Isa G. from Plano, TX asks: Happy New Year, Mitch! My question is pretty simple and straightforward, just curious if you have some thoughts on the outlook for 2022. What can investors expect, look for, etc.? Hope you had a wonderful holiday season!

Mitch’s Response:

Thank you for writing, and Happy New Year!

In looking ahead to 2022, investors should focus on the same fundamental factors that I’d recommend analyzing every year – earnings, interest rates, inflation, and economic growth. Across each of these factors, I see mostly moderating forces in the United States, what I might term a ‘normalization’ of economic fundamentals.

On the earnings front – which long-time readers know I consider to be the most important factor for stock market returns – I think corporate earnings will remain strong in response to the tight labor market, rising wages, and pent-up consumer demand for services. The pandemic shifted spending a great deal towards goods and away from services, and I think we could see a pendulum swing in the other direction as pandemic risk fades.1

Learn the 7 Secrets of Building an Effective Retirement Portfolio

Get our free guide to learn how to create a retirement investment plan that can withstand any market—and potentially help you achieve your goals.

You’ll learn the secrets of successful retirement portfolios, including the right way to set your goals and retirement needs, as well as the key basics of disciplined investing, based on our decades of experience.

If you have $500,000+ to invest, get our free 7 Secrets to Building the Ultimate DIY Retirement Portfolio2 guide today.

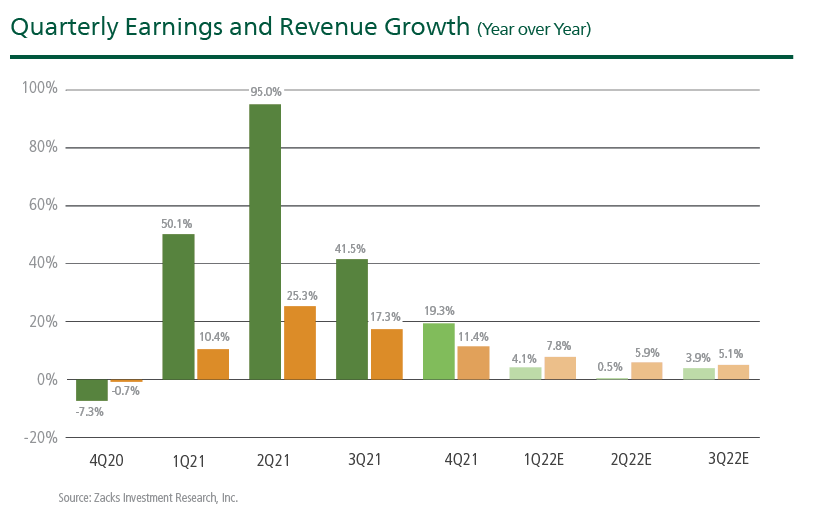

That being said, comparisons in 2022 will be tougher given that 2021 was a considerably strong year for U.S. corporations across the board. So, I’d expect moderating earnings growth rates and moderating earnings surprises, which could ultimately mean more modest stock market returns (though still positive, in my view). The chart below looks at forward-looking quarterly estimates for S&P 500 companies, which you can see leveling off:

Inflation is another factor I think will see some moderating forces in 2022. Rising prices were obviously the big story in 2021, due to imbalances caused by supply chain issues being met with robust consumer demand. Comparisons to 2021 also made the inflation numbers look very big. In my view, consumer demand for goods should moderate as supply chain issues become increasingly resolved, and should take some pressure off of rising prices. A lack of additional fiscal stimulus should help, too.

We know today based on late 2021 Federal Reserve meetings that interest rate hikes are planned for 2022, but in my view, we should not see interest rates rise to the point that the equity risk premium (which values stocks relative to the 10-year U.S. Treasury) makes stocks unattractive. I think the 10-year U.S. Treasury would need to rise to about 3% in order to compete with stocks on a risk/reward basis, and I do not see that happening in 2022.

Bottom line – I think 2022 will be a positive growth year for the U.S. economy and for corporate earnings, but tough comparisons with 2021 and moderating forces will make some of the positive surprises more challenging to come by. That does not mean stocks will suffer, but I do think it means investors will be challenged to identify individual stocks poised to deliver better-than-expected earnings.

There are still some additional steps you can take in times like these to help protect your investments and create a portfolio that meets your financial goals. To help you do this, I recommend reading our guide, 7 Secrets to Building the Ultimate DIY Retirement Portfolio.3

If you have $500,000 or more to invest, get this guide to learn our ideas on the step-by-step process of building and maintaining a retirement portfolio that will potentially help you reach your goals and enjoy a secure retirement.

Disclosure

2 ZIM may amend or rescind the guide “How to Build Your Ultimate Retirement Portfolio” for any reason and at ZIM’s discretion.

3 Zacks investment Research, Dec 15, 2021. https://www.zacks.com/commentary/1839842/making-sense-of-evolving-earnings-estimates

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.