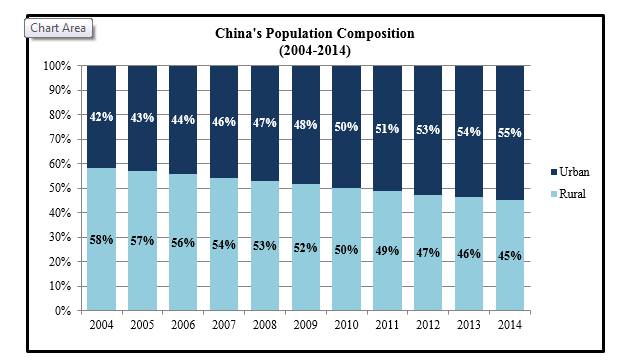

China’s evolution from a manufacturing/exports-oriented economy to a domestic services-based one suggests potential for growth in some sectors of the Chinese economy. China’s growth potential comes from its more than 1 billion population with the largest number of middle class adults globally—109 million as of 2015. What’s more, it currently has the largest pool of workers (770.4 million)…and, there’s growing urbanization. In 2011, China’s urban population exceeded the rural population for the first time in country’s history and it continues to increase.

Computations Based on Statista Data

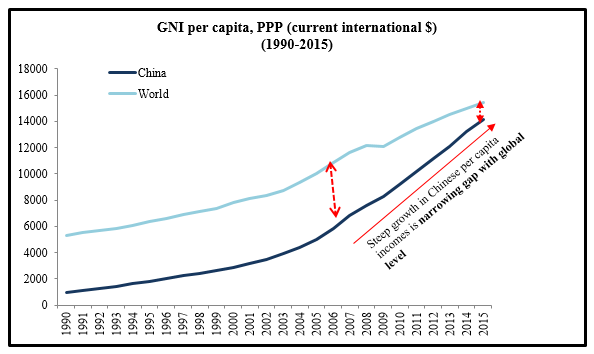

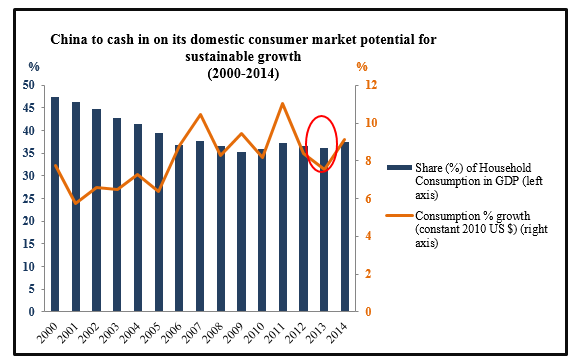

With China’s standard of living (measured in per capita income) quickly catching up with the global average, and the nation’s accelerating domestic consumption, economic restructuring has come just in time.

Data source: World Bank

Data source: World Bank

Strong Consumer Trends Ripe for a ‘New Economy’?

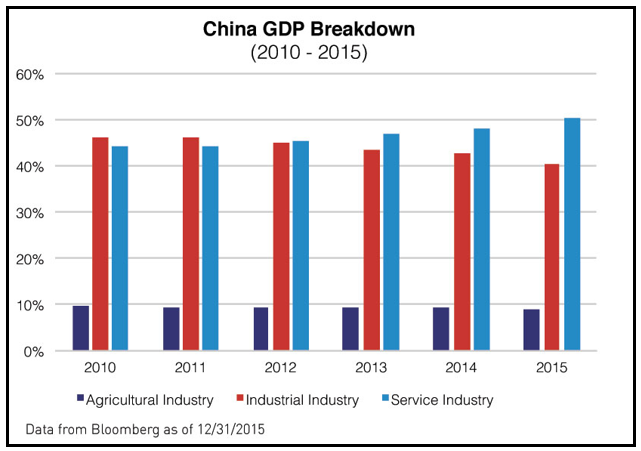

It does appear China’s economic restructuring is underway as the Chinese services sector has grown to become 50.5% of GDP in 2015; up from 48.1% the previous year and contributing to more than half of China’s GDP for the first time.

