The U.S. saw modest but steady economic growth while Britain seems to be headed for a hard Brexit. Read on to see how these stories could impact the market.

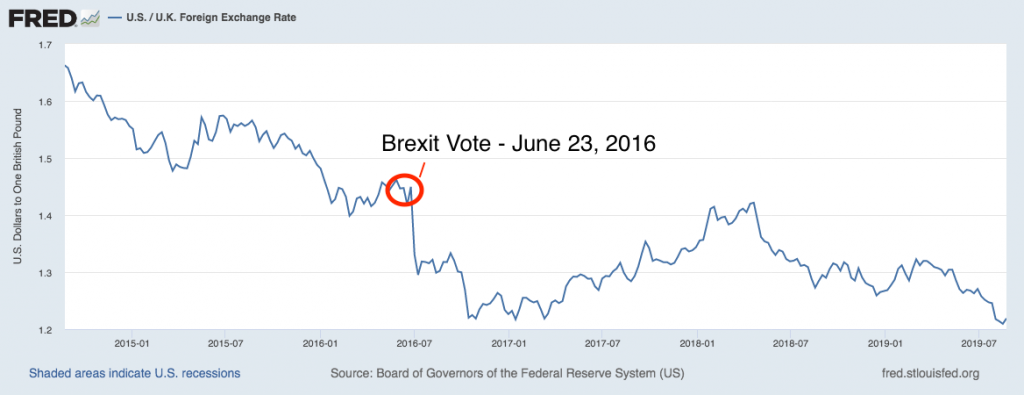

Hard Brexit Becomes More Likely – With the appointment of Prime Minister Boris Johnson, the probability of Britain leaving the European Union without a trade deal in place moved higher. But actions this week make the reality of a “hard Brexit” seem almost inevitable – Prime Minister Johnson asked permission from Queen Elizabeth II to shut down Parliament for five weeks through mid-October, all but assuring that opposition lawmakers would be prevented from blocking a no-deal Brexit. Shutting down Parliament for five weeks – when there are only eight weeks left to before a hard Brexit – all but assures that Britain will be confronted with the consequences of not having trade and customs agreements with one of their largest trading partners: the European Union. The pound sterling (Britain’s currency) continues to slide against the dollar as the deadline approaches (see chart). The date to watch is October 31, when a divorce from the EU would be final with or without a deal.1

Source: Federal Reserve Bank of St. Louis2

______________________________________________________________________________

Get These 7 Secrets to Building the Ultimate Retirement Portfolio

From news surrounding Brexit to U.S. trade updates and navigating market cycles, it is no small feat to create a retirement portfolio that meets your financial goals. To build a portfolio that can potentially reach your goals, you must put some time and effort into defining your investing objectives, determining your asset allocation, and managing your investments over time.

If you have $500,000 or more to invest, I recommend downloading our guide 7 Secrets to Building the Ultimate DIY Retirement Portfolio. It provides a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio of your own and pursue long-term investing success.

Download Your Copy of 7 Secrets to Building the Ultimate DIY Retirement Portfolio.2

_____________________________________________________________________________

U.S. Q2 GDP: Modest but Steady — The U.S. Bureau of Economic Analysis (BEA) generally releases U.S. GDP growth data in three iterations, with the first iteration usually being the least reliable. As the Bureau has more time and more information to make GDP calculations, the GDP growth figure gets revised to more accurately reflect the complete data set. As applied to Q2 2019, the BEA has revised their initial estimate down by just 0.1%, which offers a safe assumption that U.S. GDP grew 2.0% in Q2. In the first quarter, real GDP rose 3.1%. Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $105.8 billion in the second quarter, in contrast to a decrease of $78.7 billion in the first quarter. 4 On balance, we view this as modest – but quite steady – economic growth.

New NAFTA Remains Stuck in Congress – Remember the new trade deal between the U.S., Canada, and Mexico known as the USMCA? Many believe that the trade deal is over and done with, and on the books, but in fact it hasn’t even been brought up for a vote in Congress. Given that Mexico is Texas’ biggest trading partner, and Canada is its second (as measured by Texas’s exports), a Congressman from Texas is leading a renewed push to bring the trade agreement up for a vote in the House. As it were, the United States is mired in two trade dilemmas with no clear path forward, the resolution of which could arguably bring back enough economic certainty to give the expansion more room to run.5

In the meantime, as we wait to see how this story

and others pan out, I recommend focusing on your long-term financial goals. To

help you do this I am offering our just-released free guide, 7 Secrets

to Building the Ultimate DIY Retirement Portfolio.6 It

provides a step-by-step blueprint of our customized investing process to

potentially help you build a sound retirement portfolio of your own and pursue

long-term investing success.

If you have $500,000 or more to invest, get this

guide to learn our ideas on the step-by-step process to building and

maintaining a retirement portfolio that will help you reach your goals and

enjoy a secure retirement.

Disclosure

2 Board of Governors of the Federal Reserve System (US), U.S. / U.K. Foreign Exchange Rate [DEXUSUK], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DEXUSUK, August 29, 2019.

3 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

4 BEA, August 29, 2019. https://www.bea.gov/news/2019/gross-domestic-product-2nd-quarter-2019-second-estimate-corporate-profits-2nd-quarter

5 The Wall Street Journal, August 27, 2019. https://www.wsj.com/articles/swing-district-democrats-push-for-vote-on-north-america-trade-pact-11566898201?mod=djem10point

6 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

Questions posed are for demonstrative and informational purposes only and may not reflect the views of current clients or any one individual