Megan C. from Stamford, CT asks: Hi Mitch, Hope it’s been a nice summer. I know the economy is doing well at the moment with lots of spending and travel. Is there anything else you see indicating strength that people are not talking about as much?

Mitch’s Response:

There are plenty of positive, underappreciated fundamental indicators in the U.S. economy at the moment! I’m glad you asked this question. It offers me a good opportunity to remind investors that most of what we see in financial media coverage – higher consumer spending, busy travel, restaurants, and hospitality scrambling for workers, inflationary pressures – are largely priced into markets. If the data is widely known and discussed, it probably does not have much pricing power.1

One key area of underappreciated strength is business investment. We’ve seen a trend in the U.S. where companies are increasing orders for machinery, software, and other equipment to expand productivity (given the tight labor market) but also to reshape their businesses in the wake of the pandemic.

______________________________________________________________________________________________

Looking to Retire Soon? 4 Steps to Get Started!

Volatility in the market can cause investors, especially those who are nearing retirement, to worry about the day-to-day highs and lows. So, it’s normal for investors to have mixed feelings about the right steps to take.

We want you to feel as confident and assured as possible during this new and unfamiliar process. One good way to successfully build your retirement portfolio while minimalizing anxiety is to make thorough plans.

To help you do this, we are offering readers our free guide that provides a step-by-step blueprint to potentially help you build a sound retirement portfolio. This guide offers you a checklist of the most important financial, tax, and investment considerations for new retirees, with detailed explanations to help you prepare for this new stage in your life.

If you have $500,000 or more to invest, get our free guide today!

Download Zacks Guide, Thinking of Retiring Soon? Here are 4 Things to Consider First2

______________________________________________________________________________________________

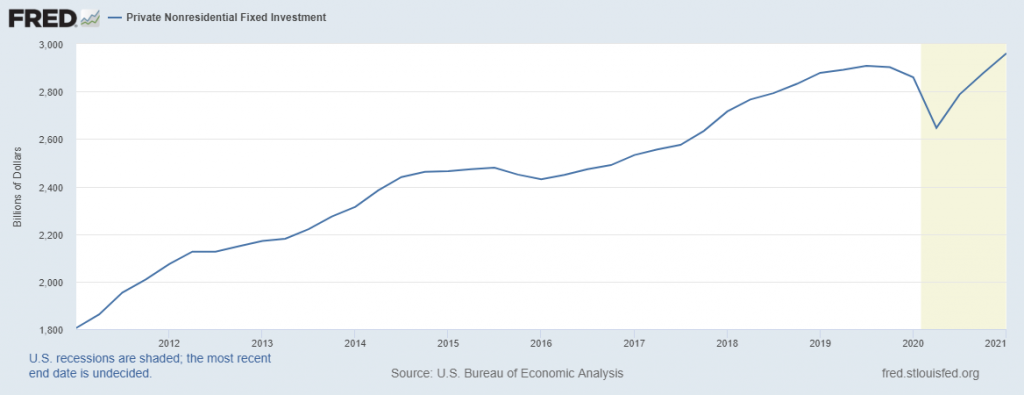

Nonresidential private fixed investment, which is the economist measure of business investment, increased at a seasonally adjusted annual rate of 11.7% in Q1, following double-digit increases in Q3 and Q4 of last year. The biggest outlays in spending came in software and tech equipment, which makes sense as businesses prepare for a future of less customer contact and more of a hybrid work model. As you can see in the chart below, business investment has now eclipsed pre-pandemic highs:

Another measure of business spending is to look at orders for nondefense capital goods, which to note are near the highest levels since the 1990s (when recordkeeping started). As I mentioned earlier, businesses are noticing a landscape of scarce workers, and are thus spending on equipment and other capital to increase productivity.

In the last economic recovery (2008-2009), worker productivity took a long time to recover, and businesses largely turned to hire workers because labor was cheap. In this recovery, labor is tight, which is driving businesses to spend more on capital instead. I think U.S. capital spending could continue soaring past pre-pandemic levels in the coming quarters, which would make its pace incredibly faster than business investment after the 2008 Financial Crisis.

I think this is a major underappreciated fundamental that could drive another leg of the recovery forward after this initial surge in consumer spending tapers off.

Are you looking to retire soon? If you are, but are hesitant and do not know where to start, here are some simple steps to consider! To guide you through this new phase, we’ve created our new guide to help you review your financial situation so you can make any adjustments necessary to keep your plans and lifestyle on track.

If you have $500,000 or more to invest and want to understand your retirement options, get our guide, Thinking of Retiring Soon? Here are 4 Things to Consider First.4 Simply click on the link below to get your copy today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

3 Fred Economic Data. June 24, 2021. https://fred.stlouisfed.org/series/PNFI

4 Zacks Investment Management reserves the right to amend the terms or rescind the free How the Looking to Retire Soon? Here are 4 Things to Consider First offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.