Patricia T. from Fairfax, VA asks: Hello Mitch, my question today is about gold. I’ve seen reports about gold performing well especially during a crisis, or when inflation may be coming. Seems to me like it’s checking all the boxes! What are your thoughts on gold as an investment?

Mitch’s Response:

Thanks for writing, Patricia. First, a little bit of background for other readers. Gold prices have indeed climbed to a new closing record for the first time in almost ten years, extending a summer rally arguably fueled by somewhat nervous investors. The precious metal is up over 20% for the year, attracting the attention of investors across the spectrum.1

The enthusiasm for gold seems to be driven by investors building portfolio hedges in light of a gloomy global economic growth outlook, depressed interest rates, and rising tensions between the U.S. and China. In terms of your comment about ‘checking all the boxes,’ the above list of concerns is certainly all in play today. Many investors are also flocking to gold because they think inflation is near, or that the U.S. dollar is doomed. Neither outcome seems likely to me in the near to medium-term.

Personally, I have never been a fan of gold as an investment. When gold became available to U.S. investors to buy and trade as an investment commodity, it has delivered a nearly +900% return.2 If that sounds like a solid return, think again: stocks and even U.S. Treasuries vastly outperformed gold over that time period.

______________________________________________________________________________

See How You Can Navigate This Recession

The market turbulence and uncertainty are scary—but now is the time to act and prepare yourself for the coming months. It’s important to understand how recessions work, how long they last, and how to potentially protect yourself and your family from long-term damage to your assets and security. We can help you with our free guide, The Economy is in Recession: 5 Insights to Navigate Your Way Through It.2

If you have $500,000 or more to invest, get our free guide today. You’ll learn the scope and impact of recessions, and get our viewpoint on the most important moves you can make to weather this one. Don’t wait—get this guide today!

Download Your Copy Today: The Economy is in Recession: 5 Insights to Navigate Your Way Through It

______________________________________________________________________________

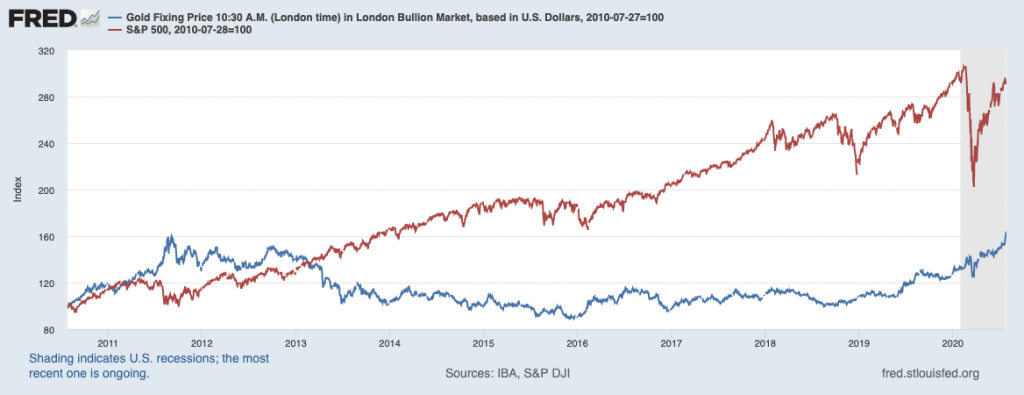

Even just considering the last ten years, stocks as measured by the S&P 500 (red line) have zoomed far beyond the total returns delivered by gold (blue line), even when taking into account the -34% decline associated with the pandemic:

Not only have stocks and bonds outperformed gold over the long-term, they have also exhibited lower volatility than gold over time. To me, if stocks as a risk asset have consistently delivered better long-term returns with lower volatility profile, the choice between stocks and gold is a no brainer.

At the end of the day, many people flock to gold because it’s a real, hard asset. Something you can feel, touch. Corporations do not have the same qualities. But at the same time, gold’s value as an asset only appreciates based on speculative demand. Gold doesn’t make anything, it doesn’t grow, it doesn’t generate a profit. Companies, on the other hand, can grow, innovate, hire new people, grow more, and generate a steady stream of earnings over time. In my view, that’s why they appreciate more over time, and are ultimately a better long-term investment.

In the current climate, uncertainty can leave many investors, especially those nearing or in retirement, fearful of what’s to come. This can cause investors to look to commodities like gold to hedge against risks. A better solution may require pivoting your retirement investing strategy.

To help you do this, it’s important to understand

how recessions work, how long they last, and how to potentially protect

yourself and your family from long-term damage to your assets. We can help

you with our free guide – The Economy is in Recession: 5 Insights to

Navigate Your Way Through It.5

If you have $500,000 or more to invest, get our

free guide today. You’ll learn the most scope and impact of recessions, and get

our viewpoint on the most important moves you can make to weather this one.

Don’t wait—get this guide today.

Disclosure

2 The Wall Street Journal, July 24, 2020. https://www.wsj.com/articles/gold-climbs-to-all-time-high-topping-2011-record-11595612234?mod=markets_minor_pos4

3 Zacks Investment Management reserves the right to amend the terms or rescind the free The Economy is in Recession: 5 Insights to Navigate Your Way Through It offer at any time and for any reason at its discretion.

4 ICE Benchmark Administration Limited (IBA), Gold Fixing Price 10:30 A.M. (London time) in London Bullion Market, based in U.S. Dollars [GOLDAMGBD228NLBM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GOLDAMGBD228NLBM, August 3, 2020.

5 Zacks Investment Management reserves the right to amend the terms or rescind the free The Economy is in Recession: 5 Insights to Navigate Your Way Through It offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual.