We’re midway through earnings season for 2015’s fourth quarter and the results appear rather grim. While large-cap corporations’ earnings were clobbered by substantial global exposure, their small-cap counterparts don’t look particularly good either.

S&P 500’s Q4 2015 Scorecard

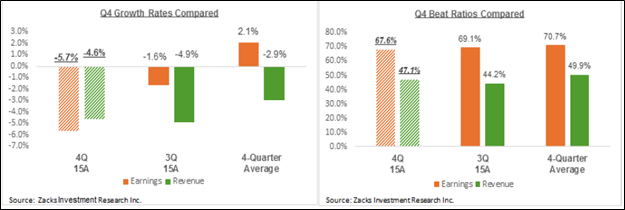

Total earnings reported by companies accounting for 79.6% of S&P 500’s total market cap reveal earnings decline of -5.7% on -4.6% lower revenues in Q4 2015 (from the same quarter the previous year) – this reflects weaker growth than recent periods. Of these corporations, 67.6% and 47.1% outperformed EPS and revenues estimates, respectively.

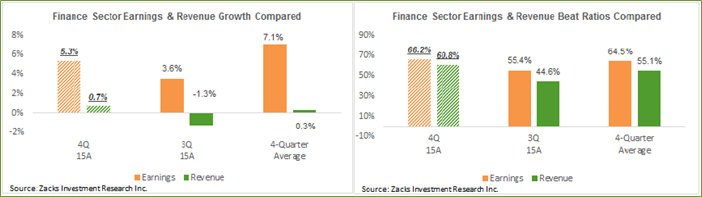

On a positive note, corporation’s that account for 78% of the Finance sector’s market cap surpassed previous quarter’s results in terms of earnings growth (+5.3%) and beat ratios.

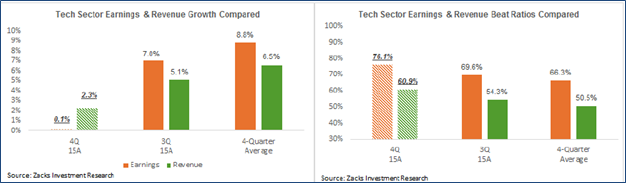

Companies consisting of 89.5% of the Technology sector’s market cap have slower earnings growth (+0.1%), but better beat ratios in Q4 2015 compared to recent quarters – also a positive as markets like upside surprises.

Companies sharing 97.7% of Transportation’s market cap reported solidly positive growth (+14.5%) owing largely to cheap oil, but with an unimpressive EPS beat ratio of 53.8%.

On the other hand, negative growth of companies in resource-sensitive industries (no surprise) dampened aggregate S&P 500 earnings: Oil/energy (-77.4%), Industrial products (-16%) and Materials (-23.2%).

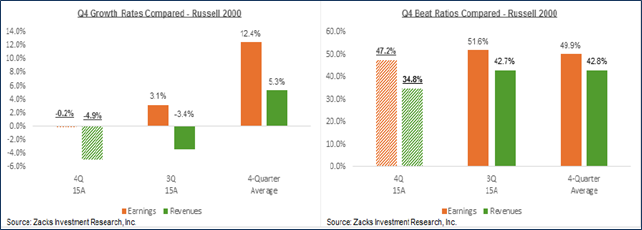

Russell 2000 Q4 2015 Scorecard

Through mid-February, the Russell 2000’s reporting for Q4 ‘15 showed total reported earnings dropping by -0.2% on -4.9% less revenues from the same quarter the preceding year, with EPS and revenue beat ratios lagging behind those of recent periods. Despite less exposure to global shocks relative to larger companies, small-caps face a difficult road ahead with a surprisingly weak earnings performance.

Earnings Expectations for Q4 2015

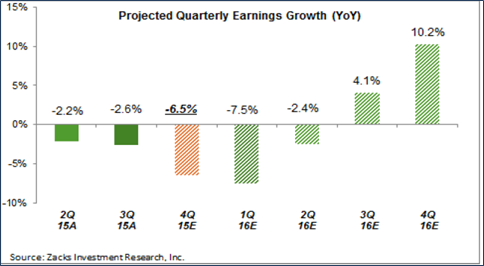

Combining the actual reported earnings of 345 companies alongwith estimates for the remaining 155, S&P 500 earnings is projected to decline by -6.5% on -4% lower revenues in Q4 2015 from the same period the previous year.

Finance earnings are estimated to grow at +3.1%, without which S&P 500’s earnings growth could drop to -8.6%.

Transportation (+14.4%), Business Services (+3.5%), Medical (+9.1%), Autos (+8.2%). Consumer Discretionary (+0.8%), and Construction (+0.2%) are predicted to grow positively.

For Technology, a tepid hardware/semi-conductor segment will outweigh the strong internet/software space leading to a -1.2% lower earnings but +1.7% higher revenues.

The maximum drag on S&P 500 earnings will, not surprisingly, be from the Energy/oil sector whose earnings are predicted to plunge -79.4%, without which the S&P 500 earnings would fall by a marginal -0.1%.

Basic Materials (-23%), Industrial Products (-17.9%) and Aerospace (-13%) constitute sharpearnings declines.

Projections for 2016

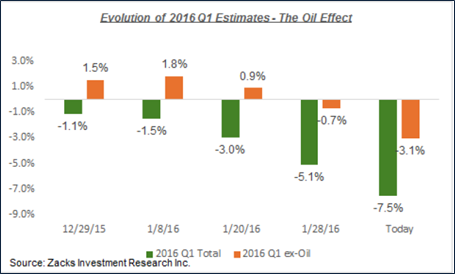

Q1 2016 S&P 500 earnings are predicted to fall by -7.5% from the same quarter of 2015 (excluding Energy, the decline is much less pronounced at -3.1%). This comes after a series of downward revisions of expectations since the end of 2015.

However, earnings are projected to accelerate from Q2 2016 onwards based on an expected rebound of the Energy sector, which we’re already starting to see signs of with crude oil prices leveling off.

Bottom Line for Investors

The S&P 500’s trailing four quarter net margin is expected to be 10.3% in Q4 2015 and 10.2% by end of 2016. Even as current global headwinds contribute to growing uncertainty for the U.S. economy, we are not yet in a recessionary phase – and we do not think we’re entering one this year either. Look for earnings to rebound as the year presses on.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.