U.S. real estate has emerged as a hotspot for foreign investors, particularly China. According to a report by Bloomberg, Chinese property acquisitions in the U.S. jumped from $10 billion in 2011 to more than $55 billion in 2015. Additionally, a National Association of Realtors (NAR) study revealed China as the largest foreign buyer of U.S. homes, even surpassing Canada in the last 12 months.

China Seeking Attractive Returns

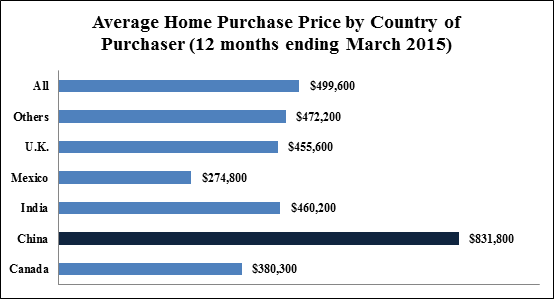

Chinese investors have been pouring money into U.S. real estate in hopes of offsetting losses in domestic assets. For foreign investors who come from countries with less developed capital markets, less diversified economies and shakier growth, most U.S. assets and debt are seen as safe havens with better yields and higher dollar returns. While China has solid growth, it is lacking in every other department. Additionally, the weakening of the yuan, coupled with lower interest rates outside the U.S., only add further incentive to invest in U.S. properties. The following NAR data shows that China surpasses other foreign buyers in bidding for U.S. homes:

Source: National Association of Realtors, June 2015 report

Is a Real Estate Bubble Looming?

With this flurry of international investments, many wonder if the next real estate bubble is on the horizon. In our view here at Zacks Investment Management, it is not believed likely. While the recent Chinese property deals in the U.S. have garnered attention, most are for trophy properties (such as Anbang Insurance Group’s reported deal to acquire $6.5 billion worth of hotel properties from Blackstone Group LP following its $1.95 billion purchase of New York’s Waldorf Astoria in 2015).

Furthermore, foreign investments in U.S. homes are generally concentrated in the upper brackets, and comprise 8% of dollar value of existing home sales as of the last 12 months ending March 2015 (according to NAR reports). Occupying a small slice of a niche market in the still-recovering U.S. real estate market, the chances of Chinese investments resulting in an unsustainable bubble look slim. Moreover, an already strong dollar should rein in some of the Chinese investments in U.S. properties going forward.

Bottom Line for Investors

This year, the value of Chinese acquisition deals in U.S. properties has already reached near half of its 2015 level, according to a Bloomberg report. The high worth of Chinese investments could bode well for U.S. foreign incomes and may also provide funding for more construction projects – something that’s desired given a tight housing market. It could also result in increased property values of existing homeowners, which adds to personal wealth in the country.

While U.S. real estate continues to lure global investors, what is the overall state of our economy? We at Zacks Investment Management are always looking hard at this data to provide context for investing for our clients. If you want an inside look at what we’re seeing, download our Economic Outlook Report (April ’16) by clicking below now…

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.