The yield curve is one of the most coveted of economic indicators, and for good reason – in my view, it can provide investors with useful insights about how the economy, stocks, and bonds could perform going forward. And at the end of the day, that’s precisely what we want to know.

Most of the commentary on the yield curve these days – including some of our own – focuses on what happens to the economy when the yield curve flattens and eventually inverts. Spoiler alert: inverted yield curves tend to be followed by recessions.

________________________________________________________

Economic Indicators You Should Keep an Eye On!

In addition to the yield curve, there are other key economic indicators that may be able to help you navigate the market and prepare your investments for what’s to come. To help you keep an eye on these economic data releases, earnings reports, and other key economic factors, we are offering all readers a look into our just-released Stock Market Outlook report.

If you have $500,000 or more to invest and want to learn more about these forecasts, click on the link below to get your free report today!

IT’S FREE. Download the Just-Released Stock Market Outlook1>>

________________________________________________________

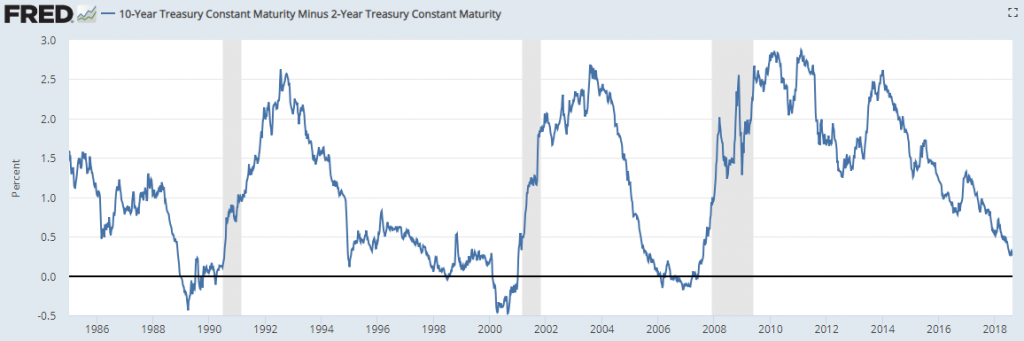

The chart below illustrates the economic point pretty clearly. In the picture, you see the 10-year U.S. Treasury minus the 2-year U.S. Treasury, which provides a suitable but not perfect representation of the yield curve. Anything above 0% on the chart above means the 10-year U.S. Treasury is higher than the 2-year, which would imply an upward sloping yield curve.

It probably won’t take readers long to notice a trend in this yield curve chart: once the line dips below zero, i.e., once the yield curve inverts, a recession (marked by the gray bars) follows shortly thereafter. It follows that the yield curve is a hot topic today given the fact that the 10-year minus the 2-year is fast approaching the zero percent line.

Source: Federal Reserve Bank of St. Louis

This data is useful, but again it only offers us insight into economic implications – not necessarily investment implications. Here’s another spoiler alert: stocks tend to do well in the months following a yield curve inversion.

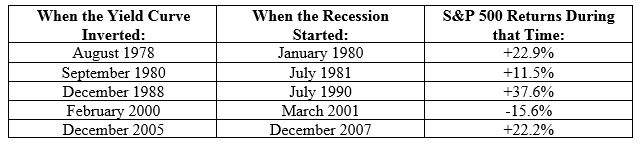

Indeed, if we take a look at how the market responds to inverted yield curves, investors might not be so intimidated by the yield curve’s flattening pattern. The table below shows how the S&P 500 performed from the time the yield curve inverted to the time a recession began. As you can see, with the exception of the ‘dot com bubble’, the S&P 500 has historically delivered solidly positive returns in the months following a yield curve inversion:

Bottom Line for InvestorsIn fact, the average return in the period between a yield curve inversion and the start of a recession is +15%, which is certainly nothing to shrug off. The reason for these positive returns, in my view, is simple: it’s because once a yield curve inverts, recessions do not tend to immediately follow. It takes an average of 17 months for an economic slowdown to take hold, and in that time, stocks have historically continued to go up.2

A flat or negatively sloped yield curve, generally speaking, may indicate unfavorable economic prospects going forward. In my view, it would be reasonable to expect that slower and/or negative growth and higher inflation would follow in the months following a yield curve inversion.

But I also believe that investors would be wise to avoid conflating an inverted yield curve with a poor or negative investment climate. Quite the opposite, in my opinion.

History tells us that once a yield curve inverts, it can take several months or even years before an economic recession follows. And history also shows that during the ‘final stretch’ of economic growth, stocks have tended to follow suit with positive returns.

In the meantime, I recommend keeping an eye on economic data releases, earnings reports, and other key economic factors. Our Just-Released September 2018 Stock Market Outlook3 Report, will give you insight into just that!

Disclosure

2 Bloomberg, Dec 18, 2017, https://www.bloomberg.com/view/articles/2017-12-18/yield-curve-inversions-and-stocks-are-a-toxic-mix

3 Zacks Investment Management reserves the right to amend the terms or rescind the free Stock Market Outlook offer at any time and for any reason at its discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

It is not possible to invest directly in an index. Investors pursuing a strategy similar to an index may experience higher or lower returns, which will be reduced by fees and expenses.