Caroline H. from Charleston, SC asks: Hi Mitch, I saw that the U.S. GDP number was recently revised higher. It seems like there are a lot of revisions happening these days, so I’m not sure if this is the final-final number or if there will be another change. Regardless, what’s your read on this revision? Good news?

Mitch’s Response:

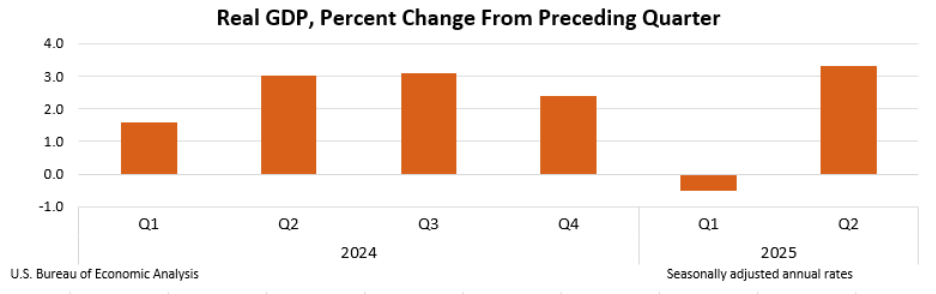

That’s a keen observation you made about the U.S. GDP headline number. Last week, the Bureau of Economic Analysis released its “second” estimate of Q2 U.S. GDP, which showed the U.S. economy grew faster than initially reported. The annualized growth rate was revised from 3.0% to 3.3%. That’s a pretty meaningful adjustment.1

Market Headlines Keep Changing. Is Your Portfolio Ready?

Economic data and market signals are constantly being revised, sending mixed messages to investors. One week, growth looks stronger than expected, and the next, the outlook shifts again. For many, it can feel like the ground is always moving.

That’s why I’m offering our free guide, Navigating Market Volatility: 4 Principles for Staying the Course3. It shares the habits and mindset that can help keep your portfolio steady, no matter how uncertain the markets become. It also covers topics such as:

- Sharp market declines and corrections are a normal part of investing

- The best market days come unexpectedly (often within days or weeks of the worst days)

- Trying to pick market tops and bottoms is nearly impossible

- Trust your strategy and discipline, not the headlines

- Plus, more insights and assistance to help you keep your investment strategy on course.

If you have $500,000 or more to invest, get your free guide today!

Download Your Free Copy Today: Navigating Market Volatility: 4 Principles for Staying the Course3

Before I dive into some of the inner workings of the revision, I think it’s important to add a note here about revisions in general. There has been a big splash in the financial media recently because of the revisions to jobs market data from the summer months, which painted a much weaker picture of the U.S. labor market than previously appreciated. The GDP revision may make it seem like a “here we go again” moment for economic data, but the reality is that revisions are very common and are to be expected. As more data comes in, we should expect the numbers to adjust accordingly.

Now, regarding the Q2 U.S. GDP revision, what stood out most to me was the upward revisions to business investment. Nonresidential fixed investment rose 5.7% annualized in the second estimate, compared with just 1.9% in the first. A big piece of that was intellectual property products, particularly research and development. R&D alone swung from showing a contraction in the first estimate (-1.9%) to solid growth of 4.3%. That’s a sharp turnaround, and it suggests businesses may not be nearly as downbeat about the future as some (including myself when I saw the “advance” GDP estimate) assumed.

Consumer spending also came in stronger, especially in healthcare, pharmaceuticals, and food services. And we’re seeing increasingly concrete signs of the AI boom in the data: software investment grew at the fastest quarterly pace since at least 2007. Those figures indicate that both households and businesses are still willing to put money to work, even amid tariff uncertainty and slower job growth.

That said, it’s important not to overstate the strength of the headline. The combined contribution of personal consumption, business investment, and residential real estate, often called “core domestic demand”, was 1.7% annualized, much lower than the headline 3.3%. Trade swings from earlier tariff-related import activity bolstered the top-line GDP number. So, while the economy is proving resilient, growth is not gangbusters as the headline alone might suggest.

From an investor’s perspective, this report is essentially old news to markets, since revisions don’t typically change the overall picture. But it does reinforce an important point: businesses are still investing, households are still spending, and the economy continues to move forward despite tariff worries and softening confidence surveys. Markets seem to be reflecting this resilience.

Revisions may not change the market’s immediate path, but they highlight how quickly the story can shift. For investors, the challenge is knowing how to stay positioned when the numbers move and the headlines follow.

That’s why we’re offering a free guide: Navigating Market Volatility: 4 Principles for Staying the Course. Inside, you’ll find:

- Sharp market declines and corrections are a normal part of investing

- The best market days come unexpectedly (often within days or weeks of the worst days)

- Trying to pick market tops and bottoms is nearly impossible

- Trust your strategy and discipline, not the headlines

- Plus, more insights and assistance to help you keep your investment strategy on course.

If you have $500,000 or more to invest, get your free guide today!

Download Your Free Copy Today: Navigating Market Volatility: 4 Principles for Staying the Course4

Disclosure

2 BEA. 2025.

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Navigating Market Volatility: 4 Principles for Staying the Course offer at any time and for any reason at its discretion.

4 Zacks Investment Management reserves the right to amend the terms or rescind the free Navigating Market Volatility: 4 Principles for Staying the Course offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The Russell 1000 Growth Index is a well-known, unmanaged index of the prices of 1000 large-company growth common stocks selected by Russell. The Russell 1000 Growth Index assumes reinvestment of dividends but does not reflect advisory fees. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks, as well as limited partnership interests. The index includes all Nasdaq-listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debenture securities. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

“The Dow Jones Industrial Average measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE). The 30 publicly-owned companies are considered leaders in the United States economy. An investor cannot directly invest in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.”

Returns for each strategy and the corresponding Morningstar Universe reflect the annualized returns for the periods indicated. The Morningstar Universes used for comparative analysis are constructed by Morningstar (median performance) and data is provided to Zacks by Zephyr Style Advisor. The percentile ranking for each Zacks Strategy is based on the gross comparison for Zacks Strategies vs. the indicated universe rounded up to the nearest whole percentile. Other managers included in universe by Morningstar may exhibit style drift when compared to Zacks Investment Management portfolio. Neither Zacks Investment Management nor Zacks Investment Research has any affiliation with Morningstar. Neither Zacks Investment Management nor Zacks Investment Research had any influence of the process Morningstar used to determine this ranking.