We’re about halfway through 2021, and many readers may be surprised to learn that Energy is the top S&P 500 sector performer year-to-date. The Energy sector has registered a greater than +30% return for the year (as I write), which is more than double the gains of the broader S&P 500 index.1

Is Energy’s performance poised to last, and should investors add exposure?

I’m not so sure. For one, investors should note that Energy’s outperformance in 2021 is following years – even a decade – of underperformance. From the S&P 500 index pre-pandemic high through the bottom of the bear market in March 2020, the Energy sector fell more than -50%. Looking even longer term, one would find that the global Energy sector has still not recaptured the highs reached in 2007.

____________________________________________________________________________

When Uncertainty Rises, Focus on the Facts and Data!

Concerns about the current energy sector and other factors surrounding the market may leave you uncertain when contemplating your next investing decision. But the key is not give in to fear and emotions! During this significant time of economic recovery, investors must stick to the facts and hard data. We recommend keeping your focus on the long-term by looking into key economic indicators that can make a positive impact on your financial success.

To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks June view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released June and July 2021 Stock Market Outlook2

____________________________________________________________________________

There are several forces at work for the Energy sector. Over the past decade, the U.S. shale boom drove production and supply significantly higher, and the response globally was to add even more supply – putting downward pressure on prices and squeezing margins for U.S. shale producers. This supply glut, coupled with the ‘muddle through’ economic expansion following the Great Recession, negatively impacted the profit picture for many oil and gas producers, many of which were carrying high debt loads. Weak stock returns followed.

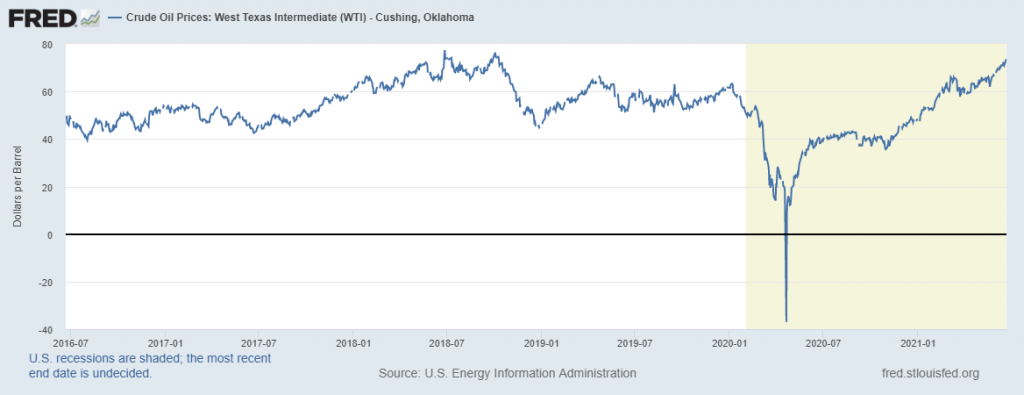

So, when considering the Energy sector’s strong bounce in 2021, I think it is important to see it as a product of a very weak base, with the sector in effect retracing losses versus reaching new all-time highs. Crude oil’s strong bounce over the past year (chart below), which was attributed to lockdowns giving way to re-openings, drove renewed interest in the sector. This initial surge in demand is likely to abate with time.

Looking ahead, the Energy sector’s structural issues remain. For one, spare capacity in the U.S. and via OPEC+ producers remain high, meaning that new supply can come online quickly in response to a better profit picture. Indeed, higher crude prices have already spurred higher rig counts and oil well completions in the U.S., which has historically been a sign of increasing production. Assuming OPEC+ countries counter higher U.S. production by adding even more supply – as they have done in the past – the profit conundrum could surface again. Uncertainty abounds.

Finally, investors may also wonder what effect renewables could have on the Energy sector outlook. There are two factors to consider here. Renewables are indeed gaining market share in total energy consumption, mainly at the expense of coal. With electricity consumption, for instance, the share of renewable generation was 28% in Q1 2020 – a growing figure.4 But the second factor is the real kicker: many renewable energy companies (wind, solar, etc.) are not even in the Energy sector! Many ‘green energy’ companies are actually classified as Utilities. Their performance does not directly impact the performance of the Energy sector, since many are not even in the Energy sector to begin with.

Bottom Line for Investors

The Energy sector is off to a strong start in 2021, but at the end of the day, the sector’s overall contribution to the S&P 500 index has been shrinking over the past decade. For investors, I think it is important to maintain exposure to the Energy sector for diversification purposes, but it is also important to make sure your weighting is close to in line with the sector’s weighting in the S&P 500.

As I write, the Energy sector makes up 2.8% of the S&P 500 index, down from over 10% before the 2008 financial crisis.5 For investors, it is important to make sure the energy sector exposure in your portfolio has shifted accordingly, in my view.

This is when keeping a diversified portfolio is key. As we reach the halfway mark of 2021, we also encourage investors to focus on key data points and economic indicators that can positively impact their long-term investments. To help you do this, I am offering all readers our just-released Stock Market Outlook report. This report contains some of our key forecasts to consider such as:

- Zacks rank S&P 500 sector picks

- Zacks June view on equity markets

- What produces 2021 optimism?

- Zacks forecasts for the remainder of the year

- Top stocks in top industries

- Sell-side and buy-side consensus

- And much more

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

Disclosure

2 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

3 Fred Economic Data. June 14, 2021. https://fred.stlouisfed.org/series/DCOILWTICO

4 IEA’s Global Energy Review 2020. https://www.iea.org/reports/global-energy-review-2020/renewables

5 S&P Dow Jones Indices. June 16, 2021. https://www.spglobal.com/spdji/en/indices/equity/sp-500/#overview

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.