In this week’s edition of Steady Investor, we dive into recent market dynamics influenced by significant events, including:

- Core inflation falls to 4.8%

- Low unemployment keeps pressure on the Fed

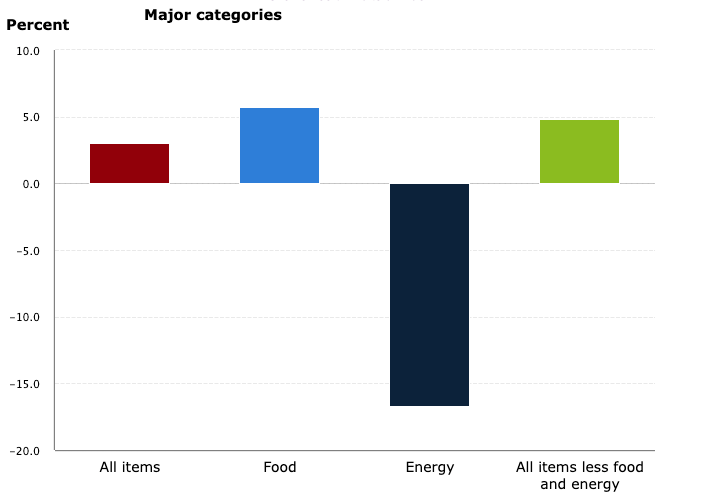

Core Inflation Falls to 4.8% in June, Still Some Distance from Fed Target – The Labor Department reported some welcome news on inflation last week. The consumer-price index (CPI) measure of inflation rose by 3% in June from a year earlier, a drastic improvement from the 9.1% peak recorded in June 2022. Core CPI, which strips out volatile food and energy Tcategories, rose by 4.8% year-over-year in June, which also registered as a solid improvement from May’s 5.3% print. The headlines largely tout the 3% figure, which makes it seem like the U.S. economy is within striking distance of the Fed’s 2% target. But core CPI matters more to the Fed, since they view food and energy’s contributions as highly volatile and also because they view the core measure as a better predictor of future inflation. As seen in the chart below, for instance, Energy was an outsized driver of the 3% headline figure, which could change considerably from month to month.1

Are you planning for retirement, but questioning the process? It’s not easy, especially if you haven’t established your goals and determined your financial needs.

However, if you spend some time focusing on what you want your retirement to look like, you can formulate a plan that works for you!

We are offering our exclusive guide that looks at important questions that we believe investors should consider when defining their financial needs in retirement, such as:

If you have $500,000 or more to invest, get our free guide, “How Much Exactly Do You Need to Retire2” today!

Source: U.S. Labor Department3

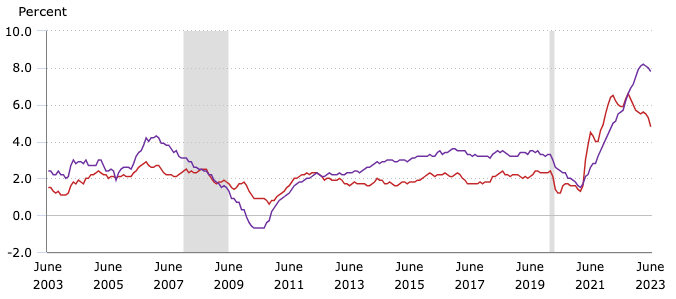

Even still, Fed officials are likely happy with June’s report, since core prices posted their smallest monthly increase (from May to June) in two years. There were many details of the latest inflation report to cheer – consumers paid less for used cars and airline tickets, growth in rent payments has slowed sharply, and the share of small businesses raising prices fell to 29%, the lowest level since March 2021. We have written many times in this space about the ‘shelter component’ of CPI, which measures rents and has a quirky component called owner’s equivalent rent (OER). This component is what homeowners would hypothetically pay to rent their own houses, and it continues to place upward pressure on the headline figure as seen in the chart below:

The Shelter Component of CPI (purple line) Lags the Headline CPI figure (red line)

Source: U.S. Labor Department4

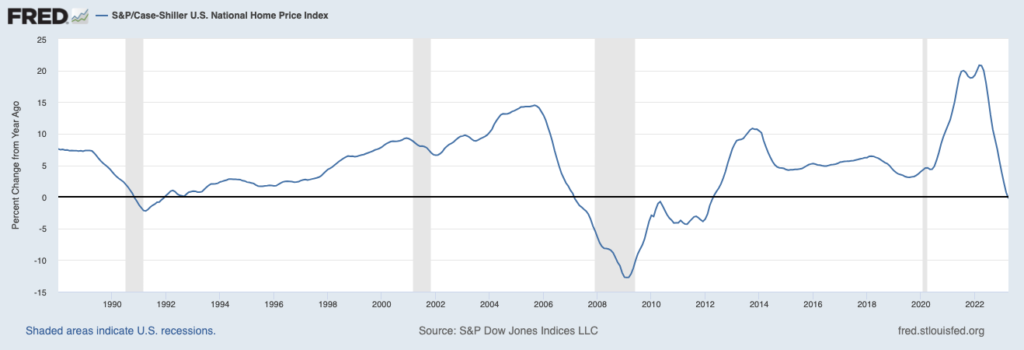

The upshot is that OER tends to lag national home prices, which are no longer being pressured higher (see chart below). If the OER follows national home prices, we should expect its impact on CPI to weaken as well.

S&P Case-Shiller U.S. National Home Price Index

Source: Federal Reserve Bank of St. Louis5

Last Friday’s Jobs Reports Complicates Inflation Optimism – Just days before this week’s inflation announcement, the Labor Department released another report that likely complicates any Fed optimism about falling inflation. It was the June jobs report. While hiring technically slowed from May, U.S. employers are still adding to payrolls at a strong pace. Private employers added 209,000 new workers in June, down from May’s 306,000 but still high by historical standards. The Fed continues to believe that too much strength in the economy and labor markets will cause inflation to be ‘sticky,’ basically complicating the last mile they need to travel to their 2% target. Indeed, employers raised hourly wages by 4.4% year-over-year in June, which is well above the pre-pandemic pace and only adds to inflationary pressures. It’s for this reason that the Fed seems almost certain to raise rates once again at their July 25-56 meeting, even as CPI measures are clearly in a downtrend.6

Planning For Retirement? Planning for retirement in a volatile market can be complicated, but the key is to envision and plan a retirement that aligns with your financial needs.

To help, we are offering our exclusive guide, How Much Exactly Do You Need to Retire7, which takes a look at important factors that we believe investors should consider when defining their goals, such as:

- What will be your retirement lifestyle? Will you travel or stay home?

- At what age do you plan to retire?

- What essential expenses will you have?

- What part will Social Security benefits play in your financial picture?

- Plus, many more factors you may want to consider to help you plan for a secure retirement

If you have $500,000 or more to invest, download this free guide today by clicking on the link below.

Disclosure

1 Wall Street Journal. July 12, 2023. https://www.wsj.com/articles/consumer-price-index-report-june-inflation-ede7f4b1

2 ZIM may amend or rescind the guide “How Much Do You Need to Retire” for any reason and at ZIM’s discretion.

3 U.S. Bureau of Labor Statistics. 2023. https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

4 U.S. Bureau of Labor Statistics. 2023. https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm

5 Fred Economic Data. June 27, 2023. https://fred.stlouisfed.org/series/CSUSHPINSA#

6 Wall Street Journal. July 7, 2023. https://www.wsj.com/articles/june-jobs-report-unemployment-rate-economy-growth-2023-af4d6547?mod=economy_more_pos3

7 ZIM may amend or rescind the guide “How Much Do You Need to Retire” for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.