer, it seems, was no. The U.S. economy posted very strong growth in Q4 2021, surging at a 6.9% annual rate. All told, 2021 was the strongest year of economic growth in the U.S. in almost 40 years, with output growing 5.5%. The quarter-over-quarter growth rate from Q3 2021 to Q4 2021 was also a meaningful 2.3%, adjusted for inflation, which underscores the light impact felt by the Omicron wave. According to the Commerce Department, households posted solid spending numbers in Q4, but the real juice behind the GDP growth surge came from businesses replenishing inventories. Without the inventory restock, GDP would have grown at a much softer 1.9% in Q4. Such a lower growth rate would have put the U.S. more in line with Europe, which has been lagging in its recovery. GDP growth for the 19-country eurozone rose just 1.7% in Q4, and Germany’s economy contracted slightly.4

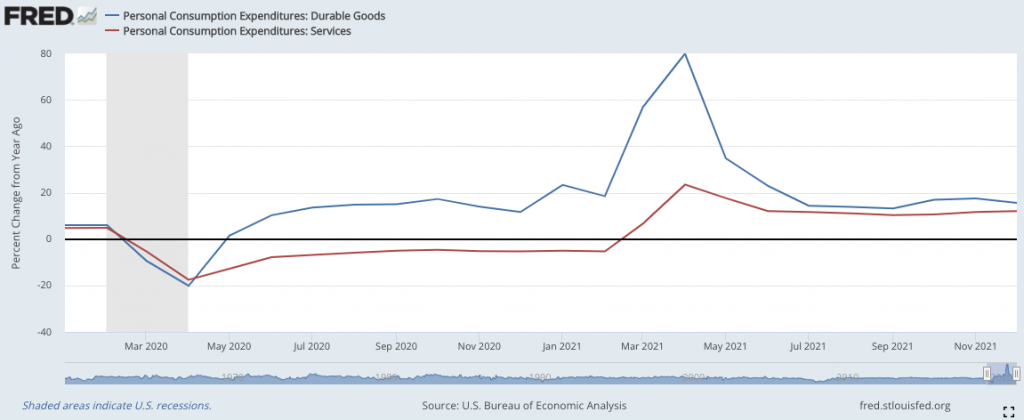

Is Consumer Spending Poised to Shift from Goods to Services? One of the key drivers of inflation over the last year was the stark U.S. consumer shift from services to goods. With the pandemic’s impact on consumers’ desire to travel, go out, etc., many opted to spend more on goods like home furnishings and computers. The result was a very robust demand for goods bumping up against snarled supply chains that simply could not keep up. Prices for goods like furniture and appliances soared 10.7% from a year earlier, while the costs of services like airfares went up a lesser 3.7%. As demand outstripped supply, prices went up. The trend may be reversing – as the Omicron wave looks to be retreating as the spring season approaches, consumers appear to be stepping out again. As readers can see in the chart below, spending on goods and services have been steadily converging over the past few months.5

Protect Your Retirement Assets – Instead of trying to predict where the market is headed, we recommend that investors, especially those planning for retirement, prepare for its unknowns. This will involve finding a retirement strategy that takes the “what ifs” into account. Our free guide can help you to prepare for what’s to come as you plan your retirement!

If you have $500,000 or more to invest, get our free guide, How Solid Is Your Retirement Strategy.7 You’ll get valuable and practical ideas to help build a “weatherproof” retirement strategy that can potentially protect your retirement nest egg from any storm that could threaten your financial security.

Disclosure

2 Fred Economic Data. January 28, 2022. https://fred.stlouisfed.org/series/ECIWAG#0

3 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

4 BEA. January 27, 2022. https://www.bea.gov/news/2022/gross-domestic-product-fourth-quarter-and-year-2021-advance-estimate#:~:text=Measured%20from%20the%20fourth%20quarter,the%20fourth%20quarter%20of%202020

5 Wall Street Journal. February 2, 2022. https://www.wsj.com/articles/consumers-are-pivoting-spending-to-services-like-dining-and-travel-11643797808

6 Fred Economic Data. January 28, 2022. https://fred.stlouisfed.org/series/PCEDG#0

7 ZIM may amend or rescind the guide “How Solid Is Your Retirement Strategy?” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.