Reviewing a timeline of the Federal Reserve’s statements and actions – and comparing them to equity market action – makes it pretty clear to me that the Fed is the single most important factor for stocks in 2019.

Long-time readers know that for Zacks Investment Management, earnings revisions and earnings growth permanently hold the top spot for ‘what drives equity markets.’ That hasn’t changed. But this far into the economic cycle, and for 2019 specifically, I think the Fed’s actions and statements are especially important and influential.

____________________________________________________________________________

Time to Focus on the Fundamentals!

Keep an eye on what drives the equity markets such as the Fed’s actions, earning revisions and earnings growth. Focus on these fundamentals and more with our just released Stock Market Outlook Report.

This report will help you stay focused on key economic indicators and base your investments on hard data. This 22-page report contains some of our key forecasts to consider such as:

- Will 2019 stay bullish or is a bear around the corner?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released Stock Market Outlook1

______________________________________________________________________

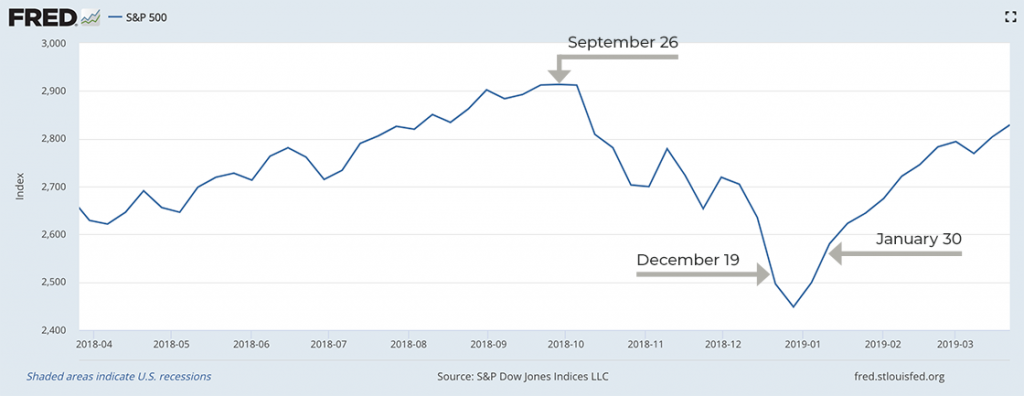

Below, the chart and timeline can help bring light to this line of thinking. What you see is the S&P 500 over the last year, with call-out dates indicating key Fed actions.

S&P 500 over the last 12 Months

Source: Federal Reserve Bank of St. Louis2

September 26 – The Fed raises the benchmark rate by a quarter point to 2% – 2.25%

Was it a coincidence that the Fed’s interest rate hike corresponded nearly perfectly with the S&P 500’s peak in 2018? Hard to say, but the market no doubt aired its grievances with rising interest rates in the months that followed, with a ~20% decline that lasted until Christmas Eve.

The Fed was arguably justified in its decision to raise interest rates – unemployment was at 3.9% at the time, economic growth was humming along, and corporations were still experiencing double-digit earnings growth. 3 The economy was strong enough to absorb higher rates, and the Fed was doing its job of trying to move rates back into the neutral ‘zone,’ in my view. The market did not seem to agree.

December 19 – The Fed raises rates again by a quarter point, to 2.25% – 2.5%

Economic strength showed few signs of weakening heading into the end of 2018, even though the market was experiencing pronounced downside volatility. I wrote several times that the economy and stocks were telling two different stories at the end of 2018, and the Fed’s decision was based on the economic side of it.

One silver lining to the Fed’s decision in December was its forecast of reducing 2019 hikes to two versus the previously stated three. The language in the Fed statement still called for “gradual” rate hikes, however, and reiterated that the U.S. economy was still growing at a strong rate. 4 The stock market’s immediate response was to decline further, but market participants may have clung to Fed language of toning down the pace of hikes as a positive development.

January 30 – Fed pauses rate hikes, Chairman Jerome Powell vows “patient” approach

The tables began to turn when the Fed toned down their hawkish language a bit in December, but it wasn’t long before the markets hit full stride when the Fed said “the case for raising rates has weakened somewhat.” The market saw this statement as the Fed fully walking back its previous position, particularly since Powell added that the 2.25% – 2.5% fed funds rate was within a reasonable range of the committee’s neutral rate estimate.5

The stock market responded in kind, and is arguably still locked into an uptrend that is now just a few percentage points away from claiming a new all-time high.

The Fed’s plan to pause interest rate increases, in this case and in statements that have followed, may have removed a key headwind for stocks in what was already set to be a challenging year for strong gains.

Bottom Line for Investors

If the Fed does indeed remain on the sidelines for the entirety of 2019, I would argue that stocks could actually post fairly solid gains for the year, assuming we also get broad-based upside surprises in earnings growth and revisions to the upside. Earnings estimates have already come down considerably to start the year, so I see this as a real, attainable possibility.

That being said, investors should also keep in mind that once rates start going up again, particularly this late in the cycle, we can reasonably expect corresponding downward pressure on stock prices – much like we saw in September and December of 2018. For 2019, it’s all eyes on the Fed.

To help you keep an eye on the Fed and other key economic indicators, we are offering you our Just-Released Stock Market Outlook Report.

This Special Report is packed with newly revised predictions that can help you base your next investment move on hard data. For example, you’ll discover Zacks’ view on:

- Will 2019 stay bullish?

- Zacks global markets’ outlook

- What sectors show the best opportunity?

- What industries within those sectors most merit your attention?

- Forecast for the S&P

- Small-cap vs. large-cap returns

- And much more.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!6

Disclosure

2 Federal Reserve Bank of St. Louis, March 26, 2019. https://fred.stlouisfed.org/series/SP500#0

3 USA Today, September 26, 2018. https://www.usatoday.com/story/money/2018/09/26/fed-raises-rate/1426946002/

4 CNBC, December 19, 2018. https://www.cnbc.com/2018/12/19/fed-hikes-rates-by-a-quarter-point-.html

5 CNBC, January 30, 2019. https://www.cnbc.com/2019/01/30/fed-chair-jerome-powell-says-the-case-for-raising-interest-rates-has-weakened.html

6 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.