In this week’s Steady Investor, we look at the biggest news stories and key factors that we believe are currently impacting the market such as:

• Rise in the U.S. Treasury Bond Yield

• U.S. households thinning

• China cuts interest rates

The 10-Year U.S. Treasury Bond Yield Keeps Rising – Yields on 10-year U.S. Treasury bonds have steadily climbed past 4.2%, placing them at levels not seen since 2008. Yields on long-term bonds tend to reflect investors’ expectations for where Fed-determined short-duration interest rates will end up. Recently, 10-year bond yields appear to reflect that the Fed may be done raising rates but also that rate cuts do not appear likely any time soon. In other words, rising yields on the 10-year U.S. Treasury are arguably tied to solid economic data on growth and jobs (which lowers the risk of recession and therefore rate cuts) and also downward trending inflation (which lowers the likelihood of more hikes). Recently released minutes from the Fed’s July meeting indicate that some officials are reluctant to raise rates too much further, if at all. There are a few notable implications of higher rates. One possible implication is that risk assets like stocks lose some appeal, as the risk-free rate climbs towards the long-term expected return of equities. Another implication is higher borrowing costs for households, notably in the mortgage market. The average rate on a 30-year fixed mortgage has climbed past 6.9%, up from 5% just a year ago and less than 3% in the months following the Covid-19 pandemic. With some expecting the Fed to keep rates higher for longer, there’s not a clear sign that mortgage rates will fall significantly any time soon.1

8 of the Biggest Financial Mistakes You Should Avoid

Many investors, especially those who are planning for retirement, may often question what to do with their investments when the market takes a turn.

While there are many unknowns, there are eight common mistakes that many investors make when planning for retirement.

We are offering our exclusive guide, 8 Retirement Mistakes to Avoid, to give you more insight into these mistakes so your retirement can potentially be the ‘golden period’ you always wanted to enjoy.

If you have $500,000 or more to invest and want to learn more, click on the link below to get your free copy:

Learn About the 8 Retirement Mistakes to Avoid!2

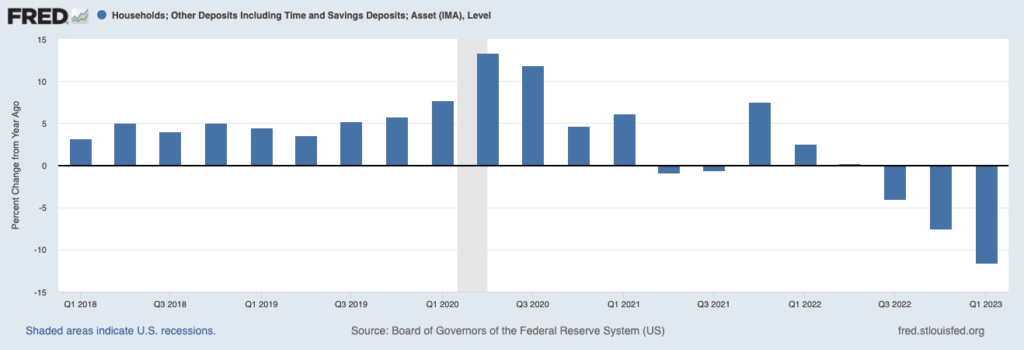

U.S. Household Savings are Thinning Out – Fiscal stimulus packages in the wake of the pandemic flooded U.S. households with excess savings, to the tune of $2.1 trillion. According to the Federal Reserve, some $1.9 trillion of these excess savings have been spent. The implication is that Americans now have just $190 billion in excess savings left, which some estimate will be drawn down to zero by the end of Q3 2023. To be clear, this drawdown does not mean Americans will no longer have net positive savings – it means that pandemic-era stimulus savings are gone.3

Household Savings (% change from a year ago)

A big reason for dwindling savings is, of course, U.S. consumers maintaining a healthy appetite for spending. In July, Americans increased retail spending by 0.7% month-over-month, which marked an acceleration from June’s month-over-month print and also indicates that Americans are spending at a faster pace than inflation.

China Cuts Interest Rates to Shore Up Ailing Economy – China’s economic struggles have finally prompted monetary policy action. The People’s Bank of China (PBOC) lowered a key loan facility interest rate from 2.65% to 2.5%, while also injecting $55.2 billion of new loan capital into the banking system. The PBOC also cut the 7-day interest rate on reverse repo options by 10 basis points, both actions of which should ultimately result in slightly lower borrowing costs for households and small businesses. The moves came after a batch of weak economic data which showed weak consumer spending, decelerating growth in factory output, and a property sector mired with falling investment and major developers on the verge of bankruptcy. Retail sales were seen growing by 2.5% year-over-year in July, compared to 3.1% in June; industrial production grew by 3.7% year-over-year down from 4.4% in June; investment in buildings, machinery, and other fixed assets rose 3.4% in the first 7 months of 2023 compared to a 3.8% pace set the previous year; and finally, property investment fell by -8.5% and new construction plummeted by 24.5%. All told, China’s economic recovery from pandemic lockdowns has not mirrored the experience in the U.S., and increased trade tensions between the U.S. and China have seen U.S. imports of Chinese goods fall to their lowest levels in 20 years.5

Avoid These Common Mistakes When Planning for Retirement – No one can predict or control the future of the market – but when you’re a long-term investor, it’s easy to fall prey to common investing mistakes.

In our exclusive guide, 8 Retirement Mistakes to Avoid6, we provide our thoughts on what we believe are 8 of the biggest retirement mistakes investors should avoid. This guide will also dive into common mistakes, such as:

• Is Your Portfolio Too Conservative?

• Trying to Time Markets

• Lack of Diversification

• Not Knowing How to Adjust Lifestyle After Retirement

• Switching Strategies Too Often

If you have $500,000 or more to invest and want to learn more, click on the link below:

Disclosure

2 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

3 Wall Street Journal. August 15, 2023. https://www.wsj.com/articles/shoppers-boost-retail-sales-for-fourth-straight-month-264d20ef?mod=djemRTE_h

4 Fred Economic Data. June 8, 2023. https://fred.stlouisfed.org/series/BOGZ1FL193030205Q

5 Wall Street Journal. August 15, 2023. https://www.wsj.com/world/china/china-slashes-rates-suspends-youth-jobless-data-as-economy-signals-sharper-downturn-418301d6

6 ZIM may amend or rescind the free guide “8 of the biggest retirement mistakes investors should avoid” for any reason and at ZIM’s discretion

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.