In this week’s Steady Investor, we’re spotlighting key market updates that every investor should keep an eye on, such as:

• An update on the Fed and inflation

• See what factor is contributing to consumer spending

• OPEC+ agrees to oil production cuts through 2025

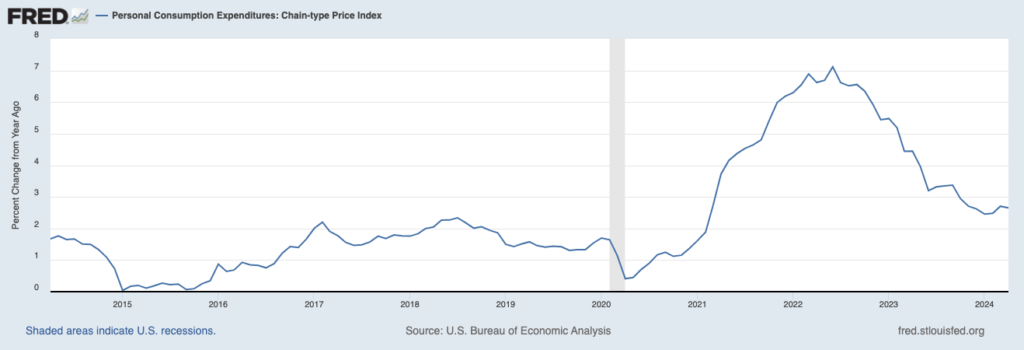

Fed’s Preferred Inflation Index Registers at 2.7% in April – The Federal Reserve’s preferred inflation measure, the headline PCE price index, rose 2.7% y/y in April—the same as March—with core prices up 2.8%. Every month, the PCE price index rose 0.3% in April, consistent with February and March’s prints.1

Personal Consumption Expenditures (PCE) Price Index Year-Over-Year % Change, All Items

While it’s challenging to accurately anticipate market performance, you can strategically position your investments to navigate potential changes ahead.

Evaluating your net worth is a great place to start. It isn’t as simple as some investors think. So, to guide you, we’re offering our free guide, Measuring Your Net Worth3, which helps answer important financial questions like:

• How do I correctly calculate my net worth?

• How does my net worth compare to other households?

• What strategies can help me grow my net worth over time?

• What are the risks and factors that can help me grow my net worth?

If you have $500,000 or more to invest and want to understand how to measure your net worth, click on the link below to get your copy today!

Download Zacks Guide, Measuring Your Net Worth3

This inflation data could be interpreted as neither positive nor negative. It showed that inflation was not getting any worse, but also that it didn’t get any better in April. As a result, the Fed’s stance on monetary policy in 2024 probably didn’t change. Looking beyond inflation, however, there was some data in the Commerce Department’s report that could soften the Fed’s stance on interest rates. Personal incomes rose 0.3% in April from March, which was a significant step down from the 0.5% month-over-month rate posted in March. Personal spending also decelerated quite a bit in April (0.2%), declining from a 0.7% month-over-month pace set in March. These figures also aren’t adjusted for inflation, meaning that incomes and spending were flat in April. This data was combined with a revised Q1 2024 GDP report, where the Bureau of Economic Analysis reported 1.3% GDP growth for the first quarter, down from the previous 1.6% estimate. Any signs of economic softening bolster the case for rate cuts later in 2024, especially if inflation does manage to come down a bit further over the summer.

A Factor That May Be Helping Consumer Spending: The Wealth Effect – The U.S. labor market remains tight, with the unemployment rate below 4% and incomes keeping pace with inflation. Plentiful jobs and higher wages have helped U.S. consumers continue spending over the past couple of years, but there’s another factor that could be supporting spending, and by extension, the economy at large: the wealth effect. Inflation has torn into the buying power of many U.S. consumers, but the higher interest rates that followed have also been putting unprecedented levels of passive income into the pockets of savers and investors. According to the Commerce Department, Americans earned $3.7 trillion in Q1 2024 from interest and dividends, which is miles above the $770 billion recorded in 2020. According to the Federal Reserve, the amount of wealth held in stocks, real estate, and other assets reached its highest level ever in Q4 2023. Higher overall levels of wealth arguably factor as a positive in spending decisions, even as inflation pushes in the other direction.4

OPEC+ Agrees to Oil Production Cuts Through 2025 – On Sunday, OPEC+ agreed to extend production cuts into 2025, in an effort to limit supply and keep a floor on prices. Back in April 2023, OPEC+ announced production cuts of 1.65 million barrels per day, which was set to expire at the end of the year. The group had also implemented additional cuts of 2.2 million barrels per day starting last November. All told, OPEC+’s cuts amount to about 5.7% of global crude supply, which is not insignificant but also is arguably not enough to have a dramatic impact on prices. Case-in-point: global oil prices have fallen by a little over 10% since OPEC+ started announcing cuts and amidst conflict in the Middle East. A key reason for oil price stability has been U.S. output, which hit a record in 2023. Other major, non-OPEC producers like Canada and Brazil have also increased production, neutralizing the impact of OPEC+ cuts.5

The market is ever-evolving, and knowing your net worth can be key to your financial health. By calculating your net worth, you gain a clearer picture of your progress toward long-term investment goals.

If you haven’t already, we recommend reading our free guide, Measuring Your Net Worth.6

You’ll get answers to important financial questions like:

• How do I correctly calculate my net worth?

• How does my net worth compare to other households?

• What strategies can help me grow my net worth over time?

• What are the risks and factors that can help me grow my net worth?

If you have $500,000 or more to invest, simply click on the link below to get your copy today!

Disclosure

2 Fred Economic Data. May 31, 2024. https://fred.stlouisfed.org/series/PCEPI#

3 ZIM may amend or rescind the “Measuring Your Net Worth” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. June 5, 2024. https://www.wsj.com/economy/americans-have-more-investment-income-than-ever-before-84b7a6c6?mod=djemMoneyBeat_us

5 CNN. June 5, 2024. https://www.cnn.com/2024/06/02/business/opec-oil-production-cuts-2025/index.html

6 ZIM may amend or rescind the “Measuring Your Net Worth” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.