In this week’s Steady Investor, we’re digging into essential factors that investors should focus on, such as:

• Lower prices this holiday shopping season

• Better deals for holiday travels and meals

• Jury finds realtors conspired to keep commissions high

Did You Notice a Lower Thanksgiving Grocery Bill This Year? – In 2022, the bird flu ravaged flocks in many states and led to diminished inventories, which put upward pressure on prices. This year was better. Wholesale prices for turkeys were down -32% in the first week of November compared to 2022 prices, with the average 16-pound turkey costing consumers $27.35 – which is 5.6% lower than last year. Other factors that drove food inflation in 2022 have also moderated, such as the impact of Russia’s invasion on the price of wheat, corn, and some cooking oils. According to the American Farm Bureau Federation, the typical Thanksgiving dinner for 10 should cost $61.17, which is 4.5% lower than 2022’s price tag. To be fair, the ‘lower’ prices for Thanksgiving are still 25% higher than they were in 2019, but at least consumers are catching somewhat of a break.1

Looking for More Market Insights for Q4 2023?

In August and September, interest rates pushed higher while stocks fell, and another war broke out as the quarter came to a close. Geopolitical uncertainty, interest rate uncertainty, and then market uncertainty started to set in.

In our free Q4 2023 Market Commentary, Zacks Investment Management CEO, Mitch Zacks, argues that there is more to this story. He believes it is important to consider why interest rates are rising—and he believes the answers may be positive for the economy and stocks. In this issue, you’ll read about:

• Are Interest Rates Hobbling the Bull Market?

• Interest Rates are Going Up, But So Are Earnings

• Assessing U.S. Economic Headwinds

• Bottom Line for Investors

If you have $500,000 or more to invest, request this guide today.

Download Our Q4 2023 Market Commentary2

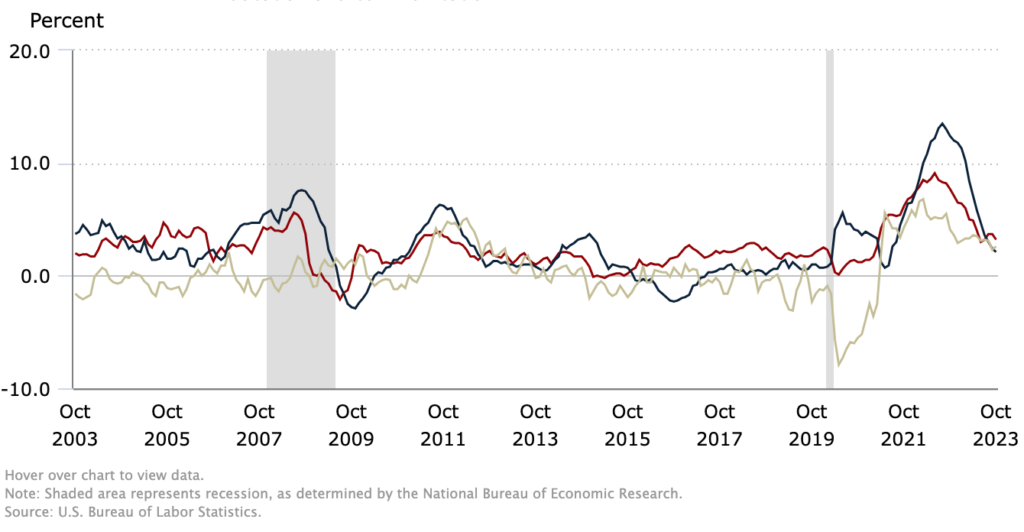

Will U.S. Consumers Benefit from Lower Prices This Holiday Shopping Season? U.S. consumers have managed to push through the era of higher prices, bolstered by a strong jobs market and higher wages. They might finally be getting a break this holiday shopping season. As consumers spend more on food – and also shift spending away from goods and towards services and experiences – retailers have felt the pinch. And they want consumers back. In a recent conference call with investors, Walmart CEO Doug McMillon said, “We may be managing through a period of deflation in the months to come, and while that would put more unit pressure on us, we welcome it, because it’s better for our customers.” This approach marks an almost complete reversal from the year or so following the pandemic when consumers were armed with stimulus money and spending far more on goods than services.3 If companies like Walmart and other retailers start slashing prices, competition for discretionary spending could lead to lower prices than last year and more deals later in the season. As seen in the chart below, prices for food (black line) and apparel (tan line) have moved lower than broad-based CPI (red line).4

Change in prices, year-over-year

Time will tell where prices land this holiday shopping season, but already we’ve seen prices for TVs, smartphones, toys, sofas and other items in decline since last year’s holiday season. According to research from Adobe, holiday discounting could hit record highs this year, with big discounts coming for toys, electronics, and furniture.

A Verdict Could Reshape How Homes are Bought and Sold in the U.S. – A jury in Kansas City delivered a verdict in mid-November that could reshape how houses are bought and sold in the U.S. The jury found the National Association of Realtors and large residential brokerages liable for approximately $1.8 billion in damages, after deciding that the organizations had conspired to keep commissions artificially high. The lawsuit was in effect an antitrust suit, as the plaintiffs’ attorneys argued that this system made it very difficult for buyers and sellers to negotiate lower rates. In the U.S., the commission on a home sale is typically between 5% and 6%, which is substantially higher than in most other developed countries. The ruling is set to be appealed, so time will tell whether it actually leads to changes in how residential real estate transactions are structured. Going forward, however, it’s possible that the U.S. may see buyers opting to represent themselves for the house hunt, and using an attorney for closing. Finding a home for sale is relatively easy these days, with several sites and apps available for use.6

Investing in Today’s Market – Today, our latest Q4 2023 Market Commentary7 is available to all Steady Investor readers for free. In this report, CEO, Mitch Zacks, assesses economic headwinds and the effect they may have in months ahead, including the threat of a government shutdown, resumption of student loan payments, oil price shock, and more.

Don’t miss this new report to get Mitch’s expert insights on key market topics including:

• Are Interest Rates Hobbling the Bull Market?

• Interest Rates are Going Up, But So Are Earnings

• Assessing U.S. Economic Headwinds

• Bottom Line for Investors

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Q4 2023 Market Commentary offer at any time and for any reason at its discretion.

3 Wall Street Journal. November 16, 2023. https://www.wsj.com/business/retail/walmart-wmt-q3-earnings-report-2024-black-friday-ac8e3503?mod=djemRTE_h

4 Wall Street Journal. November 18, 2023. https://www.wsj.com/economy/consumers/black-friday-shopping-charts-3ce30588?mod=economy_lead_pos2

5 BLS. 2023. https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category-line-chart.htm

6 Wall Street Journal. October 31, 2023. https://www.wsj.com/real-estate/jury-finds-realtors-conspired-to-keep-commissions-high-awards-nearly-1-8-billion-in-damages-b26f9c2f

7 Zacks Investment Management reserves the right to amend the terms or rescind the free Q4 2023 Market Commentary offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.