Source: KraneShares

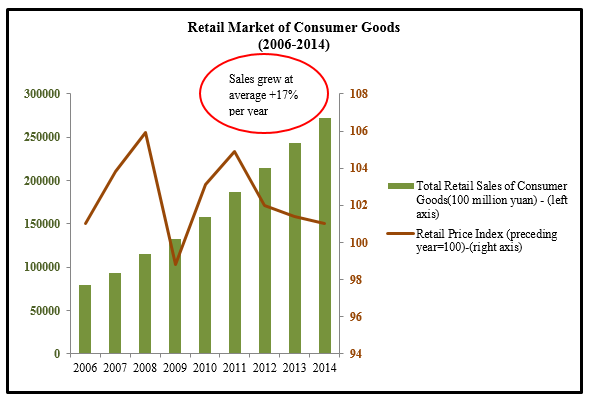

Retail sales volume increased every year by an average of +17% from 2006 through 2014, even as price levels fluctuated.

Data Source: National Bureau of Statistics of China

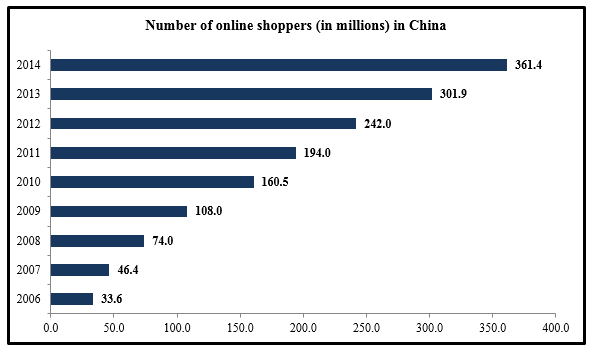

Online spending has contributed to the retail boom in a big way as the number of digital shoppers has grown dynamically from less than 33 million in 2006 to over 361 million as of 2014.

Data source: Statista

Having the largest internet user base in the world, China’s online spending (around $672 billion) comprises 16% of its total spending, as estimated by eMarketer. What’s more, online shopping in China accounts for almost 35% of global online spending, as of 2013, and is predicted to continue to grow dramatically in the coming few years.

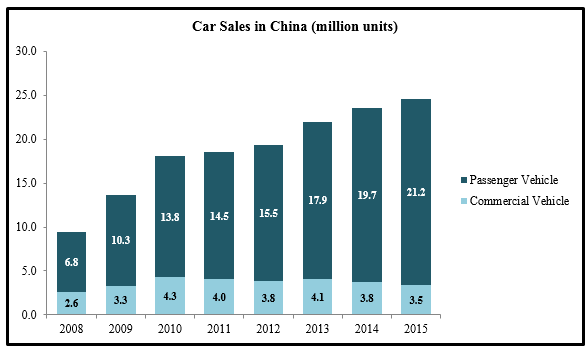

Passenger car sales have more than tripled to almost 21.2 million units in 2015 making China the leading car producer (up from around 6.8 million in 2008).

Data Source: Statista

Furthermore, China’s passenger vehicle sales saw +9.5% growth to reach 10.8 million units in the first half of 2016, largely bolstered by rising demand for SUVs—something that’s probably driven by the increasing affluence of citizens, purchase tax relaxations applicable to compact/mid-sized SUVs, and the proposed abolition of China’s “one-child” policy expected to raise demand for larger-spaced vehicles.

Travelling/tourism is another burgeoning consumer market. Statista’s estimates indicate a +29% CAGR of international tourism spending by the Chinese from 2008 through 2014.

Data source: Statista estimates

What’s more, Goldman Sachs estimates that total overseas expenditures by the Chinese amounted to almost $200 billion in 2015, topping all countries. By 2025, spending could more than double that nearing $450 billion, along with an increase in passport holders to 12% of China’s population from the current 4%.

According to eMarketer forecasts, digital travel sales are expected to climb +36% in China this year, contributing the most to the Asia-Pacific regional growth thanks to increasing smartphone usage coupled with growing discretionary income of the middle class.

Backed by rising wealth and government initiatives, health care spending by Chinese households has experienced upward momentum in recent years. Annual personal healthcare expenses per person increased more than twofold between 2004 and 2011 to $102.25 from $51.05. Additionally, sales of vitamins and dietary supplements could climb +214% to $5.3 billion by 2017 from a decade earlier, as suggested by Mintel.

Bottom Line for Investors

China’s evolving economy should spell more growth opportunities in the consumer segment. Moreover, in a recent survey by McKinsey & Company on China’s consumers, around 55% of respondents expected their incomes to increase significantly over the next five years, more than 25% of the consumers plan to increase expenses on leisure and entertainment, and around 23% plan to spend more on travel—something that should aid services sector growth, in line with the nation’s restructuring objectives.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.