Navigating today’s market requires clarity and focus. In this week’s Steady Investor, we break down three key themes shaping the investment landscape—so you can make decisions with confidence:

- Jobs revised, growth narrows

- Home sales slide sharply

- Bond spreads signal overconfidence

The Labor Market Just Got a Reality Check – January’s employment report showed a modest but still solid 130,000 payroll gain. But it was a deeper look at the jobs numbers that told a much more important story about the status of the U.S. labor market. In addition to posting the monthly payrolls number, the report delivered a significant rewrite of how investors and economists understood the past two years. The Labor Department now estimates the U.S. added 1.5 million jobs in 2024 (down from 2 million) and just 181,000 in 2025 (down from 584,000). Annual benchmark revisions alone wiped out roughly 898,000 previously reported jobs, reflecting survey distortions and an overstated pace of new business formation.Beneath the revisions, hiring has grown highly concentrated. Healthcare and social assistance added roughly 758,000 jobs over the past year, effectively carrying the labor market. Outside those sectors, private payrolls have been largely flat to negative. Manufacturing employment is down 285,000 from a year ago, while white-collar categories like professional services and finance have stagnated. Government payrolls have also declined following federal workforce reductions.Meanwhile, leading indicators are also softening. Initial jobless claims recently rose to 231,000, and January layoff announcements reached 108,435—the highest level since 2009. And as seen on the chart below, job openings have fallen to 6.5 million. Overall, the January print reinforces the idea that

the labor market is cooling, narrower in breadth, and arguably weaker than prior data implied.1

Source: Federal Reserve Bank of St. Louis2

Tax Planning? Get Our User-Friendly Guide for 2026

While tax planning might not be the most thrilling topic, it’s a crucial component of your financial strategy.

Our free guide, Tax Planning in 2026: A User-Friendly Guide2, aims to simplify the complexities of tax laws and empower individuals and business owners to make strategic decisions that minimize tax liability. It also covers a range of key tax issues, such as:

- Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

- Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

- Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions, and other essential topics.

- Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations, and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Download Tax Planning in 2026: A User-Friendly Guide3

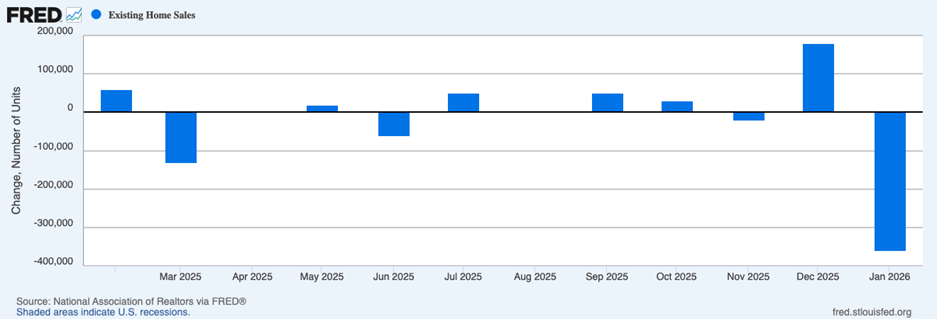

The Housing Market Stumbles in January. Is More Trouble Ahead? – Existing home sales fell 8.4% in January to a seasonally adjusted annual rate of 3.91 million, marking the largest monthly decline since February 2022. The decline follows gains in three of the prior four months, including a revised 4.4% increase in December.Mortgage rates are averaging roughly 6.1%, down from about 6.9% a year ago, helping push the typical monthly payment (20% down, excluding taxes and insurance) down 8.4% to $1,733.All told, the housing market is increasingly tilting in the direction of being a “buyer’s market,” with nearly two-thirds of buyers in 2025 paying below original listing prices. January’s sharp decline may have simply been a reset following strong December activity and a decent run in the fall season.4

Source: Federal Reserve Bank of St. Louis5

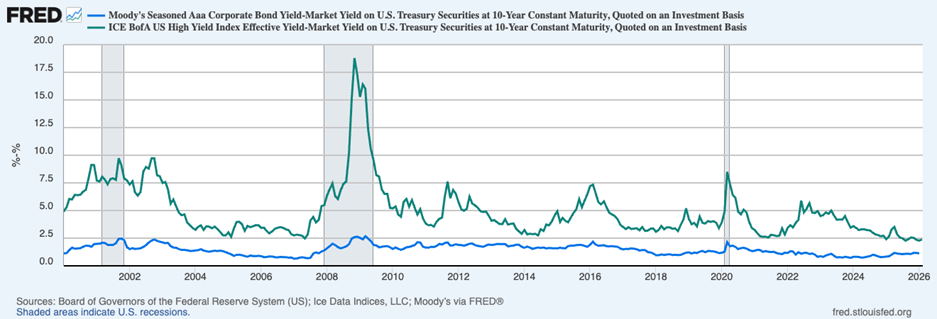

The Bond Market Isn’t Worried, and That May be a Problem – Credit markets appear to be sending a notably confident signal. The extra yield investors demand to hold highly-rated corporate bonds over U.S. Treasurys recently fell to a 27-year low, while spreads on speculative-grade debt dropped to their tightest levels in 18 years. In the $4 trillion municipal market, the yield gap between triple-A and triple-B bonds is hovering near its narrowest point in two years.Globally, institutional investors continue to seek long-dated U.S. corporate bonds, drawn by yields that remain elevated relative to other developed markets.

Corporate borrowers, meanwhile, have issued fewer long-term bonds in recent years, creating a supply-demand imbalance that has helped compress spreads further. Despite policy uncertainty, geopolitical tensions, and isolated defaults last year, credit investors appear largely unfazed. In our view, these historically tight spreads may offer limited compensation for bonds issued by riskier companies, especially if economic conditions weaken or new issuance accelerates. We think investors should continue to focus on quality.6

Source: Federal Reserve Bank of St. Louis

Is Your Tax Strategy Aligned for 2026? – Taxes may not be exciting, but they play a critical role in your long-term financial success.

Our free guide, Tax Planning in 20267, simplifies tax laws and offers strategies to help you reduce liabilities and save more. Explore topics like:

- Investments—including tax loss harvesting, loss carryover, investment interest expense deductions, and many more topics.

- Healthcare and Education—from the Child Tax Credit to Health Savings Accounts to 529 plans and more.

- Retirement Planning—Traditional and Roth IRAs, catch-up contributions, Required Minimum Distributions, and other essential topics.

- Charitable Giving & Estate Planning—Gifting strategies, Donor-Advised Funds, private foundations, and other ways to help yourself as you help others.

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 Fred Economic Data. February 5, 2026. https://fred.stlouisfed.org/series/JTSJOL

3 ZIM may amend or rescind the “Tax Planning in 2026” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. February 12, 2026. https://www.wsj.com/economy/housing/homes-sales-in-january-post-biggest-monthly-decline-in-nearly-four-years-eae1ab61?mod=hp_lead_pos7

5 Fred Economic Data. February 12, 2026. https://fred.stlouisfed.org/series/EXHOSLUSM495S

6 Wall Street Journal. February 12, 2026. https://www.wsj.com/finance/the-demand-for-bonds-is-insatiable-even-risky-borrowers-are-reaping-the-benefits-f3b8c6b6?mod=finance_lead_pos3

7 ZIM may amend or rescind the “Tax Planning in 2026” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.