The trade dispute between the U.S. and China grew last week, as the Trump administration enacted 10% tariffs on $200 billion of Chinese imports and China retaliated immediately with 10% tariffs on $60 billion of U.S. goods. For those keeping score out there, the U.S. has now levied tariffs on over $250 billion worth of Chinese goods, with China taxing just about every U.S. import possible.1

As the stakes grow higher, many investors should rightfully wonder: where’s the tipping point in this trade war? At what point are the effects of these tariffs recessionary?

Good question! The short answer in my view is “far off,” and here’s why. Let’s start with the silver lining of this latest round of tariffs, which is that they were initially set out to be in the 20%-25% range, but were ultimately scaled back considerably to 10% (at least for now).2 In such a scenario, in my view, we’ll see corporations absorb some of the additional cost and consumers absorb some of it too. Spread around, I don’t think the impact should fundamentally alter decision-making on the consumer or corporate level.

______________________________________________________________________________________________________________

Time to Dig Deeper into Market Risks?

When looking at factors that could cause market risks, it is important to keep an eye on key economic indicators. To help you do this, we are offering all readers a first-look into our just-released October 2018 Stock Market Outlook report.

This 22-page report contains some of our key forecasts to consider:

- What produces U.S. optimism?

- Forecast for the S&P

- Small-cap and large-cap outlook in 2018

- Which sectors are hot and which are not?

- What industries within those sectors most merit your attention?

- Odds of recession

- And much more.

IT’S FREE. Download the Just-Released Stock Market Outlook3 >>

______________________________________________________________________________________________________________

Economic data is also indicating, at least for now, that the tariffs to date have not derailed growth patterns in either country. In the U.S., we’re actually seeing some modest upticks in factory output and manufacturing according to the Chicago Fed Index,4 and July consumer spending data (+0.3%) remains firmly in an uptrend and consistent with previous months.5 If the trade war is supposed to be derailing U.S. economic growth, it appears that it hasn’t started yet.

The same applies to China, at least to a degree. August data showed fairly robust activity in-line with previous months, with the exception of fixed-asset investment. In August, value-added industrial input was up 6.1%, retail sales jumped 9.0%, and the unemployment rate held around 5%. Fixed asset investment was a spot of concern, but the reality is that it still rose 5.3% – hardly the stuff of a recession.6

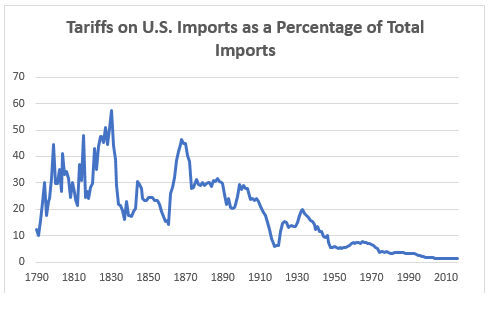

But, perhaps the most compelling argument for the trade war not reaching a tipping point (yet) is garnered through a macro understanding of how much these new tariffs actually represent as a percentage of total U.S. imports. Though recent moves by the Trump administration are moving the U.S. away from freer trade, it should be noted that over the last two centuries, the United States has made enormous strides towards eliminating tariffs altogether. The chart below demonstrates that tariffs used to be a much bigger factor in the economic picture than they are today. At the end of the day, even the recent uptick in tariffs has done very little to increase the overall rate:

Source: US International Trade Commission7

Finally, I think it’s important to remember that the threat and implementation of tariffs are no longer taking the market by surprise. The most recent round of 10% on $200 billion of Chinese goods were actually first mentioned in March, with an executive order requesting a study of Chinese trade practices in July. By August, the market was largely aware that these tariffs were coming due absent a trade deal with China,8 which never really seemed to be on the table. Any additional tariffs would need to undergo the same process, which I think gives the market plenty of time to price-in any potential impact.

Bottom Line for Investors

In my view, in order for the trade war to create a sustained market impact, it would necessitate impacting trillions of dollars in global GDP growth. As far as I see it, we’re not anywhere close to those kinds of numbers. What’s more, economic growth has actually improved in some areas in spite of the tariffs, and showed signs of stabilizing in others. The data we have so far offers only a small sample size, so it merits continued observation. But so far, I’d argue that the trade war is more of a political nuisance than an economic one.

If you would like to take a closer look at this data, I recommend reading our just-released Stock Market Outlook report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- What produces U.S. optimism?

- Forecast for the S&P

- Small-cap and large-cap outlook in 2018

- Which sectors are hot and which are not?

- What industries within those sectors most merit your attention?

- Odds of recession

- And much more.

FREE Download – Zacks’ 2018 Stock Market Outlook9 >>

Disclosure

2 The New York Times, September 17, 2018, https://www.nytimes.com/2018/09/17/us/politics/trump-china-tariffs-trade.html

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook Report at any time and for any reason at its discretion.

4 Market Watch, September 24, 2018, https://www.marketwatch.com/story/us-economy-helped-by-factories-in-late-summer-chicago-fed-index-shows-2018-09-24

5 BEA News, August 30, 2018, https://www.bea.gov/news/2018/personal-income-and-outlays-july-2018

6 The Wall Street Journal, September 14, 2018, https://www.wsj.com/articles/china-economic-activity-indicators-mixed-in-august-1536892284

7 Quartz, September 26, 2018, https://www.theatlas.com/charts/SyXJGvOtf

8 Bloomberg, September 17, 2018, https://www.bloomberg.com/news/articles/2018-09-18/the-trade-war-is-on-timeline-of-how-we-got-here-and-what-s-next

9 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook Report at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.