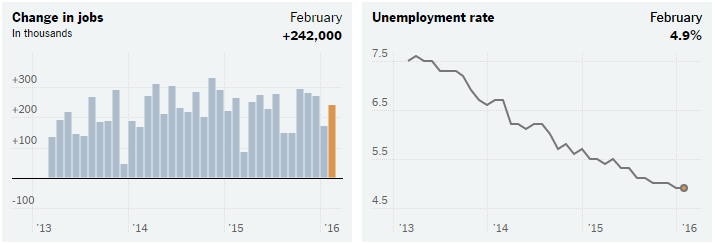

Early in March, the Bureau of Labor Statistics released a positive jobs report that exceeded expectations. The report showed that employers added 242,000 workers in February, spurred by growth in restaurants, retail and healthcare. This marked a stout increase that underscored the underappreciated strength in the labor markets.

The Jobs Picture Looks Good

(Source: Bureau of Labour Statistics)

(Source: Bureau of Labour Statistics)

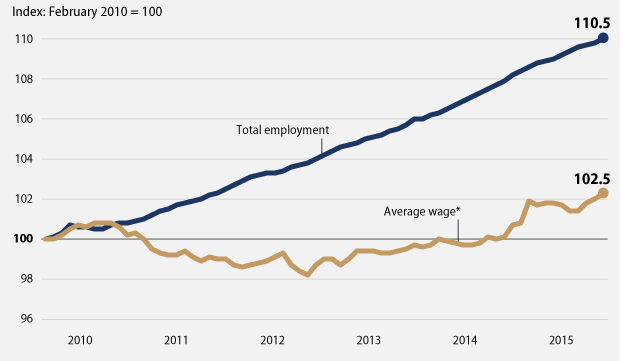

Despite healthy hiring and unemployment falling to an eight-year low of 4.9%, wage gains have been relatively stagnant. The report, published by the Labor Department, finally saw average hourly earnings go up by 0.5% in January 2016 with only a slight fall in February 2016 (by 0.1%). This puts average hourly earnings at 2.2% higher than the previous year. This was not only one of the bright spots of the report, but it also indicated that the job market is tightening to a point that forces companies to pay more to attract and retain talent.

Wage growth recovery vs. to job market recovery

(Source: Bureau of Labour Statistics)

* Average hourly earnings of production and non-supervisory employees, adjusted for the purpose of inflation.

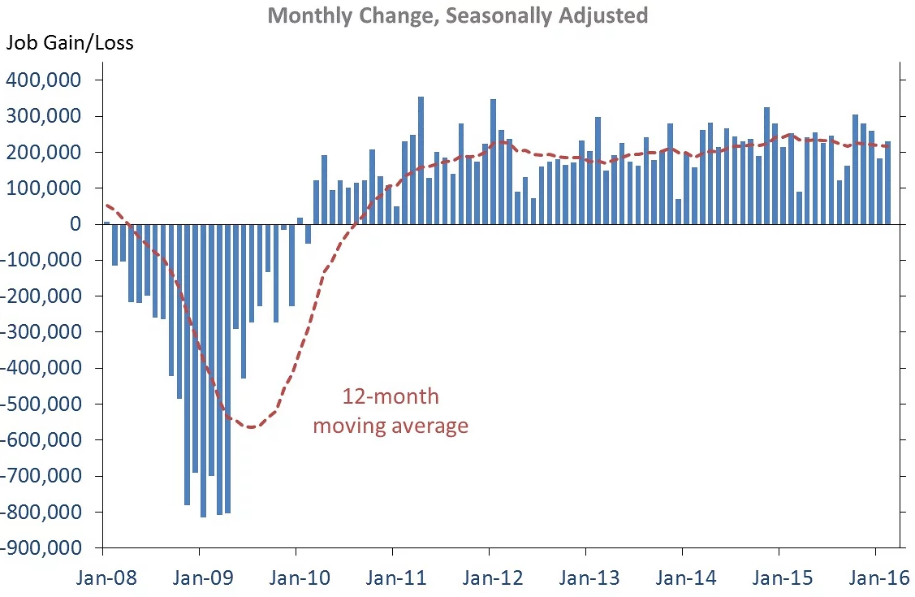

Private sector payroll employment

(Source: Bureau of Labour Statistics, current employment statistics)

In the previous presidential cycle, unemployment hovered around 8.3%, and the economic recovery was in its early stages. In this presidential cycle, the recovery is in its 8th year and the private sector has chalked up 72 months of uninterrupted job gains – the longest streak on record.

Among all sectors, health care, retail and construction remained the most positive – adding 38,000, 55,000 and 19,000 new positions respectively throughout February, and 181,000, 339,000 and 253,000 new positions respectively over the last 12 months. However, major drag was seen in sectors like mining, which include oil extraction and manufacturing. These areas experienced losses of 19,000 and 16,000 respectively in February. The majority of other major industries showed little change over the past month.

Perhaps the most encouraging part of the report was the indication that people who had long been side-lined were seemingly re-entering the job market. The overall labor force participation rate increased by 0.5% bringing it to 62.9%, while the employment-population ratio ticked up by 0.5%.

Bottom Line for Investors

A growing workforce is a good indication that output in the country is increasing, but stagnating wages can pose a headwind – it means little to no improvement in discretionary income levels which can stifle consumer spending growth.

Nevertheless, signs that wages are inching upward are encouraging. Rising retail sales and an improving housing sector of late indicate higher discretionary income levels and an improving consumer economy.

The last six months have been the best extended period for employees’ pay checks since the inception of the recovery, which suggests underlying strengths should allay fears of an imminent U.S. recession. Low likelihood of recession also shrinks the bearish case, which should pave the way for higher stock prices in the months ahead.

Disclosure

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.