The following events surrounding the market show that now is a good time for investors to start thinking about possible investment themes. In today’s Steady Investor, we focus on:

- Russia’s invasion of Ukraine and its possible effect on oil prices

- U.S. government’s budget surplus

- More retirees in the U.S.

- Update on retail sales

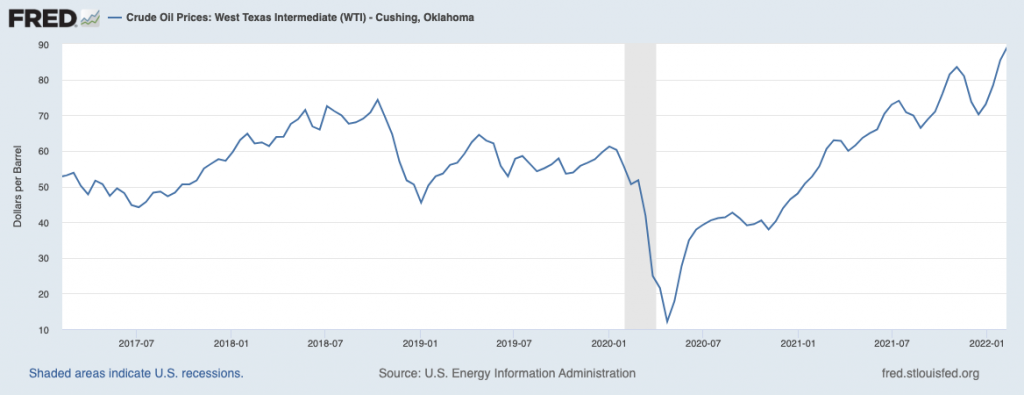

Oil Prices are High – Will a Russian Invasion of Ukraine Send Them Higher? Oil prices have been moving steadily higher since spring 2020 (see chart below) when the global economy started to reopen following the pandemic-induced lockdown. OPEC and U.S. shale producers slashed supply in response to the lockdowns, but over time demand for oil returned to the economy far faster than supply came back online. Global oil production is still below pre-pandemic highs. That has given way to high and rising oil prices, which many readers likely know given recent trips to the gas station. U.S. shale producers are steadily ramping production and OPEC has made ‘commitments’ to increase output, but it could take months before additional supply starts to put downward pressure on prices. And then there’s Russia, the world’s third-largest oil producer. An invasion of Ukraine could result in dented production, which could result in a short-term hit to already tight oil supplies. How the situation between Russia and Ukraine plays out is unknown today, but oil traders appear to be pricing in a significant “geopolitical risk premium,” with oil approaching $100 a barrel.1

7 Secrets to Building the Ultimate Retirement Portfolio!

Navigating through unprecedented times is difficult, but we still believe it is possible to avoid the damage of economic downturns and achieve your retirement goals.

Achieving these goals involves some work: defining your investment objectives, determining your asset allocation, managing investments over time. Our guide can help you achieve these goals by providing a step-by-step blueprint of our customized investing process to potentially help you build a sound retirement portfolio.

If you have $500,000 or more to invest, get this guide to learn our ideas on building and maintaining a retirement portfolio to potentially achieve your long-term goals.

Get our FREE guide: 7 Secrets to Building the Ultimate DIY Retirement Portfolio3

U.S. Government Runs a Budget Surplus for First Time in Years – Did readers see that correctly? Did the U.S. government run a budget surplus? Indeed – in January, the U.S. government ran a monthly surplus for the first time since September 2019, of $119 billion. The monthly surplus comes from the expiration of fiscal stimulus programs like the child tax credit, aid to workers and small businesses, and other Covid-19 spending programs, coupled with an increase in tax revenue triggered by higher wages (which increases taxable earnings), more workers in the economy, and higher corporate revenues. Spending from the infrastructure bill has not yet been deployed, so the budget surplus seen in January may be more of a one-off event than part of a larger trend.4

More Retirees in the U.S. – The number of retirees in the U.S. increased over the past year, with the percentage of the U.S. population in retirement at close to 20% – up from 18.3% in early 2020. According to the Federal Reserve Bank of St. Louis, approximately 4.2 million people left the workforce during the pandemic, with a meaningful percentage of them planning never to return. There are a few reasons more people entered retirement. For one, the stock market and housing market have both delivered robust gains over the past two years, meaning that many retirees and would-be retirees have seen their net worth rise to record levels. But there was also a recalibration of people’s perception of work once the lockdowns took hold and the ‘remote work’ movement gained traction.5

Retail Spending Bounces Back Firmly, But… January was a strong month for retail sales, which rose 3.8% from December – the biggest monthly gain since March 2021. Sales fell in December as the Omicron variant spread quickly, so the rebound in January was likely attributed to waning pandemic risk coupled with accumulated savings from the previous month. There’s a “but,” however – retail sales figures are not adjusted for inflation, meaning that higher prices will push sales figures higher. As such, the strong January performance is arguably just as much inflation-driven as it is purchase-driven. The upshot is that retail sales figures also do not account for spending on services, which are poised to see a rebound in Q1 (and hopefully beyond) and pandemic restrictions fade. In fact, there are already early signs this transition from goods to services may be taking hold – spending on services increased 12% year-over-year for the week ended February 5, as consumers dished out more for airfares, hotels, entertainment, and dining out.6

How to Build the Ultimate Retirement Portfolio – As you consider these current events when making investment decisions, there are things you can do to protect and create a retirement portfolio that meets your financial goals.

To help you do

this, we recommend reading our guide, 7 Secrets to Building the

Ultimate DIY Retirement Portfolio.7 It provides a

step-by-step blueprint of our customized investing process to potentially help

you build a sound retirement portfolio of your own and pursue long-term

investing success.

If you have $500,000 or more to invest, get this

guide to learn our ideas on the step-by-step process of building and

maintaining a retirement portfolio that will potentially help you reach your

goals and enjoy a secure retirement.

Disclosure

2 Fred Economic Data. February 16, 2022. https://fred.stlouisfed.org/series/DCOILWTICO#0

3 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

4 Wall Street Journal. February 10, 2022. https://www.wsj.com/articles/u-s-government-recorded-119-billion-budget-surplus-its-first-since-before-pandemic-11644519768?mod=djemRTE_h

5 Wall Street Journal. February 11, 2022. https://www.wsj.com/articles/you-got-richer-during-the-pandemic-early-retirement-is-still-risky-11644575419?mod=djemRTE_h

6 Wall Street Journal. February 16, 2022. https://www.wsj.com/articles/us-economy-january-2022-retail-sales-11644963650?mod=hp_lead_pos1

7 ZIM may amend or rescind the “7 Secrets to Building the Ultimate DIY Retirement Portfolio” guide for any reason and at ZIM’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable.

Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.